Region:Asia

Author(s):Rebecca

Product Code:KRAB2269

Pages:91

Published On:January 2026

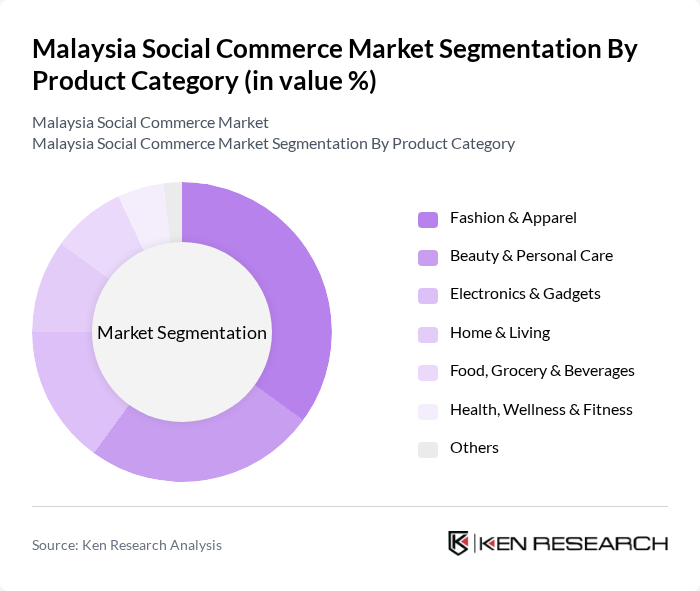

By Product Category:The product categories in the Malaysia Social Commerce Market include Fashion & Apparel, Beauty & Personal Care, Electronics & Gadgets, Home & Living, Food, Grocery & Beverages, Health, Wellness & Fitness, and Others. This categorisation is consistent with leading industry analyses that segment Malaysian social commerce across clothing and footwear, beauty and personal care, food and grocery, appliances and electronics, home-related categories, travel and hospitality. Among these, Fashion & Apparel is the leading segment, supported by the rapid growth of fashion e-commerce in Malaysia and the strong role of social media and live commerce in fashion discovery, styling content, and influencer collaborations. Consumers are increasingly turning to social platforms, short-form video, and livestream sessions for fashion inspiration and peer reviews, leading to higher sales in this category through social commerce channels.

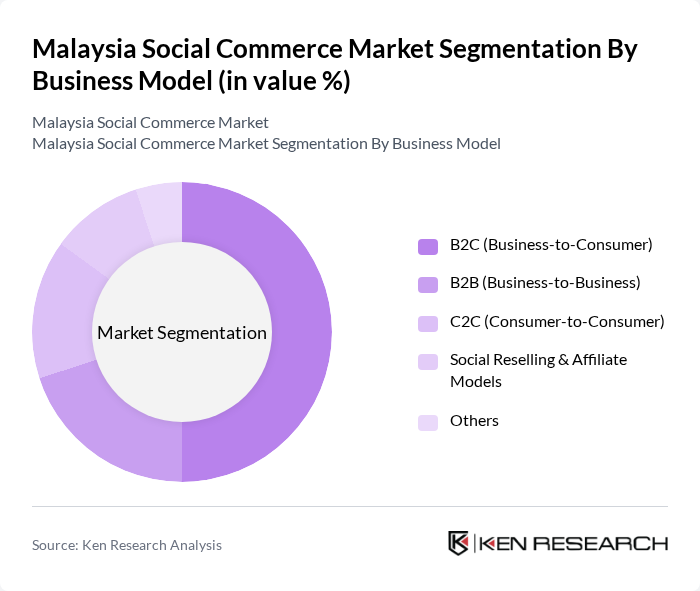

By Business Model:The business models in the Malaysia Social Commerce Market include B2C (Business-to-Consumer), B2B (Business-to-Business), C2C (Consumer-to-Consumer), Social Reselling & Affiliate Models, and Others. This is aligned with industry reports that segment Malaysia’s social commerce by B2C, B2B, and C2C as the core end-use models, alongside social reselling and group-buying structures. The B2C model is the most prominent, as it allows brands and retailers to directly engage with consumers through social media platforms and in-app shops, integrating content, community, and commerce to enhance customer experience and drive sales. This model has gained traction due to the convenience of chat-based selling, integrated payment and logistics features, and the ability for brands to leverage influencers, live streams, and personalised messaging at scale for marketing and conversion.

The Malaysia Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shopee, Lazada, Facebook (Meta Platforms), Instagram (Meta Platforms), TikTok Shop, Carousell, Grab, Zalora, Fave, Boost, Klook, foodpanda, Mydin, PrestoMall, TikTok Seller Ecosystem Partners contribute to innovation, geographic expansion, and service delivery in this space, with platforms increasingly embedding live commerce, short-form video, and in-app checkout to capture social-driven demand.

The future of the Malaysian social commerce market appears promising, driven by technological advancements and evolving consumer behaviors. The integration of artificial intelligence and machine learning is expected to enhance personalized shopping experiences, while the rise of live commerce will further engage consumers. Additionally, as digital payment solutions become more secure and accessible, they will likely boost consumer confidence in online transactions, fostering a more robust social commerce ecosystem in Malaysia.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Fashion & Apparel Beauty & Personal Care Electronics & Gadgets Home & Living Food, Grocery & Beverages Health, Wellness & Fitness Others |

| By Business Model | B2C (Business-to-Consumer) B2B (Business-to-Business) C2C (Consumer-to-Consumer) Social Reselling & Affiliate Models Others |

| By Payment Method | Credit/Debit Cards E-Wallets Bank Transfers/FPX Buy Now Pay Later (BNPL) Cash on Delivery Others |

| By Social Commerce Format | Live Commerce (Live Streaming) Social Network–Led Commerce Group Buying & Community Buying Social Reselling Product Review & Recommendation Platforms Others |

| By Consumer Demographics | By Age Group By Gender By Income Level By Location (Tier-1, Tier-2 Cities & Rural) Others |

| By Type of City | Tier-1 Cities (Kuala Lumpur, Penang, Johor Bahru, etc.) Tier-2 Cities Semi-urban & Rural Areas Cross-Border Shoppers Others |

| By Marketing & Engagement Approach | Influencer & KOL-led Commerce Brand-owned Social Shops Community & Group-based Commerce User-generated Content–led Commerce Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Behavior in Social Commerce | 150 | Online Shoppers, Social Media Users |

| SME Engagement in Social Commerce | 120 | Business Owners, Marketing Managers |

| Platform Insights from Social Media Companies | 60 | Product Managers, Data Analysts |

| Brand Strategies in Social Commerce | 70 | Brand Managers, Digital Marketing Specialists |

| Trends in Social Media Advertising | 90 | Advertising Executives, Media Buyers |

The Malaysia Social Commerce Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by increased smartphone penetration and social media usage, which have transformed consumer shopping behaviors in the region.