Region:Europe

Author(s):Rebecca

Product Code:KRAB5881

Pages:84

Published On:October 2025

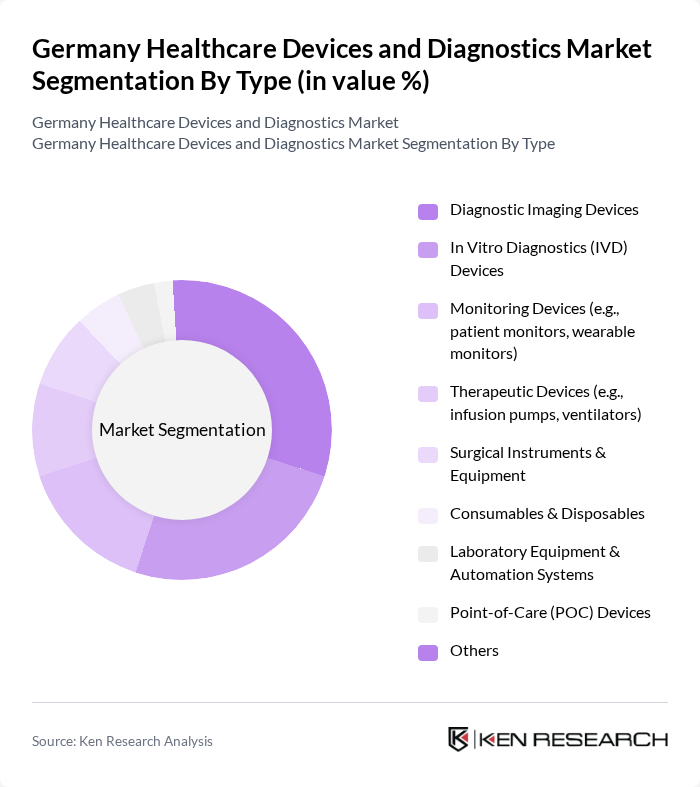

By Type:The market is segmented into various types of healthcare devices and diagnostics, including diagnostic imaging devices, in vitro diagnostics (IVD) devices, monitoring devices, therapeutic devices, surgical instruments and equipment, consumables and disposables, laboratory equipment and automation systems, point-of-care (POC) devices, and others. Among these, diagnostic imaging devices and IVD devices are particularly prominent due to their critical role in early disease detection and management, with strong demand for advanced imaging modalities (MRI, CT) and molecular diagnostics that support personalized medicine .

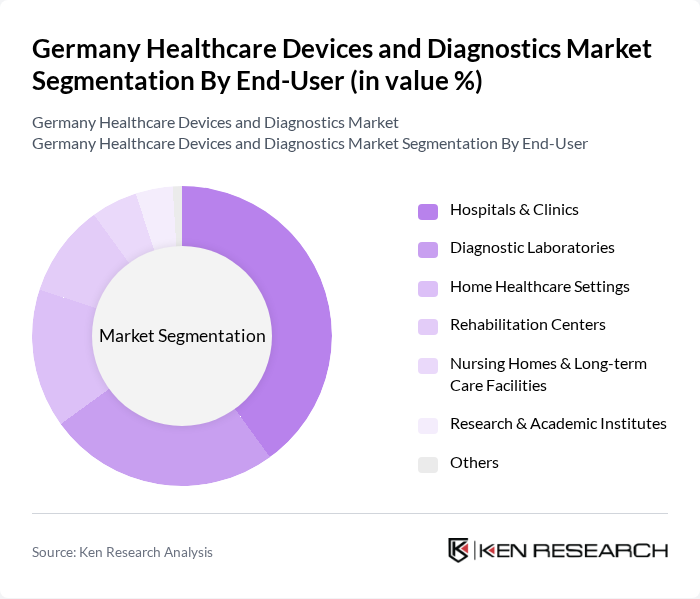

By End-User:The end-user segmentation includes hospitals and clinics, diagnostic laboratories, home healthcare settings, rehabilitation centers, nursing homes and long-term care facilities, research and academic institutes, and others. Hospitals and clinics are the largest end-users, driven by the increasing demand for advanced diagnostic and therapeutic solutions to address a growing and aging patient population. Home healthcare and point-of-care settings are also expanding rapidly, reflecting a shift toward decentralized care and remote patient monitoring .

The Germany Healthcare Devices and Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, Roche Diagnostics GmbH, B. Braun Melsungen AG, Drägerwerk AG & Co. KGaA, Philips Medizin Systeme Böblingen GmbH, GE Healthcare GmbH, Abbott Laboratories GmbH, Medtronic GmbH, Johnson & Johnson Medical GmbH, Olympus Europa SE & Co. KG, Stryker GmbH & Co. KG, Thermo Fisher Scientific GmbH, Canon Medical Systems GmbH, QIAGEN GmbH, BioMérieux Deutschland GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany healthcare devices and diagnostics market appears promising, driven by ongoing technological advancements and a growing emphasis on preventive healthcare. As the integration of digital health solutions and AI technologies continues to evolve, healthcare providers are expected to adopt more personalized and efficient care models. Additionally, the expansion of telemedicine services will likely enhance access to healthcare, particularly in rural areas, fostering a more inclusive healthcare environment and improving patient outcomes across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Devices In Vitro Diagnostics (IVD) Devices Monitoring Devices (e.g., patient monitors, wearable monitors) Therapeutic Devices (e.g., infusion pumps, ventilators) Surgical Instruments & Equipment Consumables & Disposables Laboratory Equipment & Automation Systems Point-of-Care (POC) Devices Others |

| By End-User | Hospitals & Clinics Diagnostic Laboratories Home Healthcare Settings Rehabilitation Centers Nursing Homes & Long-term Care Facilities Research & Academic Institutes Others |

| By Application | Cardiovascular Neurology Orthopedics Oncology Diabetes Management Infectious Disease Diagnostics Critical Care & Emergency Others |

| By Distribution Channel | Direct Sales Distributors & Wholesalers Online Sales Retail Pharmacies Others |

| By Region | North Germany South Germany East Germany West Germany Central Germany Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Technology | Digital Health Technologies (e.g., telemedicine, AI-enabled devices) Traditional Medical Devices Hybrid Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Diagnostic Imaging Devices | 85 | Radiologists, Imaging Technicians |

| In-vitro Diagnostic Devices | 70 | Laboratory Managers, Clinical Pathologists |

| Wearable Health Devices | 65 | Healthcare Innovators, Product Managers |

| Point-of-Care Testing Devices | 75 | Emergency Room Physicians, Nurse Practitioners |

| Telehealth Solutions | 80 | Telemedicine Specialists, IT Managers in Healthcare |

The Germany Healthcare Devices and Diagnostics Market is valued at approximately USD 44 billion, driven by factors such as an aging population, increasing chronic diseases, and advancements in diagnostic technologies that enhance patient outcomes.