Region:Africa

Author(s):Geetanshi

Product Code:KRAB5704

Pages:94

Published On:October 2025

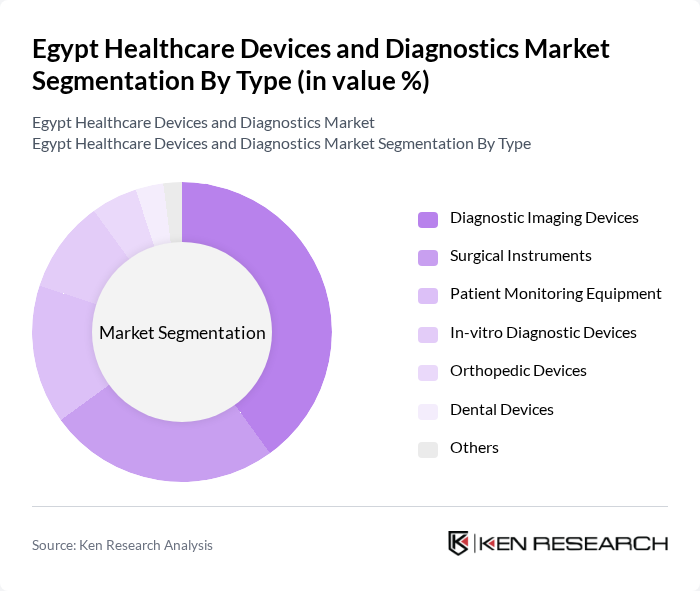

By Type:The market is segmented into various types of healthcare devices and diagnostics, including diagnostic imaging devices, surgical instruments, patient monitoring equipment, in-vitro diagnostic devices, orthopedic devices, dental devices, and others. Among these, diagnostic imaging devices are leading the market due to their critical role in disease diagnosis and management. The increasing adoption of advanced imaging technologies, such as MRI and CT scans, is driving this segment's growth. Surgical instruments also hold a significant share, supported by the rising number of surgical procedures performed in hospitals.

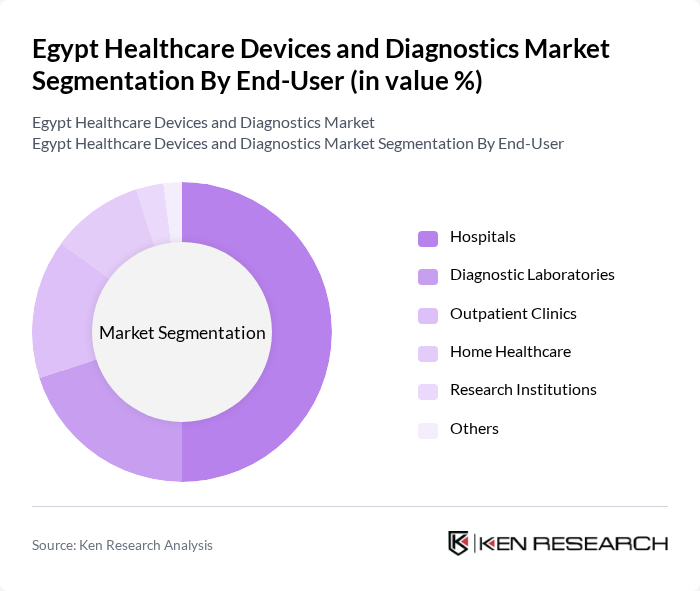

By End-User:The end-user segmentation includes hospitals, diagnostic laboratories, outpatient clinics, home healthcare, research institutions, and others. Hospitals are the leading end-user segment, driven by the increasing number of patients seeking medical care and the growing demand for advanced medical technologies. Diagnostic laboratories also play a crucial role, as they require a wide range of diagnostic devices to support their testing capabilities. The rise of home healthcare services is also notable, reflecting a shift towards patient-centered care.

The Egypt Healthcare Devices and Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers Egypt, GE Healthcare Egypt, Philips Healthcare Egypt, Medtronic Egypt, Abbott Egypt, Roche Diagnostics Egypt LLC, Becton, Dickinson and Company Egypt, Johnson & Johnson Medical Egypt, Stryker Egypt, Olympus Egypt, Boston Scientific Egypt, Thermo Fisher Scientific Egypt, Cardinal Health Egypt, Hologic Egypt, FUJIFILM Healthcare Middle East S.A.E., Nile Medical Group, Metamed (TechnoScan Egypt), BioMérieux Egypt, Allengers Medical Systems (Egypt), Canon Medical Systems Egypt, Mindray Medical International Limited Egypt, Epigenomics Egypt, Carestream Health Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthcare devices and diagnostics market in Egypt appears promising, driven by increasing healthcare investments and a growing focus on preventive care. The integration of digital health solutions and telemedicine is expected to enhance patient engagement and accessibility. Additionally, the government’s commitment to improving healthcare infrastructure will likely facilitate the adoption of advanced medical technologies, fostering a more robust healthcare ecosystem that meets the evolving needs of the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Devices Surgical Instruments Patient Monitoring Equipment In-vitro Diagnostic Devices Orthopedic Devices Dental Devices Others |

| By End-User | Hospitals Diagnostic Laboratories Outpatient Clinics Home Healthcare Research Institutions Others |

| By Application | Cardiovascular Applications Neurology Applications Orthopedic Applications Respiratory Applications Diabetes Management Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Premium Price Range |

| By Technology | Digital Health Technologies Traditional Medical Devices Advanced Therapeutic Devices Others |

| By Regulatory Compliance | CE Marking FDA Approval ISO Certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Diagnostic Laboratories | 60 | Laboratory Managers, Quality Control Officers |

| Healthcare Device Manufacturers | 50 | Product Managers, Sales Directors |

| Patient Advocacy Groups | 40 | Patient Representatives, Healthcare Advocates |

| Regulatory Bodies | 45 | Regulatory Affairs Specialists, Compliance Officers |

The Egypt Healthcare Devices and Diagnostics Market is valued at approximately USD 4.35 billion, reflecting a robust growth driven by increased healthcare expenditure, the rising prevalence of chronic diseases, and advancements in medical technology.