Region:Middle East

Author(s):Rebecca

Product Code:KRAA5580

Pages:81

Published On:January 2026

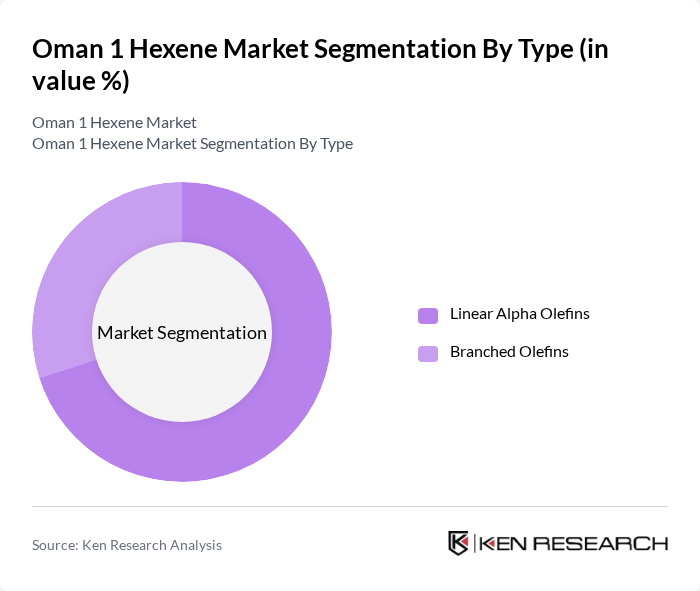

By Type:The market is segmented into Linear Alpha Olefins and Branched Olefins. Linear Alpha Olefins are primarily used in the production of polyethylene co-monomers, while Branched Olefins find applications in various chemical processes. Linear Alpha Olefins dominate the market due to their versatility and higher demand in the production of high-performance polymers.

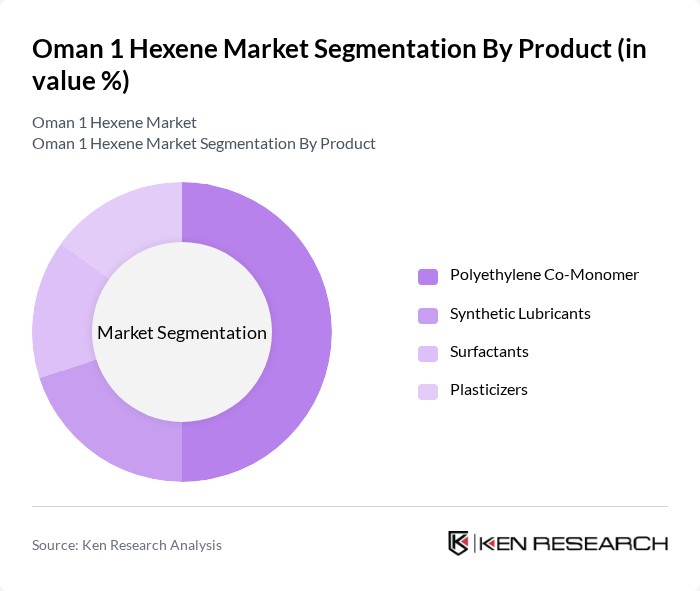

By Product:The product segmentation includes Polyethylene Co-Monomer, Synthetic Lubricants, Surfactants, and Plasticizers. Polyethylene Co-Monomer is the leading product due to its extensive use in the packaging industry, driven by the growing demand for lightweight and durable materials. Synthetic Lubricants are also gaining traction as industries seek high-performance alternatives to conventional options.

The Oman 1 Hexene Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical Company, LyondellBasell Industries, Shell Chemicals, Chevron Phillips Chemical Company, SABIC (Saudi Basic Industries Corporation), INEOS Group, LG Chem, Reliance Industries Limited, BASF SE, Shaanxi Yanchang Petroleum Group Co., Ltd., Oman Oil Refineries and Petroleum Industries Company (ORPIC), Gulf Petrochemicals Industries Company (GPIC), Sohar Refinery Company, Oman Methanol Company, Salalah Methanol Company contribute to innovation, geographic expansion, and service delivery in this space.

The Oman 1 hexene market is poised for significant growth, driven by increasing demand from the polymer industry and ongoing investments in petrochemical facilities. As sustainability becomes a priority, manufacturers are likely to adopt greener production methods, aligning with global trends. Additionally, the expansion into emerging markets presents a promising avenue for growth, allowing Omani producers to tap into new customer bases and diversify their offerings, ultimately enhancing their competitive edge in the global market.

| Segment | Sub-Segments |

|---|---|

| By Type | Linear Alpha Olefins Branched Olefins |

| By Product | Polyethylene Co-Monomer Synthetic Lubricants Surfactants Plasticizers |

| By Application | Polyethylene Production Heptanol Production Detergent Alcohols Oil Field Chemicals Adhesives and Sealants |

| By Purity Grade | Technical Grade Pure Grade |

| By Production Process | Olefins Process Metathesis Process |

| By End-User Industry | Packaging Industry Automotive Industry Chemical Industry Cosmetics and Pharmaceuticals Industry Textiles Industry Consumer Goods |

| By Geography | Muscat Salalah Sohar Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Polyethylene Production Facilities | 100 | Production Managers, Chemical Engineers |

| Specialty Chemical Manufacturers | 80 | Product Development Managers, R&D Directors |

| Logistics and Distribution Companies | 70 | Supply Chain Managers, Logistics Coordinators |

| Regulatory Bodies and Industry Associations | 50 | Policy Makers, Industry Analysts |

| End-User Industries (e.g., Automotive, Packaging) | 90 | Procurement Officers, Operations Managers |

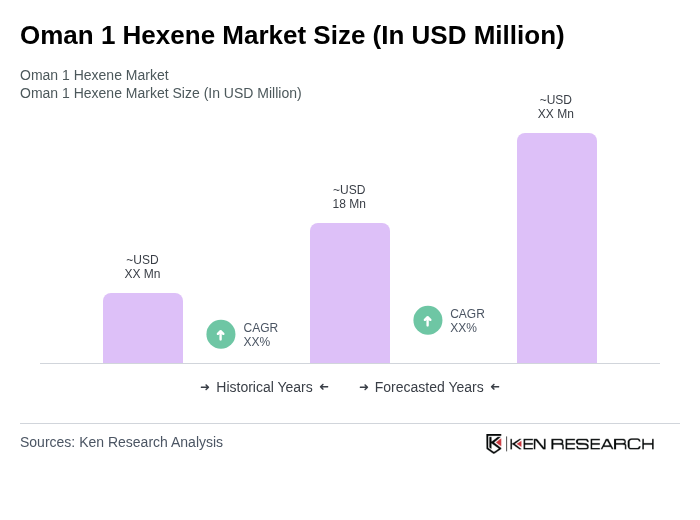

The Oman 1 Hexene Market is valued at approximately USD 18 million, driven by the increasing demand for polyethylene co-monomers in various applications, particularly in the packaging and automotive industries.