Region:Asia

Author(s):Geetanshi

Product Code:KRAB5796

Pages:88

Published On:October 2025

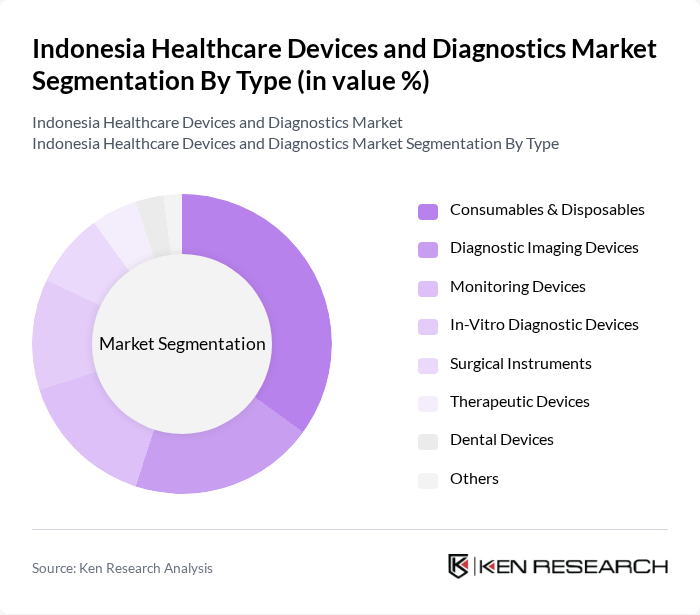

By Type:The market is segmented into diagnostic imaging devices, in-vitro diagnostic devices, monitoring devices, surgical instruments, therapeutic devices, dental devices, consumables & disposables, and others. Consumables & disposables represent the largest segment due to their high volume and recurring usage in hospitals, clinics, and home healthcare. Diagnostic imaging and monitoring devices also hold significant shares, driven by the expansion of tertiary care and increased focus on early disease detection. The demand for in-vitro diagnostic devices is rising with the growing incidence of chronic and infectious diseases and the adoption of personalized medicine .

By End-User:The end-user segmentation includes public hospitals (BPJS-affiliated), private hospitals, diagnostic laboratories, home healthcare, clinics, research institutions, independent laboratories, point-of-care venues, and others. Public hospitals account for the largest share, driven by high-volume procurement under the national health insurance scheme. Private hospitals and diagnostic laboratories follow, supported by growing demand for premium healthcare services and medical tourism. Home healthcare and point-of-care venues are expanding due to increased focus on remote monitoring and decentralized diagnostics .

The Indonesia Healthcare Devices and Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Bio Farma (Persero), PT Kimia Farma Tbk, PT Indofarma Tbk, PT Prodia Widyahusada Tbk, PT Kalbe Farma Tbk, PT Siloam International Hospitals Tbk, PT Mitra Keluarga Karyasehat Tbk, PT SehatQ, PT Medisafe Technologies, PT Alkesindo, PT Sumber Daya Medika, PT Medika Sarana Trijaya, PT Citra Medika, PT Anugerah Medika, PT Bina Sehat, PT Global Medika, PT Primaya Hospital, PT Mayapada Healthcare Group, PT Omni Hospitals, PT Eka Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia healthcare devices and diagnostics market appears promising, driven by increasing healthcare investments and a growing focus on preventive care. The expansion of telemedicine and digital health solutions is expected to enhance patient access to healthcare services, particularly in rural areas. Additionally, the rising health awareness among consumers will likely drive demand for innovative medical devices, creating a conducive environment for market growth and technological advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Devices In-Vitro Diagnostic Devices Monitoring Devices Surgical Instruments Therapeutic Devices Dental Devices Consumables & Disposables Others |

| By End-User | Hospitals Diagnostic Laboratories Home Healthcare Clinics Research Institutions Independent Laboratories Point-of-Care Venues Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Application | Cardiovascular Diabetes Management Cancer Diagnostics Infectious Diseases Neurology Respiratory Diseases Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| By Brand Recognition | Established Brands Emerging Brands Private Labels |

| By Regulatory Compliance | CE Marked Devices FDA Approved Devices Local Compliance Certified Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Equipment Procurement | 70 | Procurement Managers, Hospital Administrators |

| Diagnostic Device Usage | 60 | Laboratory Technicians, Radiologists |

| Patient Experience with Medical Devices | 50 | Patients, Caregivers |

| Market Trends in Home Healthcare Devices | 40 | Homecare Providers, Medical Device Retailers |

| Regulatory Impact on Device Approval | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Indonesia Healthcare Devices and Diagnostics Market is valued at approximately USD 4.8 billion, driven by increased healthcare infrastructure investment, the expansion of the national health insurance program, and rising demand for innovative diagnostic solutions.