Region:North America

Author(s):Shubham

Product Code:KRAC2207

Pages:82

Published On:October 2025

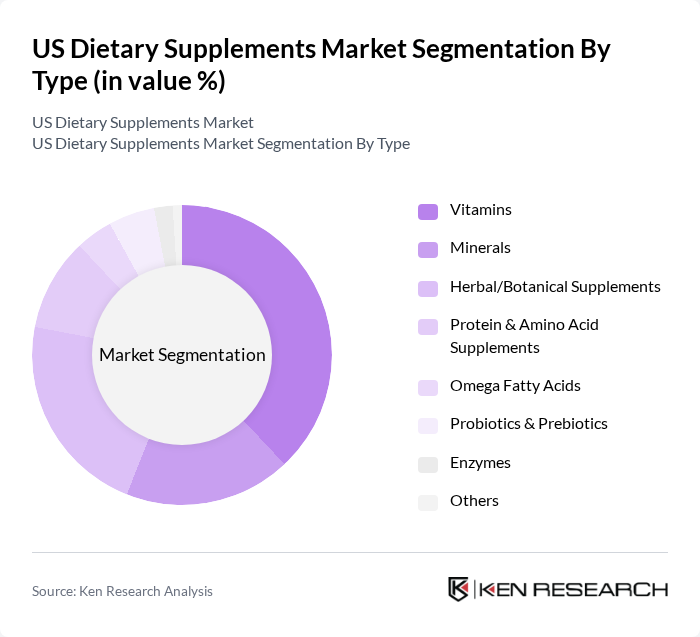

By Type:The dietary supplements market is segmented into various types, including Vitamins, Minerals, Herbal/Botanical Supplements, Protein & Amino Acid Supplements, Omega Fatty Acids, Probiotics & Prebiotics, Enzymes, and Others. Among these, Vitamins and Herbal/Botanical Supplements are particularly dominant due to their widespread consumer acceptance and perceived health benefits. The increasing trend of preventive healthcare and the growing popularity of natural products have significantly contributed to the growth of these segments. The vitamin segment holds the largest share, driven by high consumer awareness and demand for multivitamins, supported by innovations in clean-label formulations and convenient delivery formats .

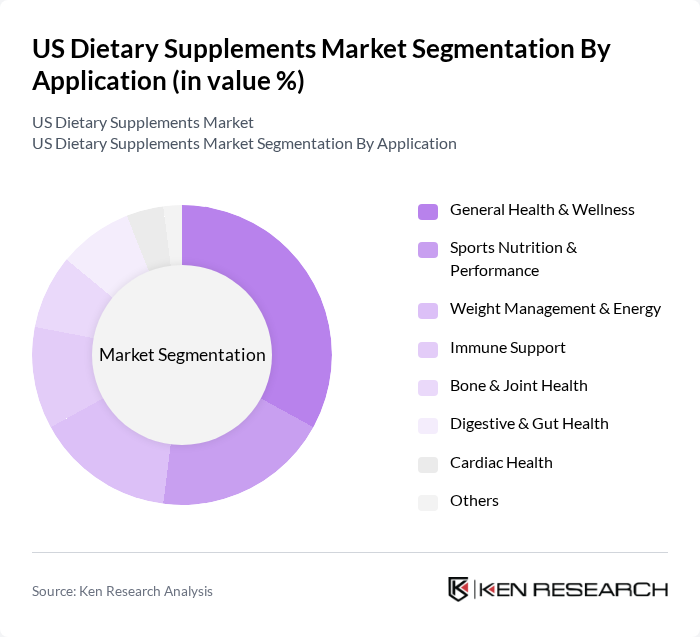

By Application:The market is also segmented by application, which includes General Health & Wellness, Sports Nutrition & Performance, Weight Management & Energy, Immune Support, Bone & Joint Health, Digestive & Gut Health, Cardiac Health, and Others. The General Health & Wellness segment leads the market, driven by a growing awareness of health and fitness among consumers. Additionally, the Sports Nutrition & Performance segment is gaining traction as more individuals engage in fitness activities and seek supplements to enhance their performance. Immune support and digestive health are also notable growth areas, reflecting consumer priorities post-pandemic .

The US Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, Inc., Nature's Bounty Co. (The Bountiful Company), USANA Health Sciences, Inc., Garden of Life, LLC (Nestlé Health Science), NOW Foods, Inc., Optimum Nutrition, Inc. (Glanbia Performance Nutrition), NutraBio Labs, Inc., Solgar Inc. (Nestlé Health Science), MegaFood, LLC, Jarrow Formulas, Inc., Nature Made (Pharmavite LLC), New Chapter, Inc. (Procter & Gamble), Swanson Health Products, Inc., Abbott Laboratories, Pfizer Inc., GlaxoSmithKline plc, The Archer-Daniels-Midland Company, Nature’s Sunshine Products, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The US dietary supplements market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As personalized nutrition gains traction, companies are expected to leverage data analytics to tailor products to individual health needs. Additionally, the rise of e-commerce platforms will facilitate broader access to supplements, enhancing consumer engagement. These trends indicate a dynamic market landscape, where innovation and adaptability will be key to capturing emerging opportunities and addressing evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal/Botanical Supplements Protein & Amino Acid Supplements Omega Fatty Acids Probiotics & Prebiotics Enzymes Others |

| By Application | General Health & Wellness Sports Nutrition & Performance Weight Management & Energy Immune Support Bone & Joint Health Digestive & Gut Health Cardiac Health Others |

| By Distribution Channel | Online Platforms Pharmacies & Drugstores Supermarkets/Hypermarkets Health Food Stores Direct Sales Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) |

| By Formulation | Tablets Capsules Powders Liquids (RTD, Shots, Drops, Tinctures) Gummies Softgels Others |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Established Brands New Entrants Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Dietary Supplement Sales | 100 | Store Managers, Category Buyers |

| Online Supplement Purchases | 80 | E-commerce Managers, Digital Marketing Specialists |

| Health Professional Insights | 60 | Nutritionists, Dietitians, Health Coaches |

| Consumer Preferences and Trends | 100 | Health-Conscious Consumers, Fitness Enthusiasts |

| Regulatory Impact Assessment | 40 | Regulatory Affairs Specialists, Compliance Officers |

The US Dietary Supplements Market is valued at approximately USD 57 billion, reflecting a significant growth trend driven by increasing health consciousness, preventive healthcare measures, and a shift towards natural and organic products among consumers.