Region:Middle East

Author(s):Rebecca

Product Code:KRAD8254

Pages:84

Published On:December 2025

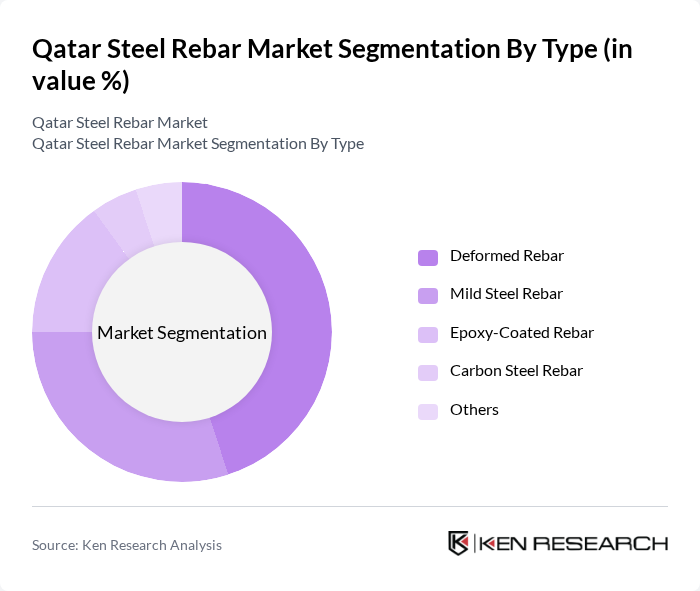

By Type:The market is segmented into various types of rebar, including Deformed Rebar, Mild Steel Rebar, Epoxy-Coated Rebar, Carbon Steel Rebar, and Others. Among these, Deformed Rebar is the most dominant segment due to its superior bonding properties and strength from ribbed surfaces, making it the preferred choice for large-scale construction activities requiring high-strength reinforcement. Mild Steel Rebar follows closely, valued for its flexibility and ease of use in various applications. The demand for Epoxy-Coated Rebar is also rising, particularly in corrosive environments, as it offers enhanced durability.

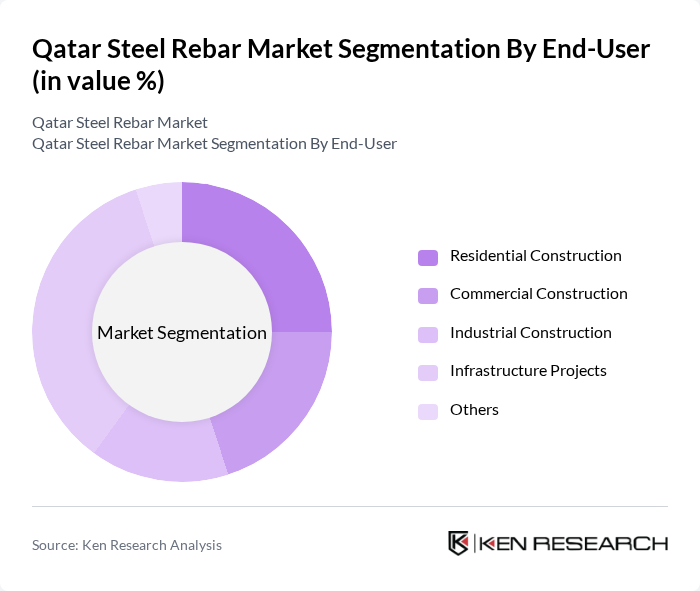

By End-User:The end-user segmentation includes Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Projects, and Others. Infrastructure Projects dominate this segment, driven by significant government spending on roads, bridges, public facilities, Doha Metro, Lusail City, and Hamad Port expansions. Residential Construction is also a key contributor, supported by the growing population and urbanization trends. Commercial Construction is witnessing growth due to increased investments in retail, office spaces, high-rise buildings, and hospitality projects, while Industrial Construction remains stable, catering to manufacturing and logistics sectors.

The Qatar Steel Rebar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Steel Company, QSteel, Hamriyah Steel, Gulf Steel Industries, Emsteel, Emirates Rebar Limited, Union Iron & Steel, Madar Building Materials Co. Ltd., Union Rebar Factory, Shattaf Group, Qatar Metal Coating Company, Qatar Reinforcement Steel Company, Qatar Steel Industries, Al Jazeera Steel Products Company, Qatar Industrial Manufacturing Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar steel rebar market appears promising, driven by ongoing infrastructure projects and a strong focus on sustainable construction practices. As the government continues to invest in mega projects, the demand for steel rebar is expected to rise significantly. Additionally, advancements in production technologies and a shift towards eco-friendly materials will likely reshape the market landscape. The integration of smart construction technologies will further enhance efficiency, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Deformed Rebar Mild Steel Rebar Epoxy-Coated Rebar Carbon Steel Rebar Others |

| By End-User | Residential Construction Commercial Construction Industrial Construction Infrastructure Projects Others |

| By Application | Structural Applications Non-Structural Applications Precast Concrete Applications Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Doha Al Rayyan Al Wakrah Umm Salal Al Khor & Al Thakhira Rest of Qatar |

| By Size of Project | Small Scale Projects Medium Scale Projects Large Scale Projects Others |

| By Material Source | Local Production Imported Materials Recycled Materials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Engineers |

| Commercial Infrastructure Developments | 80 | Construction Managers, Architects |

| Industrial Facility Construction | 70 | Procurement Managers, Operations Directors |

| Government Infrastructure Initiatives | 60 | Policy Makers, Urban Planners |

| Rebar Distribution Channels | 90 | Distributors, Sales Managers |

The Qatar Steel Rebar Market is valued at approximately USD 2 billion, driven by significant growth in the construction sector, particularly due to government investments in infrastructure and urban development projects aligned with Qatar National Vision 2030.