Region:Africa

Author(s):Geetanshi

Product Code:KRAB5195

Pages:98

Published On:October 2025

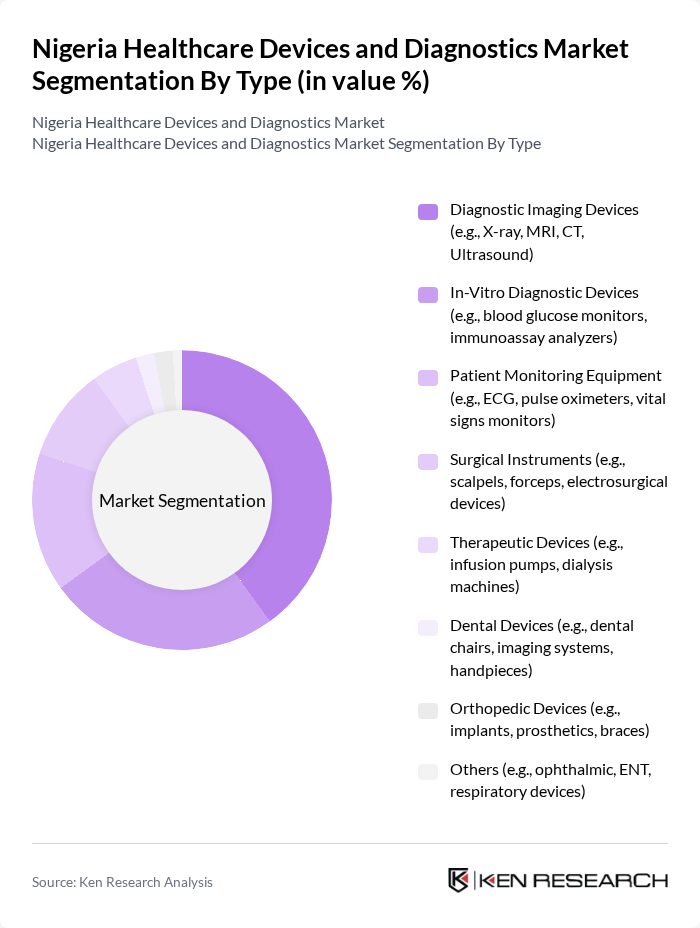

By Type:The market is segmented into various types of healthcare devices and diagnostics, including diagnostic imaging devices, in-vitro diagnostic devices, patient monitoring equipment, surgical instruments, therapeutic devices, dental devices, orthopedic devices, and others. Among these, diagnostic imaging devices and in-vitro diagnostic devices are particularly significant due to their essential role in disease detection and management. Diagnostic imaging devices lead the segment, driven by demand for early detection and monitoring of chronic diseases, while in-vitro diagnostic devices are vital for laboratory-based and point-of-care testing .

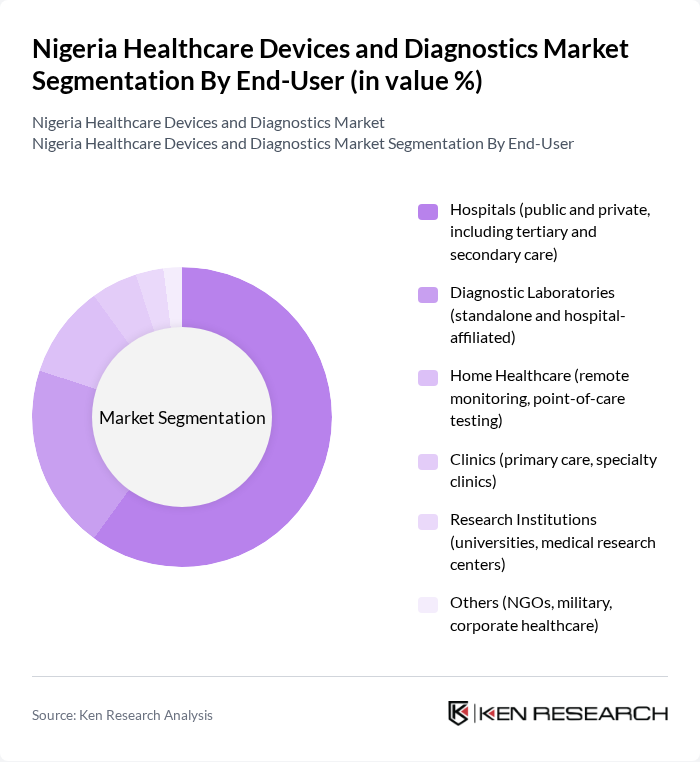

By End-User:The end-user segmentation includes hospitals, diagnostic laboratories, home healthcare, clinics, research institutions, and others. Hospitals are the largest end-users due to their comprehensive healthcare services and the need for a wide range of medical devices and diagnostics to cater to patient needs. Diagnostic laboratories are the second largest segment, reflecting the growing demand for laboratory-based and point-of-care testing. Home healthcare is expanding, supported by the adoption of remote monitoring and telemedicine solutions .

The Nigeria Healthcare Devices and Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, GE Healthcare, Medtronic, Abbott Laboratories, Roche Diagnostics, Johnson & Johnson, Becton, Dickinson and Company, Stryker Corporation, Boston Scientific, Thermo Fisher Scientific, Cardinal Health, Hologic, Inc., Olympus Corporation, and 3M Health Care contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Nigeria healthcare devices and diagnostics market appears promising, driven by increasing investments in healthcare technology and a growing emphasis on preventive care. As the government continues to implement policies aimed at enhancing healthcare access, the demand for innovative medical devices is expected to rise. Additionally, the integration of digital health solutions will likely facilitate better patient management and diagnostics, paving the way for a more efficient healthcare system in Nigeria.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Devices (e.g., X-ray, MRI, CT, Ultrasound) In-Vitro Diagnostic Devices (e.g., blood glucose monitors, immunoassay analyzers) Patient Monitoring Equipment (e.g., ECG, pulse oximeters, vital signs monitors) Surgical Instruments (e.g., scalpels, forceps, electrosurgical devices) Therapeutic Devices (e.g., infusion pumps, dialysis machines) Dental Devices (e.g., dental chairs, imaging systems, handpieces) Orthopedic Devices (e.g., implants, prosthetics, braces) Others (e.g., ophthalmic, ENT, respiratory devices) |

| By End-User | Hospitals (public and private, including tertiary and secondary care) Diagnostic Laboratories (standalone and hospital-affiliated) Home Healthcare (remote monitoring, point-of-care testing) Clinics (primary care, specialty clinics) Research Institutions (universities, medical research centers) Others (NGOs, military, corporate healthcare) |

| By Application | Cardiovascular Applications (e.g., pacemakers, stents, imaging) Neurology Applications (e.g., EEG, neurostimulation devices) Orthopedic Applications (e.g., joint replacements, trauma fixation) Diabetes Management (e.g., glucose meters, insulin pumps) Cancer Diagnostics (e.g., biopsy devices, imaging systems) Others (e.g., infectious disease, maternal health, pediatrics) |

| By Distribution Channel | Direct Sales (manufacturer to end-user) Distributors (local and international medical device distributors) Online Sales (e-commerce platforms, B2B portals) Retail Pharmacies (over-the-counter diagnostic devices) Others (government tenders, NGO procurement) |

| By Price Range | Low-End Devices (basic diagnostic and monitoring tools) Mid-Range Devices (advanced diagnostics, portable imaging) High-End Devices (premium imaging, robotic surgery, advanced therapeutics) |

| By Brand Recognition | Established Brands (multinationals with strong local presence) Emerging Brands (local manufacturers, startups) Private Labels (white-label products for hospitals and labs) |

| By Regulatory Compliance | CE Marked Devices (European conformity) FDA Approved Devices (U.S. Food and Drug Administration) NAFDAC Registered Devices (Nigeria’s regulatory authority) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Diagnostic Imaging Devices | 60 | Radiologists, Imaging Technologists |

| In-vitro Diagnostic Devices | 50 | Laboratory Managers, Pathologists |

| Patient Monitoring Devices | 40 | Nurses, Clinical Engineers |

| Healthcare Procurement Officers | 45 | Procurement Managers, Supply Chain Coordinators |

| Healthcare Policy Makers | 40 | Government Officials, Health Policy Analysts |

The Nigeria Healthcare Devices and Diagnostics Market is valued at approximately USD 1.5 billion, driven by increasing healthcare expenditure, the rising prevalence of chronic diseases, and a growing demand for advanced medical technologies.