Region:Africa

Author(s):Rebecca

Product Code:KRAB5261

Pages:89

Published On:October 2025

By Type:The market is segmented into various types of healthcare devices and diagnostics, including in-vitro diagnostic devices, diagnostic imaging devices, monitoring devices, point-of-care devices, laboratory equipment, consumables, surgical instruments, therapeutic devices, dental devices, self-testing devices, and others. Among these, in-vitro diagnostic devices are leading the market due to their critical role in disease detection and management, particularly for infectious and chronic conditions. Diagnostic imaging devices also hold a significant share, driven by technological advancements and increasing demand for early detection of diseases .

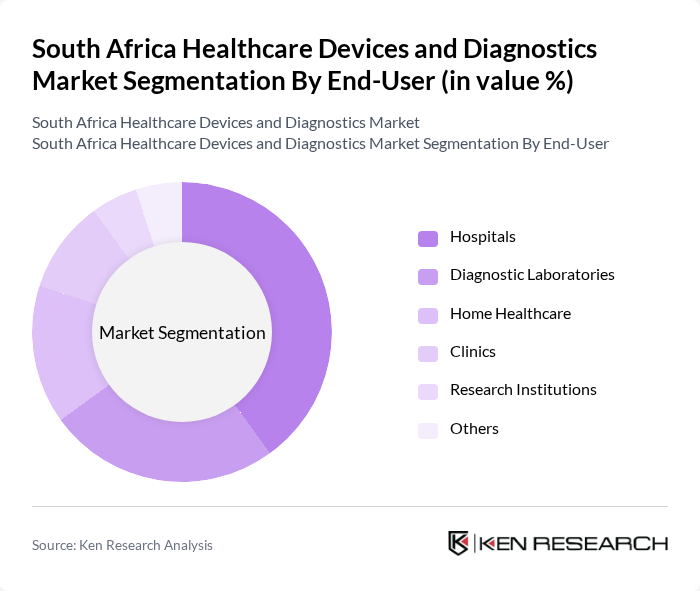

By End-User:The end-user segmentation includes hospitals, diagnostic laboratories, clinics, home care settings, research institutions, and others. Hospitals are the dominant end-user segment, driven by the increasing number of patients requiring diagnostic and therapeutic services, and the need for advanced medical technologies to improve patient outcomes and operational efficiency. Diagnostic laboratories and home healthcare are also growing segments, reflecting the expansion of testing services and the adoption of decentralized care models .

The South Africa Healthcare Devices and Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic, Siemens Healthineers, Philips Healthcare, GE Healthcare, Abbott Laboratories, Roche Diagnostics, Johnson & Johnson, Becton, Dickinson and Company, Stryker Corporation, Thermo Fisher Scientific, Canon Medical Systems, Olympus Corporation, Hologic, Inc., Mindray Medical International Limited, 3M Health Care, Ascendis Health, Adcock Ingram, Litha Healthcare Group, Werfen South Africa, Beckman Coulter South Africa, Dräger South Africa (Draegerwerk AG & Co. KGaA), Boston Scientific South Africa, Biomerieux South Africa, Cepheid South Africa, Sysmex South Africa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthcare devices and diagnostics market in South Africa appears promising, driven by technological innovations and increased healthcare spending. The integration of artificial intelligence in diagnostics is expected to enhance accuracy and efficiency, while the expansion of telemedicine will improve access to healthcare services. As the government continues to invest in healthcare infrastructure, the market is likely to witness significant growth, fostering a more robust healthcare ecosystem that prioritizes patient-centered solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Devices In-Vitro Diagnostic Devices Monitoring Devices Surgical Instruments Therapeutic Devices Dental Devices Point-of-Care Testing Devices Self-Testing Devices Others |

| By End-User | Hospitals Diagnostic Laboratories Home Healthcare Clinics Research Institutions Others |

| By Application | Cardiovascular Neurology Oncology Orthopedics Infectious Diseases Diabetes Autoimmune Diseases Nephrology Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Technology | Digital Health Technologies Traditional Medical Devices Hybrid Devices |

| By Regulatory Compliance | CE Marking FDA Approval ISO Certification |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 60 | Procurement Managers, Supply Chain Coordinators |

| Diagnostic Laboratories | 40 | Laboratory Managers, Quality Assurance Officers |

| Private Clinics and Practices | 50 | General Practitioners, Specialist Physicians |

| Medical Device Distributors | 40 | Sales Managers, Business Development Executives |

| Patient Advocacy Groups | 40 | Patient Representatives, Healthcare Advocates |

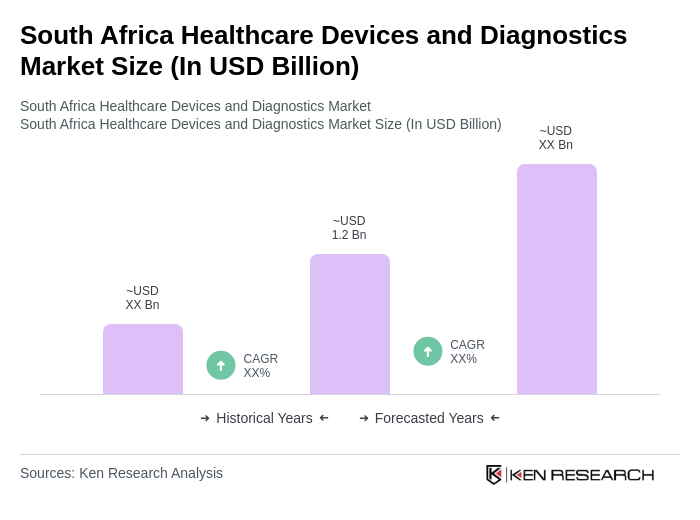

The South Africa Healthcare Devices and Diagnostics Market is valued at approximately USD 1.2 billion, driven by increased healthcare expenditure and the rising prevalence of chronic diseases such as diabetes and HIV/AIDS.