Region:Asia

Author(s):Rebecca

Product Code:KRAA7071

Pages:84

Published On:January 2026

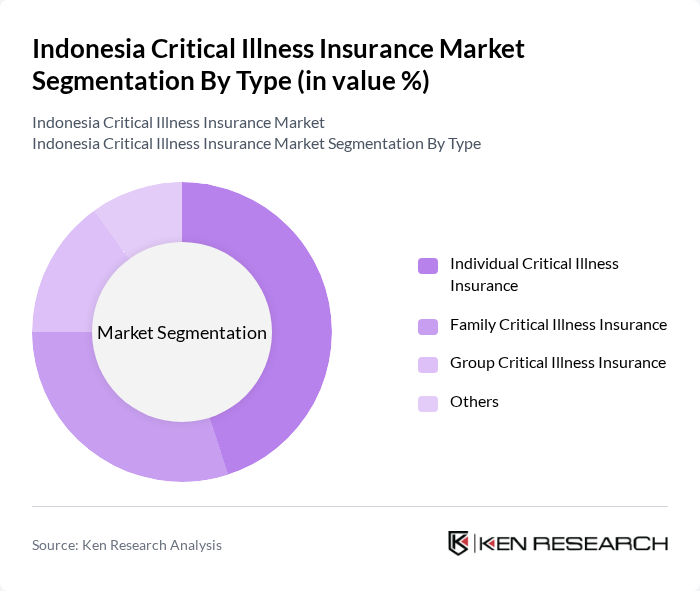

By Type:The market is segmented into various types of critical illness insurance, including Individual Critical Illness Insurance, Family Critical Illness Insurance, Group Critical Illness Insurance, and Others. Among these, Individual Critical Illness Insurance is the most dominant segment, driven by the increasing number of individuals seeking personalized health coverage. The growing awareness of health risks and the need for financial security in case of critical illnesses have led to a surge in demand for individual policies.

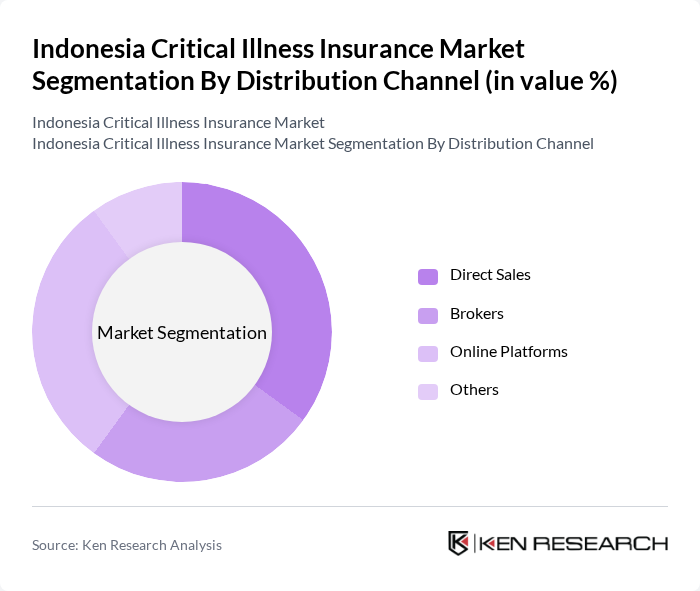

By Distribution Channel:The distribution channels for critical illness insurance include Direct Sales, Brokers, Online Platforms, and Others. Online Platforms have gained significant traction, especially among younger consumers who prefer the convenience of purchasing insurance digitally, supported by rising healthcare literacy and digital insurance platforms simplifying policy comparison and purchase processes. This shift towards digital channels is reshaping the market landscape, making it easier for consumers to compare policies and make informed decisions.

The Indonesia Critical Illness Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allianz Indonesia, AXA Mandiri, Prudential Indonesia, Manulife Indonesia, AIA Financial Indonesia, BNI Life Insurance, Sinarmas MSIG Life, Cigna Indonesia, Sequis Life, Tokio Marine Life Insurance Indonesia, Great Eastern Life Indonesia, Asuransi Jiwa Bersama (AJB) Bumiputera, Avrist Assurance, FWD Insurance, Zurich Insurance Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the critical illness insurance market in Indonesia appears promising, driven by increasing healthcare costs and a growing prevalence of critical illnesses. As digital platforms expand, insurers are likely to enhance accessibility and streamline the purchasing process. Additionally, the integration of telemedicine and AI in insurance services will likely improve customer engagement and satisfaction. These trends indicate a shift towards more personalized and efficient insurance solutions, fostering a more robust market environment in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Critical Illness Insurance Family Critical Illness Insurance Group Critical Illness Insurance Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Others |

| By Demographics | Age Group (18-30, 31-45, 46-60, 60+) Gender Income Level Others |

| By Policy Duration | Short-term Policies Long-term Policies Others |

| By Payment Mode | Monthly Payments Annual Payments One-time Payments Others |

| By Coverage Amount | Low Coverage (Below IDR 100 million) Medium Coverage (IDR 100 million - IDR 500 million) High Coverage (Above IDR 500 million) Others |

| By Customer Segment | Individuals Families Corporates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Policyholders | 120 | Individuals aged 30-50 with critical illness insurance |

| Insurance Brokers | 80 | Licensed insurance brokers with experience in health products |

| Healthcare Professionals | 60 | Doctors and healthcare providers involved in patient care |

| Insurance Company Executives | 40 | Senior management from insurance firms offering critical illness products |

| Financial Advisors | 50 | Financial advisors specializing in insurance and investment products |

The Indonesia Critical Illness Insurance Market is valued at approximately USD 6.5 billion, reflecting a significant growth driven by rising healthcare costs, increased awareness of critical illnesses, and a growing middle class seeking financial protection against health-related risks.