Region:Asia

Author(s):Shubham

Product Code:KRAA6638

Pages:95

Published On:January 2026

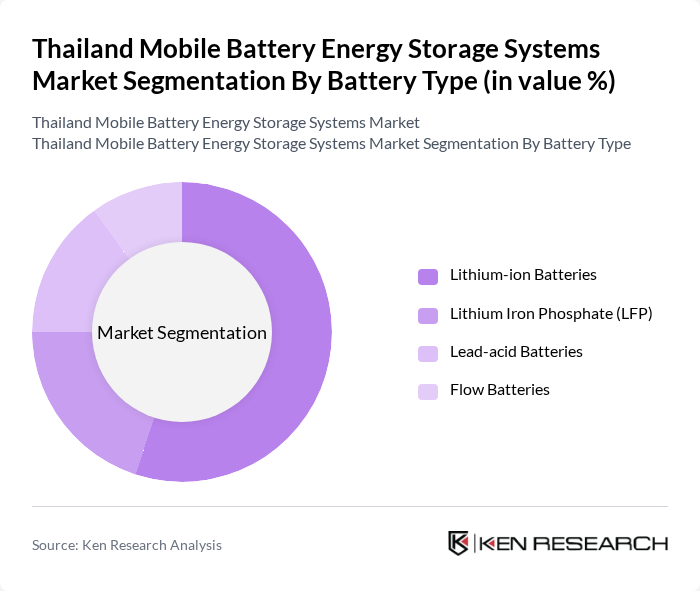

By Battery Type:

The battery type segmentation includes Lithium-ion Batteries, Lithium Iron Phosphate (LFP), Lead-acid Batteries, and Flow Batteries. Among these, Lithium-ion Batteries are dominating the market due to their high energy density, longer lifespan, and decreasing costs. The growing adoption of electric vehicles and renewable energy systems has further propelled the demand for Lithium-ion technology. LFP batteries are also gaining traction, particularly in commercial applications, due to their safety and thermal stability. Lead-acid batteries, while still in use, are gradually being replaced by more advanced technologies. Flow batteries are emerging as a viable option for large-scale energy storage, but their market share remains limited compared to Lithium-ion solutions.

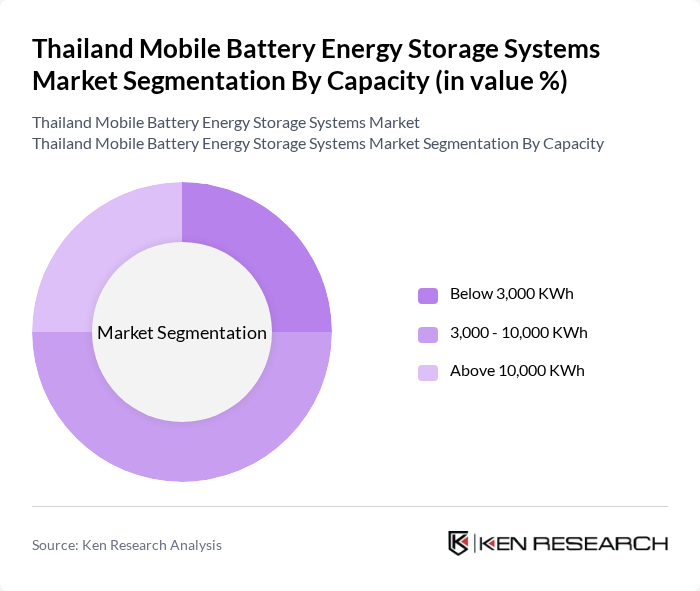

By Capacity:

The capacity segmentation reflects diverse application needs across residential, commercial, and utility-scale projects. The segment of 3,000 - 10,000 KWh is currently leading the market, driven by its suitability for commercial and industrial applications. This capacity range offers a balance between cost and performance, making it an attractive option for businesses looking to optimize energy usage and reduce costs. The Below 3,000 KWh segment is popular among residential users, while the Above 10,000 KWh segment is gaining traction in utility-scale projects, with industrial applications increasingly adopting multi-hour discharge capabilities for peak demand management.

The Thailand Mobile Battery Energy Storage Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., BYD Company Ltd., LG Energy Solution, Bosch Limited, The AES Corporation, Tesla, Inc., Panasonic Corporation, Samsung SDI Co., Ltd., CATL (Contemporary Amperex Technology Co., Limited), Schneider Electric SE, Siemens AG, Eaton Corporation plc, Enphase Energy, Inc., Fluence Energy, Inc., Moxion Power contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand mobile battery energy storage systems market appears promising, driven by technological advancements and increasing energy demands. As urbanization accelerates, the need for efficient energy management solutions will grow. Additionally, the integration of smart grid technologies is expected to enhance system efficiency and reliability. With ongoing government support and rising consumer interest, the market is poised for significant expansion, fostering innovation and sustainability in energy consumption practices.

| Segment | Sub-Segments |

|---|---|

| By Battery Type | Lithium-ion Batteries Lithium Iron Phosphate (LFP) Lead-acid Batteries Flow Batteries |

| By Capacity | Below 3,000 KWh 3,000 - 10,000 KWh Above 10,000 KWh |

| By Application | Residential Commercial Industrial Utilities & Grid Support |

| By Connection Type | On-Grid (Grid-Tied) Systems Off-Grid (Standalone) Systems |

| By Ownership Model | Customer-Owned Utility-Owned Third-Party Owned |

| By Technology Component | Battery Management Systems Energy Management Systems Smart Inverters Others |

| By End-User Segment | Remote & Off-Grid Areas Military & Defense Non-Residential Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Energy Storage Users | 45 | Homeowners, Energy Managers |

| Commercial Battery Storage Solutions | 40 | Facility Managers, Operations Directors |

| Industrial Energy Storage Applications | 35 | Plant Managers, Energy Efficiency Consultants |

| Utility-Scale Storage Projects | 30 | Utility Executives, Project Managers |

| Battery Technology Providers | 45 | Product Development Managers, Sales Directors |

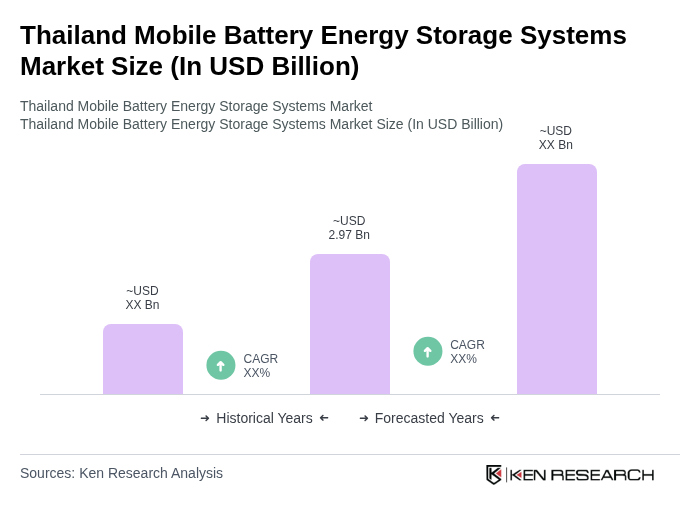

The Thailand Mobile Battery Energy Storage Systems Market is valued at approximately USD 2.97 billion. This growth is driven by the increasing demand for renewable energy integration, grid stability, and the rising adoption of electric vehicles.