Region:Asia

Author(s):Shubham

Product Code:KRAD3063

Pages:82

Published On:January 2026

By Type:The corrosion protection coating market is segmented into various types, including epoxy coatings, polyurethane coatings, zinc-rich coatings, acrylic coatings, inorganic coatings, and others. Among these, epoxy coatings are the most dominant due to their excellent adhesion, chemical resistance, and durability, making them suitable for a wide range of applications in industrial and commercial sectors. Polyurethane coatings also hold a significant share, favored for their flexibility and aesthetic appeal. The demand for zinc-rich coatings is driven by their effectiveness in preventing corrosion in steel structures, particularly in the oil and gas industry.

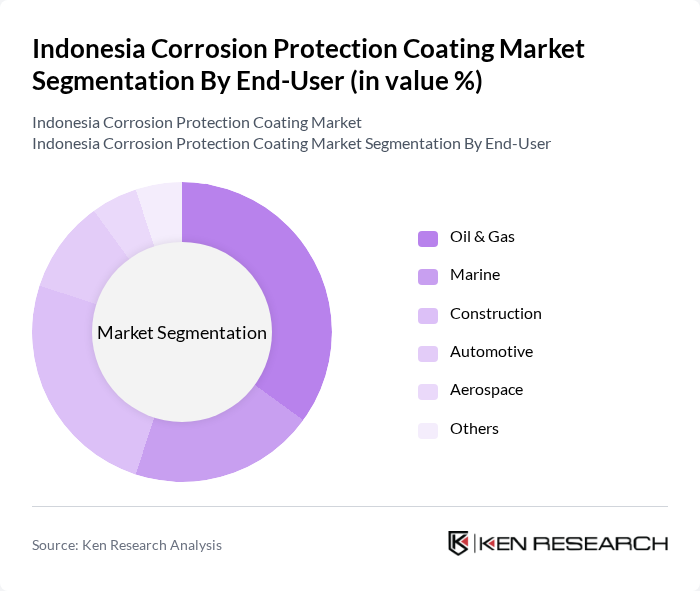

By End-User:The end-user segmentation includes oil & gas, marine, construction, automotive, aerospace, and others. The oil & gas sector is the leading end-user, driven by the need for corrosion protection in pipelines and offshore structures. The construction industry follows closely, as protective coatings are essential for maintaining the integrity of buildings and infrastructure. The automotive sector is also significant, with coatings used to enhance vehicle durability and aesthetics.

The Indonesia Corrosion Protection Coating Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. PPG Coatings Indonesia, PT. AkzoNobel Indonesia, PT. Jotun Indonesia, PT. Nippon Paint Indonesia, PT. BASF Indonesia, PT. Sika Indonesia, PT. Sherwin-Williams Indonesia, PT. Hempel Indonesia, PT. Asian Paints Indonesia, PT. Dow Chemical Indonesia, PT. Rust-Oleum Indonesia, PT. 3M Indonesia, PT. DuPont Indonesia, PT. Henkel Indonesia, PT. Tikkurila Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia corrosion protection coating market is poised for significant growth as industries increasingly prioritize sustainability and innovation. The shift towards eco-friendly and bio-based coatings is expected to gain momentum, driven by consumer demand and regulatory pressures. Additionally, advancements in smart coatings with self-healing properties are likely to revolutionize the market, offering enhanced durability and performance. As the oil and gas and marine sectors expand, the demand for specialized coatings will further solidify the market's growth trajectory, creating a dynamic landscape for manufacturers and suppliers.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Coatings Polyurethane Coatings Zinc-Rich Coatings Acrylic Coatings Inorganic Coatings Others |

| By End-User | Oil & Gas Marine Construction Automotive Aerospace Others |

| By Application | Protective Coatings Decorative Coatings Industrial Coatings Specialty Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Retail Stores Others |

| By Region | Java Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Others |

| By Technology | Conventional Coating Technology Advanced Coating Technology Nano Coating Technology Others |

| By Market Segment | Commercial Residential Industrial Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Marine Coating Applications | 45 | Marine Engineers, Shipyard Managers |

| Industrial Coating Solutions | 40 | Plant Managers, Maintenance Supervisors |

| Construction Sector Coatings | 50 | Project Managers, Architects |

| Oil & Gas Industry Coatings | 48 | Procurement Officers, Safety Managers |

| Automotive Coating Applications | 42 | Quality Control Managers, Production Supervisors |

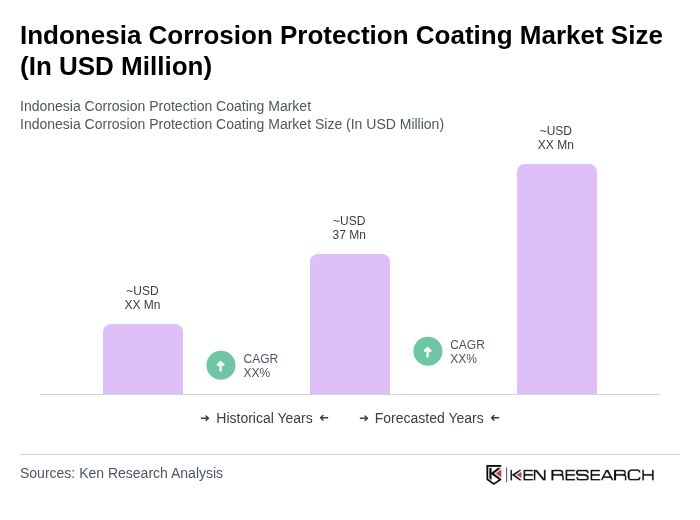

The Indonesia Corrosion Protection Coating Market is valued at approximately USD 37 million, reflecting a five-year historical analysis. This growth is driven by increasing demand across various industries, including oil and gas, construction, and automotive sectors.