Region:Asia

Author(s):Rebecca

Product Code:KRAA5575

Pages:90

Published On:January 2026

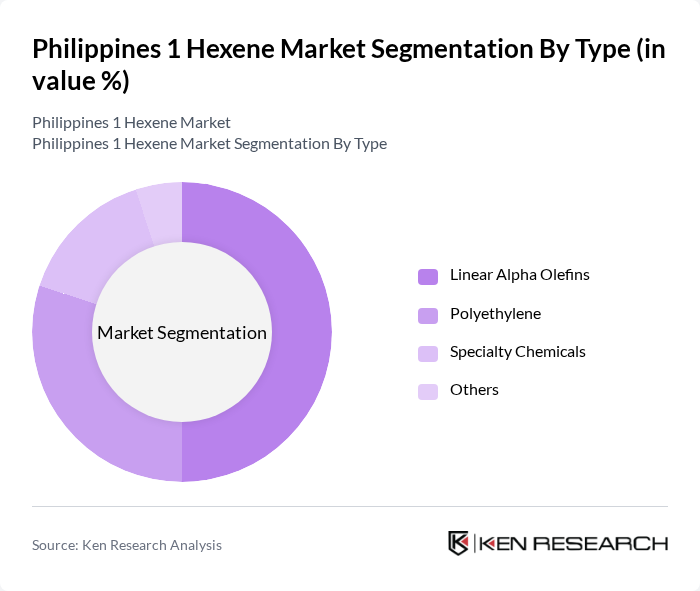

By Type:The market is segmented into various types, including Linear Alpha Olefins, Polyethylene, Specialty Chemicals, and Others. Among these, Linear Alpha Olefins are the most dominant due to their extensive use in producing high-performance polymers and surfactants. The demand for Polyethylene is also significant, driven by its applications in packaging and consumer goods. Specialty Chemicals and Others contribute to niche markets but have a smaller share compared to the leading segments.

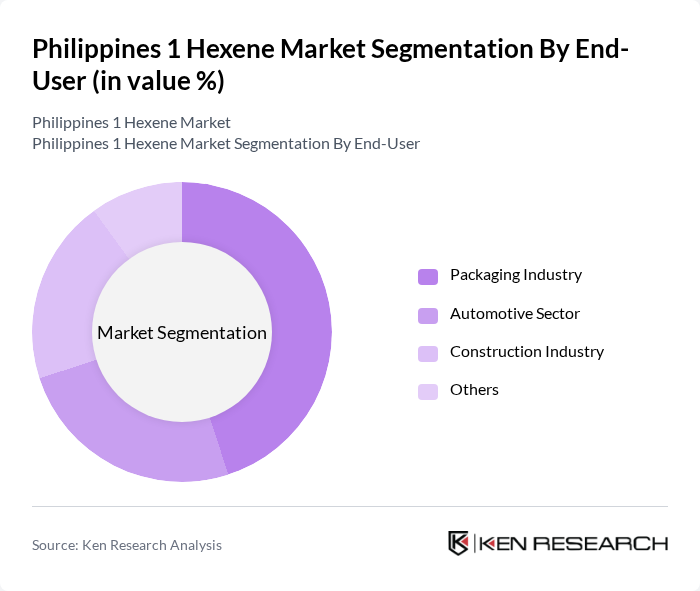

By End-User:The end-user segmentation includes the Packaging Industry, Automotive Sector, Construction Industry, and Others. The Packaging Industry is the largest consumer of 1 hexene, driven by the growing demand for flexible packaging solutions. The Automotive Sector also plays a crucial role, utilizing hexene in manufacturing various components. The Construction Industry is emerging as a significant user, particularly in producing construction materials and coatings.

The Philippines 1 Hexene Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pilipinas Shell Petroleum Corporation, Petron Corporation, JG Summit Petrochemicals Group, D&L Industries, Inc., Chemrez Technologies, Inc., A. Brown Company, Inc., San Miguel Corporation, Universal Robina Corporation, Asia United Bank Corporation, First Philippine Holdings Corporation, Manila North Tollways Corporation, Energy Development Corporation, Ayala Corporation, Filinvest Development Corporation, Aboitiz Equity Ventures, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines 1 hexene market is poised for significant growth, driven by increasing demand from the plastics industry and ongoing investments in petrochemical projects. As manufacturers adapt to environmental regulations, a shift towards sustainable production practices is anticipated. Additionally, technological advancements in hexene production will likely enhance efficiency and reduce costs. The market's future will also be shaped by strategic partnerships that leverage local resources and expertise, fostering innovation and competitiveness in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Linear Alpha Olefins Polyethylene Specialty Chemicals Others |

| By End-User | Packaging Industry Automotive Sector Construction Industry Others |

| By Application | Polymer Production Chemical Intermediates Coatings and Adhesives Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Luzon Visayas Mindanao Others |

| By Customer Type | Large Enterprises SMEs Government Agencies Others |

| By Product Form | Liquid Hexene Solid Hexene Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Polyethylene Production | 45 | Production Managers, Chemical Engineers |

| Specialty Chemicals Applications | 40 | Product Development Managers, R&D Directors |

| Textile Manufacturing | 40 | Procurement Managers, Operations Supervisors |

| Automotive Sector Usage | 40 | Supply Chain Managers, Quality Assurance Heads |

| Market Research Analysts | 45 | Market Analysts, Business Development Executives |

The Philippines 1 Hexene Market is valued at approximately USD 145 million, reflecting a significant growth driven by the increasing demand for linear alpha olefins in various applications, including detergents, lubricants, and plastics.