Region:Global

Author(s):Rebecca

Product Code:KRAA6870

Pages:94

Published On:January 2026

By Purity:The purity of 1-hexene is a critical factor influencing its applications and market dynamics. The two main subsegments are Technical-grade 1-hexene and Pure-grade 1-hexene. Technical-grade 1-hexene is widely used in various industrial applications due to its cost-effectiveness, while Pure-grade 1-hexene is preferred for high-end applications requiring stringent quality standards.

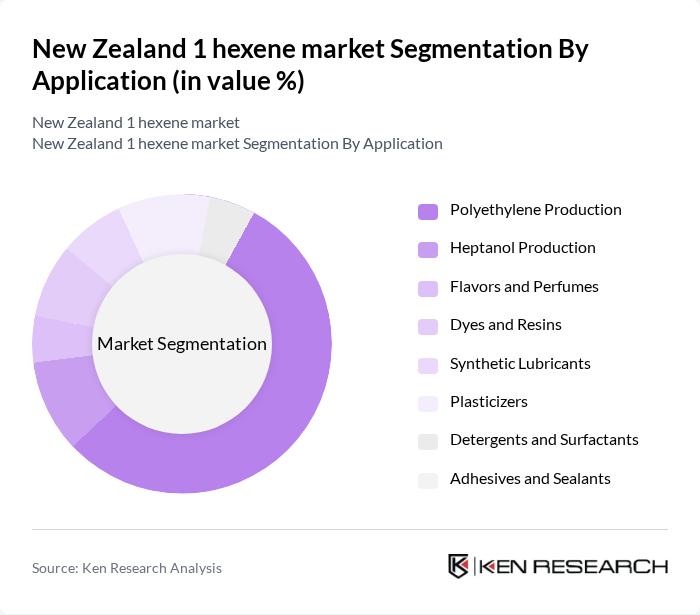

By Application:The applications of 1-hexene are diverse, encompassing several industries. Key applications include Polyethylene Production, Heptanol Production, Flavors and Perfumes, Dyes and Resins, Synthetic Lubricants, Plasticizers, Detergents and Surfactants, and Adhesives and Sealants. Polyethylene production is the leading application due to the high demand for plastic products in various sectors.

The New Zealand 1 hexene market is characterized by a dynamic mix of regional and international players. Leading participants such as Dow Chemical Company, BASF SE, LyondellBasell Industries, INEOS, Huntsman Corporation, Eastman Chemical Company, Solvay S.A., Air Products and Chemicals, Univar Solutions, Chemtrade Logistics, Z Energy, Methanex Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand 1 hexene market is poised for growth, driven by increasing demand from various sectors, including polymers and coatings. The anticipated expansion of petrochemical production facilities will enhance supply capabilities, while technological advancements in production processes will improve efficiency. Additionally, the shift towards sustainable practices and bio-based production methods is expected to reshape the market landscape, creating new opportunities for innovation and collaboration among industry players.

| Segment | Sub-Segments |

|---|---|

| By Purity | Technical-grade 1-hexene Pure-grade 1-hexene |

| By Application | Polyethylene Production Heptanol Production Flavors and Perfumes Dyes and Resins Synthetic Lubricants Plasticizers Detergents and Surfactants Adhesives and Sealants |

| By End-Use Industry | Paper Industry Consumer Goods Chemical Industry Automotive Industry Packaging Industry Cosmetics and Pharmaceuticals Industry Construction Industry Agriculture Industry Textiles Industry |

| By Production Process | Olefins Process Metathesis Process |

| By Geography | North Island South Island |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Polyethylene Production | 45 | Production Managers, Chemical Engineers |

| Specialty Chemicals Applications | 40 | Product Development Managers, R&D Directors |

| Market Distribution Channels | 35 | Supply Chain Managers, Sales Directors |

| Regulatory Compliance Insights | 30 | Compliance Officers, Environmental Managers |

| End-user Industry Feedback | 40 | Procurement Officers, Industry Analysts |

The New Zealand 1 hexene market is valued at approximately USD 5 million, reflecting a steady growth driven by increasing demand for polyethylene and its derivatives across various industries, including packaging and automotive sectors.