Region:Middle East

Author(s):Rebecca

Product Code:KRAA5578

Pages:83

Published On:January 2026

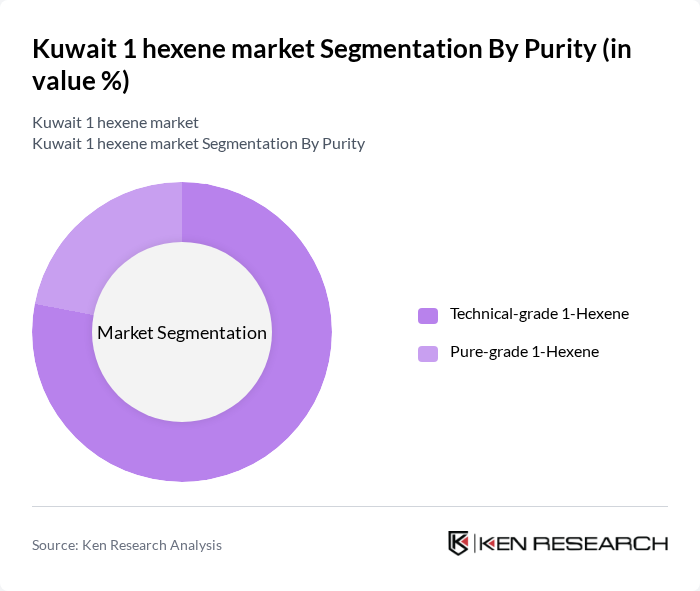

By Purity:The purity of 1 hexene is categorized into two main subsegments: Technical-grade 1-Hexene and Pure-grade 1-Hexene. Technical-grade 1-Hexene is primarily used in industrial applications, while Pure-grade 1-Hexene is favored for high-end applications requiring greater purity levels. The demand for Pure-grade 1-Hexene is increasing due to its applications in specialized chemical processes and high-performance materials. Technical-grade 1-hexene holds a dominant market position globally, capturing more than 78% of the market share, reflecting its widespread industrial utility.

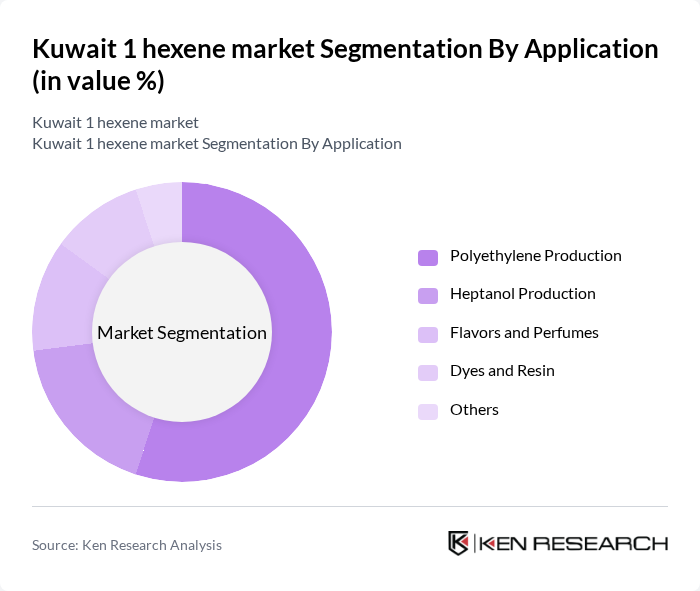

By Application:The applications of 1 hexene are diverse, including Polyethylene Production, Heptanol Production, Flavors and Perfumes, Dyes and Resin, and Others. Polyethylene production is the leading application, driven by the growing demand for packaging materials in construction, automotive, and consumer goods sectors. The versatility of 1 hexene in producing various chemical compounds makes it a critical component in multiple industries.

The Kuwait 1 hexene market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Petroleum Corporation, Equate Petrochemical Company, Gulf Petrochemicals Industries Company, Petrochemical Industries Company, Kuwait Styrene Company, Al-Dar Petroleum Services, Kuwait Chemical Company, Kuwait National Petroleum Company, Gulf Chemical Industries, Kuwait Oil Company, KPC Chemicals, Kuwait Industrial Company, Al-Mansour Holding Company, Royal Dutch Shell plc, SABIC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait 1 hexene market appears promising, driven by ongoing investments in petrochemical infrastructure and a growing emphasis on sustainable production practices. As the polymer industry continues to expand, the demand for 1 hexene is expected to rise, particularly in high-performance applications. Additionally, technological advancements in production methods will likely enhance efficiency and reduce costs, positioning Kuwait as a competitive player in the regional market for 1 hexene.

| Segment | Sub-Segments |

|---|---|

| By Purity | Technical-grade 1-Hexene Pure-grade 1-Hexene |

| By Application | Polyethylene Production Heptanol Production Flavors and Perfumes Dyes and Resin Others |

| By End-Use | Chemical Industry Packaging Industry Automotive Industry Consumer Goods Paper Industry Cosmetics and Pharmaceuticals Industry Others |

| By Distribution Channel | Direct Sales Indirect Sales |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hexene Production Facilities | 45 | Plant Managers, Production Supervisors |

| Hexene Distribution Channels | 40 | Logistics Coordinators, Supply Chain Managers |

| End-User Industries (Plastics, Rubber) | 40 | Procurement Managers, Product Development Leads |

| Regulatory Bodies and Compliance | 40 | Regulatory Affairs Specialists, Environmental Compliance Officers |

| Market Analysts and Consultants | 40 | Industry Analysts, Market Research Professionals |

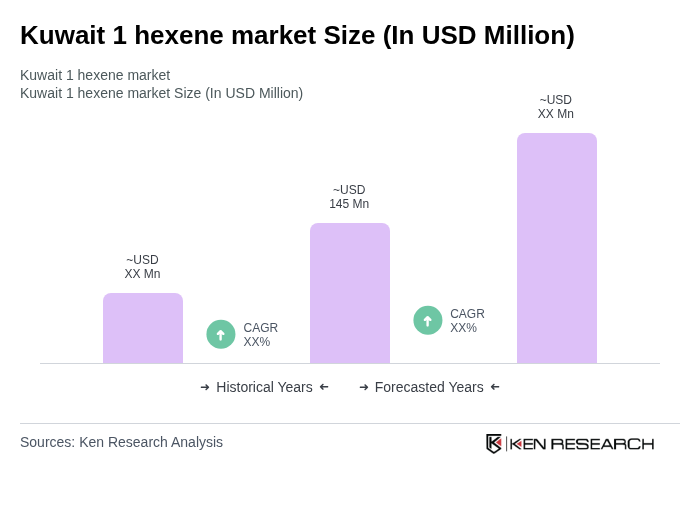

The Kuwait 1 hexene market is valued at approximately USD 145 million, reflecting a five-year historical analysis. This valuation is driven by increasing demand for polyethylene and other derivatives across various industries, including packaging and automotive.