Poland Data Analytics Market Overview

- The Poland Data Analytics Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of data-driven decision-making across various sectors, including finance, healthcare, and retail. The demand for advanced analytics solutions is further fueled by the rise of big data technologies and the need for businesses to enhance operational efficiency and customer engagement.

- Key cities such as Warsaw, Kraków, and Wroc?aw dominate the market due to their robust technological infrastructure and a high concentration of IT talent. Warsaw, as the capital, serves as a hub for many multinational corporations and startups, while Kraków and Wroc?aw are known for their vibrant tech ecosystems, attracting investments and fostering innovation in data analytics.

- In 2023, the Polish government implemented the "Digital Poland" program, which aims to enhance the digital economy by investing in data analytics capabilities. This initiative includes funding for research and development in data technologies, promoting collaboration between academia and industry, and establishing data-driven public services to improve efficiency and transparency.

Poland Data Analytics Market Segmentation

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Diagnostic Analytics, and Others. Each of these sub-segments plays a crucial role in helping organizations derive insights from data, optimize processes, and make informed decisions. Among these, Predictive Analytics is currently leading the market due to its ability to forecast trends and behaviors, which is increasingly vital for businesses aiming to stay competitive in a rapidly changing environment.

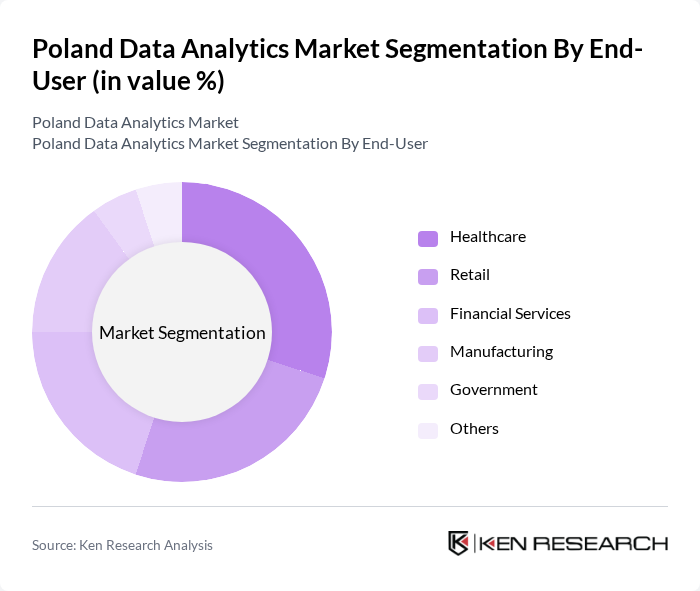

By End-User:The end-user segmentation includes Healthcare, Retail, Financial Services, Manufacturing, Government, and Others. Each sector utilizes data analytics to enhance operational efficiency, improve customer experiences, and drive innovation. The Healthcare sector is currently the dominant end-user, leveraging analytics for patient care optimization, operational management, and research, which has become increasingly important in the wake of the COVID-19 pandemic.

Poland Data Analytics Market Competitive Landscape

The Poland Data Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAS Institute Inc., IBM Corporation, Microsoft Corporation, SAP SE, Oracle Corporation, Tableau Software, QlikTech International AB, TIBCO Software Inc., Alteryx, Inc., Informatica LLC, Domo, Inc., MicroStrategy Incorporated, Sisense Inc., Looker (Google Cloud), Teradata Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Poland Data Analytics Market Industry Analysis

Growth Drivers

- Increasing Demand for Data-Driven Decision Making:The Polish economy is increasingly recognizing the value of data-driven decision making, with 70% of businesses reporting enhanced performance through analytics. In future, the Polish GDP is projected to grow by 3.5%, fostering an environment where companies invest in data analytics to optimize operations. This trend is supported by the World Bank's report indicating that data utilization can improve productivity by up to 20%, driving demand for analytics solutions across various sectors.

- Growth of E-commerce and Digital Services:Poland's e-commerce sector is expected to reach €20 billion in future, reflecting a 15% increase from the previous year. This growth is propelling the demand for data analytics to understand consumer behavior and optimize marketing strategies. The Central Statistical Office of Poland reported that 80% of e-commerce businesses are leveraging analytics to enhance customer experiences, indicating a robust market for data analytics solutions tailored to digital services and e-commerce platforms.

- Government Initiatives for Digital Transformation:The Polish government has allocated €1.5 billion for digital transformation initiatives in future, aiming to enhance the digital infrastructure across industries. This funding is expected to drive the adoption of data analytics tools, as public sector organizations increasingly seek to improve service delivery and operational efficiency. The Digital Poland program emphasizes the importance of data analytics in achieving these goals, creating a favorable environment for market growth.

Market Challenges

- Data Privacy and Security Concerns:With the implementation of GDPR, Polish companies face stringent data privacy regulations that complicate data analytics efforts. In future, the Polish Data Protection Authority reported over 1,000 compliance checks, highlighting the challenges businesses encounter in ensuring data security. This regulatory environment can deter investment in data analytics solutions, as companies prioritize compliance over innovation, potentially stifling market growth.

- Shortage of Skilled Data Professionals:The demand for skilled data professionals in Poland is projected to exceed 50,000 in future, according to the Polish Ministry of Education. However, the current workforce is only able to supply about 30,000 qualified individuals, creating a significant skills gap. This shortage hampers the ability of organizations to effectively implement and utilize data analytics solutions, posing a challenge to market expansion and innovation.

Poland Data Analytics Market Future Outlook

The future of the Poland data analytics market appears promising, driven by technological advancements and increasing digitalization across sectors. As businesses prioritize real-time analytics and integrate advanced technologies, the demand for tailored analytics solutions is expected to rise. Furthermore, the emphasis on data democratization will empower non-technical users to leverage analytics, fostering a culture of data-driven decision making. This shift will likely enhance operational efficiencies and drive innovation across various industries in Poland.

Market Opportunities

- Expansion of AI and Machine Learning Applications:The integration of AI and machine learning into data analytics is set to revolutionize the Polish market. With an estimated investment of €500 million in AI technologies in future, businesses can harness predictive analytics to enhance decision-making processes, leading to improved operational efficiencies and competitive advantages.

- Development of Industry-Specific Analytics Solutions:There is a growing demand for industry-specific analytics solutions tailored to sectors such as healthcare, finance, and manufacturing. By future, the Polish healthcare analytics market is projected to reach €200 million, driven by the need for data-driven insights to improve patient outcomes and operational efficiencies, presenting a significant opportunity for specialized analytics providers.