Region:Middle East

Author(s):Shubham

Product Code:KRAB7866

Pages:83

Published On:October 2025

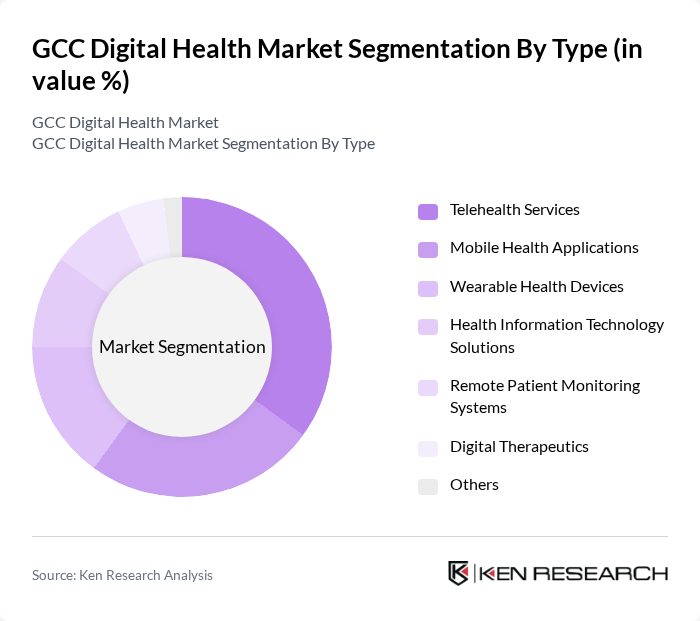

By Type:The market is segmented into various types, including Telehealth Services, Mobile Health Applications, Wearable Health Devices, Health Information Technology Solutions, Remote Patient Monitoring Systems, Digital Therapeutics, and Others. Among these, Telehealth Services are leading due to their convenience and the growing acceptance of virtual consultations, especially post-pandemic.

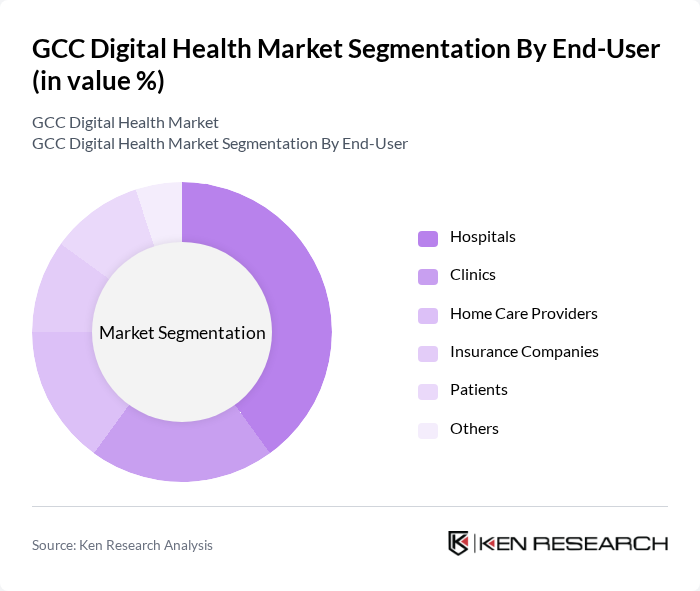

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Care Providers, Insurance Companies, Patients, and Others. Hospitals are the dominant segment, driven by the increasing need for integrated healthcare solutions and the adoption of digital health technologies to enhance patient care and operational efficiency.

The GCC Digital Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, Cerner Corporation, Allscripts Healthcare Solutions, Medtronic, GE Healthcare, IBM Watson Health, Oracle Health Sciences, Teladoc Health, Health Catalyst, DarioHealth Corp., Zocdoc, Babylon Health, Amwell, DocuSign contribute to innovation, geographic expansion, and service delivery in this space.

The GCC digital health market is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As healthcare providers increasingly adopt patient-centric models, the integration of artificial intelligence and machine learning into health solutions will enhance service delivery. Furthermore, the expansion of telehealth services and remote monitoring technologies will cater to the growing demand for accessible healthcare. These trends indicate a shift towards more personalized and efficient healthcare solutions, positioning the GCC as a leader in digital health innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Telehealth Services Mobile Health Applications Wearable Health Devices Health Information Technology Solutions Remote Patient Monitoring Systems Digital Therapeutics Others |

| By End-User | Hospitals Clinics Home Care Providers Insurance Companies Patients Others |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Services Rehabilitation Services Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Healthcare Providers Retail Pharmacies Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Others |

| By Customer Segment | Individual Consumers Healthcare Professionals Corporate Clients Government Agencies Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Models Bundled Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers (Hospitals & Clinics) | 150 | Healthcare Administrators, IT Managers |

| Digital Health Startups | 100 | Founders, Product Managers |

| Patients Using Digital Health Solutions | 200 | Patients, Caregivers |

| Health Insurance Companies | 80 | Policy Analysts, Product Development Managers |

| Regulatory Bodies | 50 | Health Policy Makers, Compliance Officers |

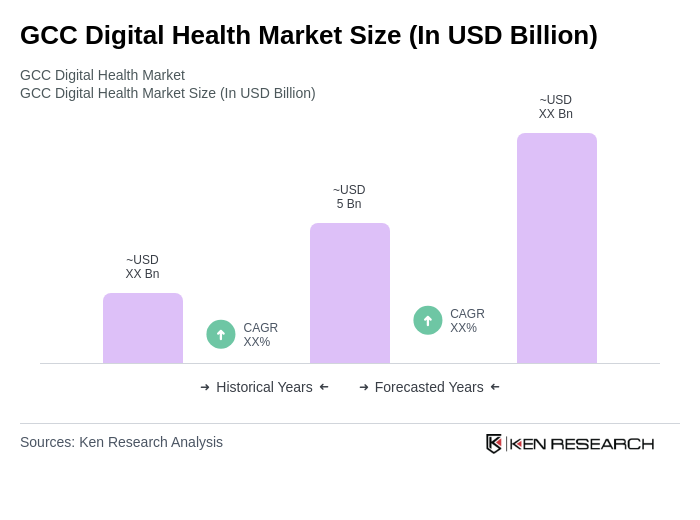

The GCC Digital Health Market is valued at approximately USD 5 billion, reflecting significant growth driven by the adoption of telehealth services, mobile health applications, and wearable health devices, particularly in Saudi Arabia and the United Arab Emirates.