Region:Europe

Author(s):Dev

Product Code:KRAA3573

Pages:92

Published On:September 2025

By Type:This segmentation includes Digital-only banks (Neobanks), Traditional banks with digital offerings, Payment service providers, Wealth management and robo-advisory platforms, and Fintech lenders. Digital-only banks are gaining traction among younger demographics for their convenience and low fees, while traditional banks are rapidly digitizing their services to maintain competitiveness. Payment service providers like Bizum and PayPal are widely adopted for peer-to-peer and e-commerce transactions. Wealth management and robo-advisory platforms are expanding, particularly among affluent and tech-savvy users. Fintech lenders are addressing the needs of underserved SMEs and freelancers by offering faster, more flexible credit solutions .

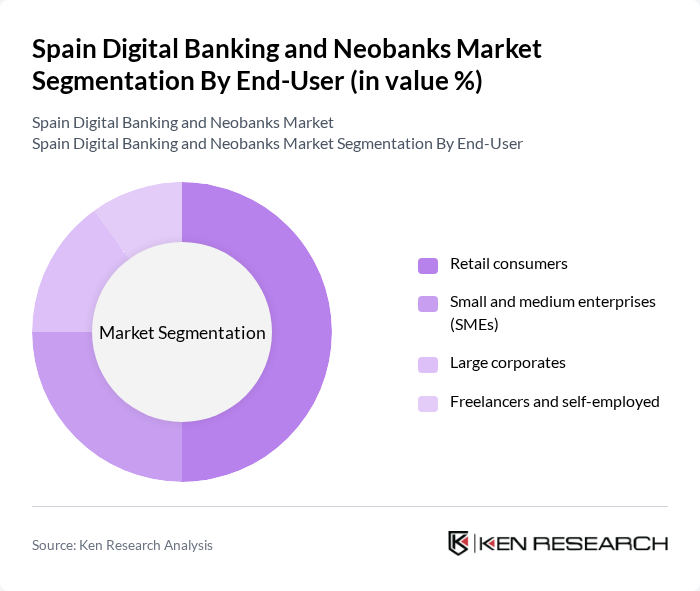

By End-User:This segmentation encompasses Retail consumers, Small and medium enterprises (SMEs), Large corporates, and Freelancers and self-employed individuals. Retail consumers are the primary end-users, driven by demand for mobile-first banking and seamless digital experiences. SMEs and freelancers are increasingly adopting digital banking for streamlined payments and access to digital lending, while large corporates leverage advanced digital platforms for treasury and cash management .

The Spain Digital Banking and Neobanks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco Sabadell, BBVA, CaixaBank, ING, N26, Revolut, Openbank, Bnext, Fintonic, Bankinter, Self Bank, Wise, MyInvestor, Qonto contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital banking and neobanks market in Spain appears promising, driven by technological advancements and evolving consumer preferences. As digital wallets gain traction, with over 25 million users expected by in future, neobanks will likely expand their service offerings to include more integrated financial solutions. Additionally, the focus on sustainability will push banks to adopt eco-friendly practices, aligning with consumer values and enhancing brand loyalty in an increasingly competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital-only banks (Neobanks) Traditional banks with digital offerings Payment service providers (e.g., Bizum, PayPal) Wealth management and robo-advisory platforms Fintech lenders |

| By End-User | Retail consumers Small and medium enterprises (SMEs) Large corporates Freelancers and self-employed |

| By Service Offered | Current and savings accounts Lending and credit products Investment and wealth management Insurance and protection products Payment and money transfer services |

| By Customer Segment | Millennials Gen Z Professionals Retirees |

| By Distribution Channel | Mobile banking apps Web platforms Third-party aggregators (e.g., comparison sites, fintech apps) API/Open Banking integrations |

| By Pricing Model | Subscription-based Transaction-based Freemium Commission-based |

| By Geographic Presence | Urban areas Rural areas Pan-European operations International expansion |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Banking Usage | 120 | Retail Banking Customers, Neobank Users |

| Small Business Banking Solutions | 60 | Small Business Owners, Financial Managers |

| Fintech Adoption Trends | 50 | Fintech Enthusiasts, Early Adopters |

| Regulatory Impact on Neobanks | 40 | Compliance Officers, Regulatory Affairs Managers |

| Customer Satisfaction in Digital Banking | 80 | Customer Service Representatives, User Experience Designers |

The Spain Digital Banking and Neobanks Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the adoption of digital financial services and consumer preferences shifting towards online and mobile banking solutions.