Region:Asia

Author(s):Rebecca

Product Code:KRAE3007

Pages:89

Published On:February 2026

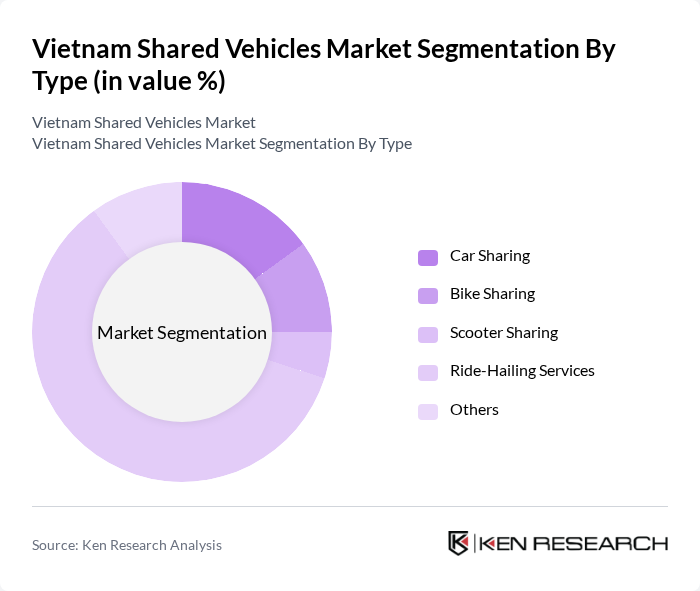

By Type:This segmentation includes various modes of shared vehicles, reflecting the diverse preferences of consumers. The subsegments are Car Sharing, Bike Sharing, Scooter Sharing, Ride-Hailing Services, and Others. Among these, Ride-Hailing Services dominate the market due to their convenience and widespread adoption, particularly in urban areas where traditional transport options may be limited.

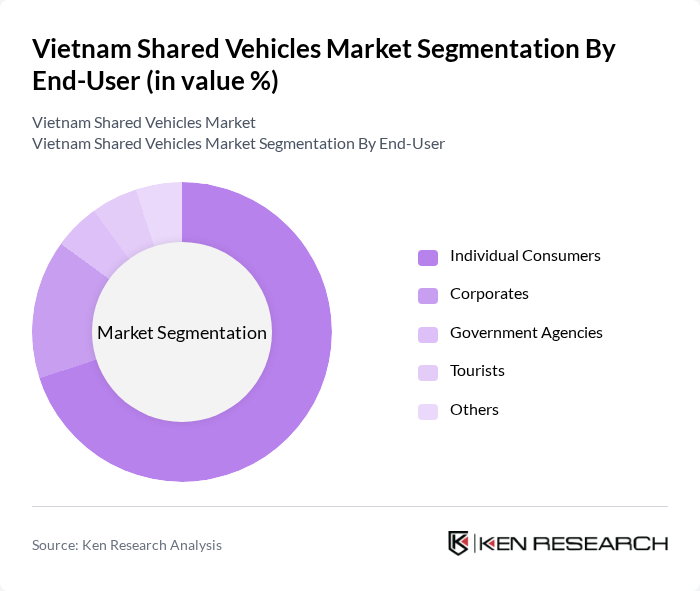

By End-User:This segmentation categorizes users of shared vehicles into Individual Consumers, Corporates, Government Agencies, Tourists, and Others. Individual Consumers represent the largest segment, driven by the increasing preference for flexible and cost-effective transportation solutions. The rise in urban mobility challenges has led to a significant shift towards shared services among everyday users.

The Vietnam Shared Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grab, Go-Viet, Be Group, FastGo, Uber (now part of Grab), Gojek, Momo, ZaloPay, VinFast, TNG Holdings Vietnam, Vinasun, Mai Linh, Thue Xe, Xe Chia Se, Viettel contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam shared vehicles market appears promising, driven by increasing urbanization and a growing emphasis on sustainability. As the government continues to invest in infrastructure and regulatory frameworks, shared mobility solutions are expected to gain traction. The integration of technology, such as mobile apps and autonomous vehicles, will further enhance user experience. Additionally, partnerships with local businesses will create synergies that expand service offerings, making shared vehicles a more attractive option for urban commuters in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Car Sharing Bike Sharing Scooter Sharing Ride-Hailing Services Others |

| By End-User | Individual Consumers Corporates Government Agencies Tourists Others |

| By Vehicle Ownership Model | Peer-to-Peer Sharing Fleet Management Subscription Services Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Payment Model | Pay-Per-Use Subscription-Based Membership Plans Others |

| By Vehicle Type | Electric Vehicles Hybrid Vehicles Conventional Vehicles Others |

| By Service Type | On-Demand Services Scheduled Services Corporate Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Shared Bike Users | 150 | Urban Commuters, College Students |

| Car-Sharing Service Users | 100 | Young Professionals, Families |

| Electric Scooter Users | 80 | Tourists, Local Residents |

| Fleet Operators | 60 | Business Owners, Fleet Managers |

| Urban Mobility Experts | 50 | City Planners, Transportation Analysts |

The Vietnam Shared Vehicles Market is valued at approximately USD 1.5 billion, driven by urbanization, rising disposable incomes, and a shift towards sustainable transportation solutions. This growth reflects the increasing demand for cost-effective and convenient alternatives to traditional vehicle ownership.