Region:Asia

Author(s):Rebecca

Product Code:KRAA5587

Pages:87

Published On:January 2026

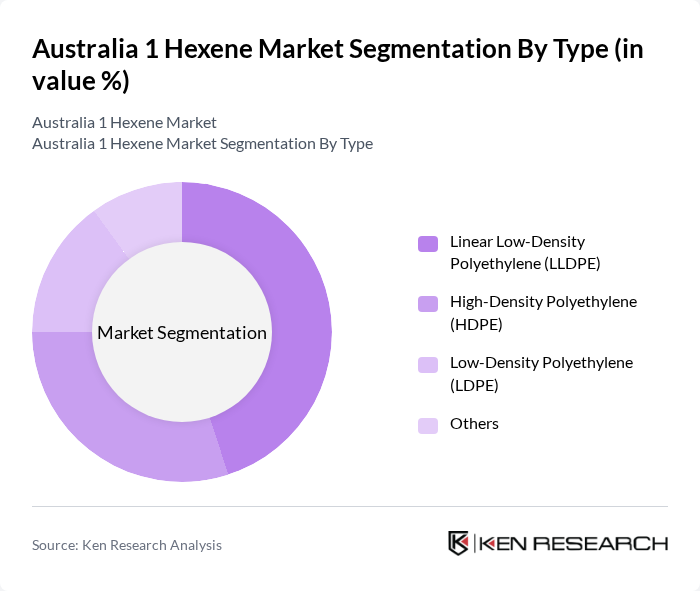

By Type:The market is segmented into Linear Low-Density Polyethylene (LLDPE), High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), and Others. Among these, LLDPE is the leading subsegment due to its versatility and superior mechanical properties, making it highly sought after in various applications, particularly in packaging and films. The demand for LLDPE is driven by its lightweight nature and excellent tensile strength, which are essential for modern packaging solutions.

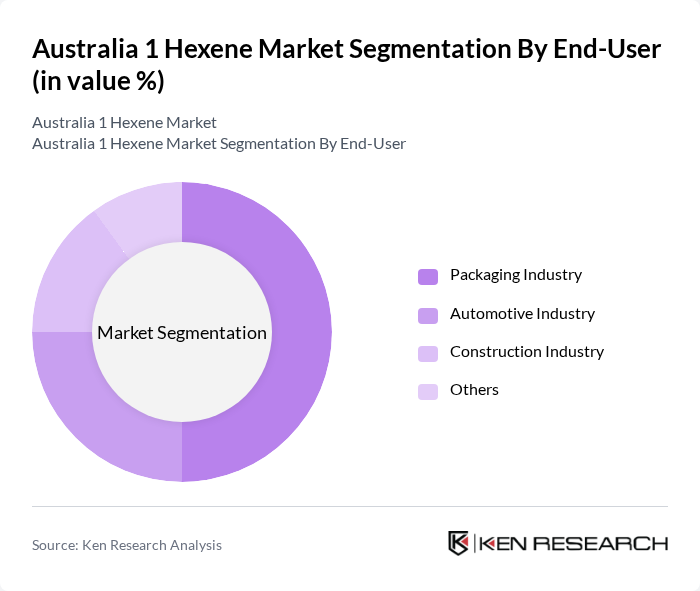

By End-User:The end-user segmentation includes the Packaging Industry, Automotive Industry, Construction Industry, and Others. The Packaging Industry is the dominant segment, driven by the increasing demand for flexible packaging solutions. The rise in e-commerce and consumer goods packaging has significantly boosted the need for hexene-derived products, particularly in creating lightweight and durable packaging materials.

The Australia 1 Hexene Market is characterized by a dynamic mix of regional and international players. Leading participants such as LyondellBasell Industries, Chevron Phillips Chemical Company, INEOS, ExxonMobil Chemical, SABIC, Dow Chemical Company, Braskem, Reliance Industries, Formosa Plastics Corporation, Westlake Chemical Corporation, Mitsubishi Chemical Corporation, Sumitomo Chemical Company, LG Chem, BASF SE, Huntsman Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Australia 1 hexene market is poised for significant growth, driven by increasing demand for sustainable and innovative chemical solutions. As industries shift towards eco-friendly practices, the adoption of bio-based hexene is expected to rise, aligning with global sustainability trends. Additionally, strategic partnerships among key players will enhance market competitiveness, facilitating access to new technologies and expanding production capabilities. This collaborative approach will likely position the market favorably for future developments and increased export opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Linear Low-Density Polyethylene (LLDPE) High-Density Polyethylene (HDPE) Low-Density Polyethylene (LDPE) Others |

| By End-User | Packaging Industry Automotive Industry Construction Industry Others |

| By Application | Films and Sheets Injection Molding Blow Molding Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | New South Wales Victoria Queensland Others |

| By Product Form | Granules Powders Liquids Others |

| By End-User Size | Large Enterprises Small and Medium Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Polyethylene Production | 45 | Production Managers, Chemical Engineers |

| Textile Manufacturing | 40 | Product Development Managers, Supply Chain Coordinators |

| Automotive Component Suppliers | 40 | Procurement Managers, Quality Assurance Officers |

| Specialty Chemicals Sector | 40 | Research Scientists, Business Development Managers |

| Consumer Goods Manufacturers | 45 | Marketing Managers, Operations Directors |

The Australia 1 Hexene Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This valuation is primarily driven by the increasing demand for polyethylene products across various industries, including packaging, automotive, and construction.