US Animal Health Market Overview

- The US Animal Health Market is valued at USD 19 billion, based on a five-year historical analysis. This growth is primarily driven by increasing pet ownership, rising awareness of animal health, and advancements in veterinary medicine. The demand for pharmaceuticals, vaccines, and diagnostics has surged as pet owners and livestock farmers prioritize animal welfare and preventive care. Recent trends include the growing adoption of companion animals by millennials, rising livestock production, and heightened concerns about food-borne and zoonotic diseases, which are further accelerating market expansion.

- Key players in this market include major cities such as New York, Los Angeles, and Chicago, which dominate due to their large populations and high disposable incomes. Additionally, states with significant agricultural activities, like Texas and California, contribute to the market's growth by emphasizing livestock health and productivity. The market also benefits from regional diversity, with urban centers driving companion animal healthcare and rural/agricultural states supporting production animal health.

- In 2023, the US government implemented the Animal Drug User Fee Amendments (ADUFA), which aims to expedite the approval process for animal drugs. The Animal Drug User Fee Amendments of 2023, issued by the US Food and Drug Administration, require manufacturers to pay user fees for the review and approval of new animal drugs, thereby enhancing the efficiency and timeliness of bringing new veterinary products to market. This regulation covers prescription and generic animal drugs, sets specific fee schedules, and mandates compliance with FDA review standards.

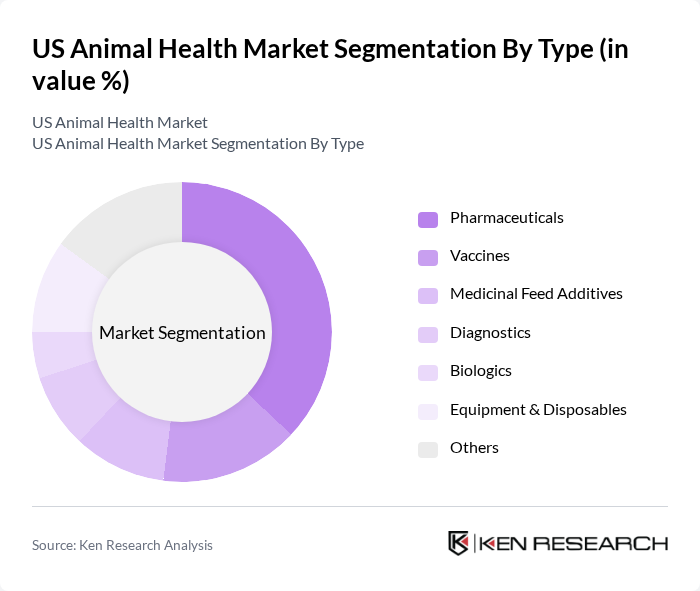

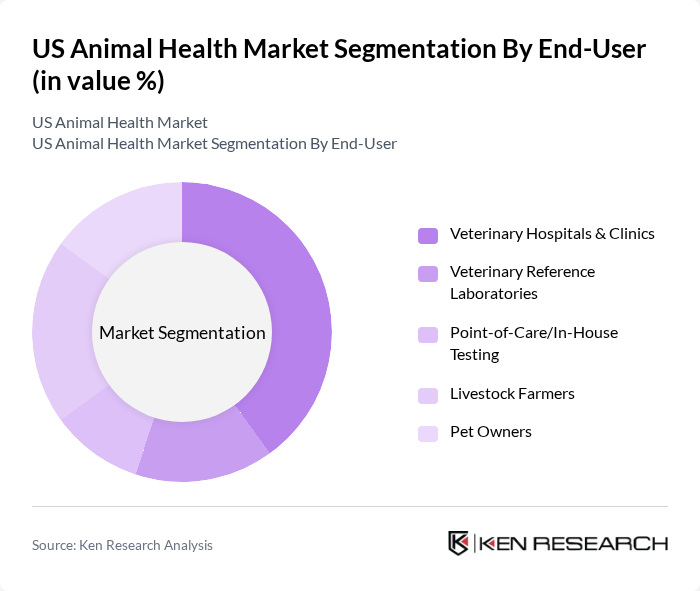

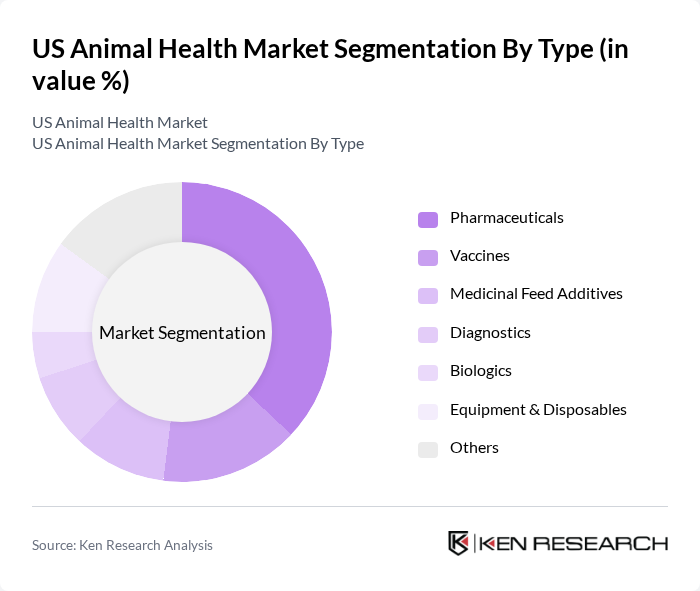

US Animal Health Market Segmentation

By Type:The market is segmented into various types, including Pharmaceuticals, Vaccines, Medicinal Feed Additives, Diagnostics, Biologics, Equipment & Disposables, and Others. Among these, Pharmaceuticals and Vaccines are the leading segments due to their critical role in disease prevention and treatment in both companion and production animals. The increasing prevalence of zoonotic diseases and the growing trend of preventive healthcare are driving the demand for these products. Pharmaceuticals account for the largest share, reflecting strong demand for parasiticides, antibiotics, and pain management products, while vaccines continue to grow due to their importance in preventive care and outbreak control.

By End-User:The end-user segmentation includes Veterinary Hospitals & Clinics, Veterinary Reference Laboratories, Point-of-Care/In-House Testing, Livestock Farmers, and Pet Owners. Veterinary Hospitals & Clinics dominate this segment as they are the primary providers of animal healthcare services, driving the demand for various health products and services. The increasing number of pet owners and livestock farmers seeking professional veterinary care further supports this trend. Veterinary Hospitals & Clinics account for the largest share, reflecting their central role in both companion and production animal health management.

US Animal Health Market Competitive Landscape

The US Animal Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Virbac Corporation, IDEXX Laboratories, Inc., Neogen Corporation, Phibro Animal Health Corporation, Vetoquinol USA, Covetrus, Inc., PetIQ, Inc., VetCor, Trupanion, Inc., PetSmart, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

US Animal Health Market Industry Analysis

Growth Drivers

- Increasing Pet Ownership:The American Pet Products Association reported that approximately 70% of U.S. households own a pet, translating to around 90 million homes. This surge in pet ownership has led to increased spending on veterinary services, with the American Veterinary Medical Association estimating that pet owners spent over $34 billion on veterinary care in the future. This trend is expected to continue, driving demand for animal health products and services as pet owners prioritize their pets' health and well-being.

- Rising Demand for Animal Protein:The U.S. Department of Agriculture projected that meat production in the U.S. would reach approximately 102 billion pounds in the future, driven by a growing population and increasing protein consumption. This demand for animal protein necessitates enhanced animal health measures to ensure livestock productivity and disease prevention. Consequently, investments in veterinary services and animal health products are expected to rise, supporting the overall growth of the animal health market.

- Advancements in Veterinary Medicine:The veterinary medicine sector is experiencing rapid advancements, with the market for veterinary pharmaceuticals expected to exceed $12 billion in the future. Innovations such as biologics, advanced diagnostics, and telemedicine are enhancing treatment options for animals. The integration of technology in veterinary practices is improving efficiency and outcomes, leading to increased adoption of veterinary services and products, thereby driving market growth in the animal health sector.

Market Challenges

- High Cost of Veterinary Services:The cost of veterinary care has been rising significantly, with average expenditures per pet reaching approximately $1,600 annually in the future. This financial burden can deter pet owners from seeking necessary medical care for their animals, potentially leading to untreated health issues. As a result, the high cost of veterinary services poses a significant challenge to the growth of the animal health market, particularly among low-income households.

- Stringent Regulatory Environment:The animal health industry is subject to rigorous regulations from agencies such as the FDA and USDA, which can complicate the approval process for new products. In the future, the FDA processed over 1,200 new animal drug applications, reflecting the stringent oversight in place. These regulatory hurdles can delay product launches and increase costs for companies, ultimately impacting their ability to compete effectively in the market.

US Animal Health Market Future Outlook

The future of the U.S. animal health market appears promising, driven by ongoing trends in pet ownership and advancements in veterinary care. As consumers increasingly prioritize preventive healthcare for their pets, the demand for innovative health solutions is expected to rise. Additionally, the integration of technology in veterinary practices will likely enhance service delivery, making veterinary care more accessible and efficient. These trends indicate a robust growth trajectory for the animal health sector in the coming years.

Market Opportunities

- Expansion of Telemedicine in Veterinary Care:The rise of telemedicine offers significant opportunities for the animal health market, with a projected increase in virtual consultations expected to reach 25 million in the future. This trend allows pet owners to access veterinary care conveniently, particularly in underserved areas, thereby expanding the market reach and improving overall animal health outcomes.

- Growth in E-commerce for Pet Products:E-commerce sales of pet products are anticipated to exceed $35 billion in the future, driven by changing consumer preferences for online shopping. This shift presents a lucrative opportunity for animal health companies to enhance their distribution channels and reach a broader audience, ultimately boosting sales of veterinary products and services.