Region:Middle East

Author(s):Rebecca

Product Code:KRAC9656

Pages:91

Published On:November 2025

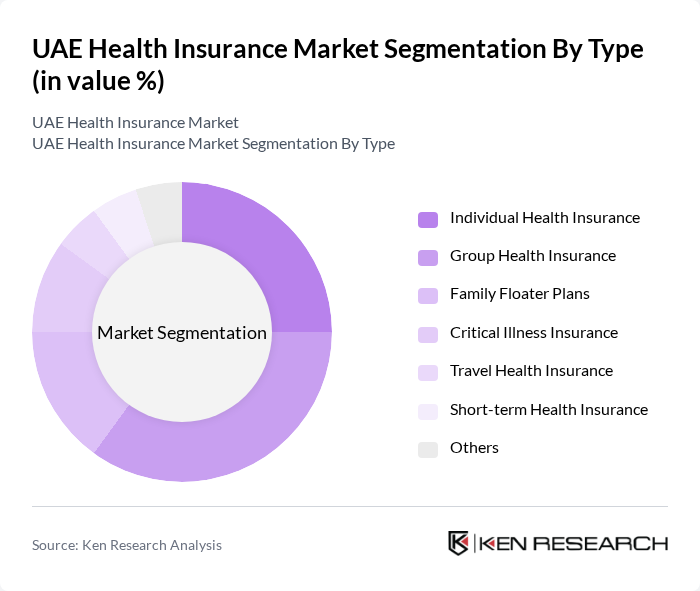

By Type:The segmentation of the market by type includes various health insurance products tailored to meet the diverse needs of consumers. The subsegments are Individual Health Insurance, Group Health Insurance, Family Floater Plans, Critical Illness Insurance, Travel Health Insurance, Short-term Health Insurance, and Others. Each of these products serves different demographics and preferences, contributing to the overall market dynamics .

The Group Health Insurance segment is currently the leading subsegment in the market, driven by the increasing number of expatriates and the mandatory health insurance regulations imposed by the UAE government. Corporates are increasingly opting for group plans to provide comprehensive coverage for their employees, which not only enhances employee satisfaction but also helps in attracting and retaining talent. The trend towards corporate wellness programs and the cost-efficiency of bulk premiums further boost the demand for group health insurance, making it a dominant force in the market .

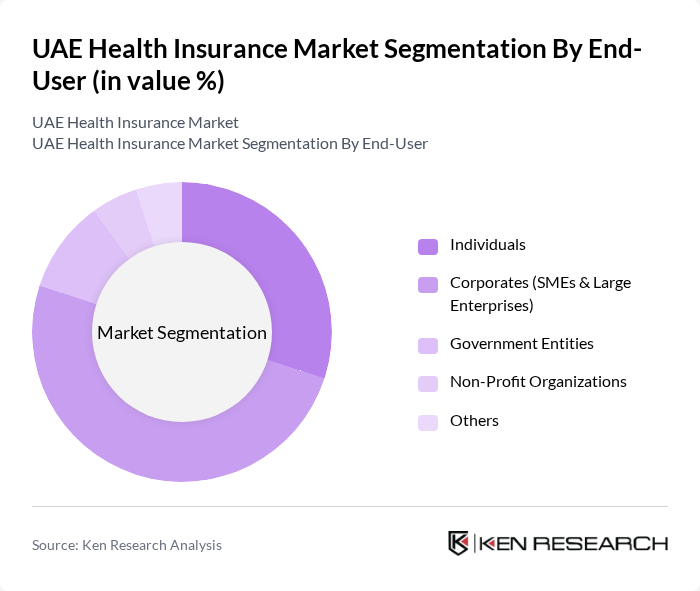

By End-User:The market segmentation by end-user includes Individuals, Corporates (SMEs & Large Enterprises), Government Entities, Non-Profit Organizations, and Others. This classification helps in understanding the different consumer bases and their specific insurance needs .

The Corporates (SMEs & Large Enterprises) segment is the most significant contributor to the market, as many companies are mandated to provide health insurance to their employees. This requirement has led to a surge in demand for comprehensive group health plans, which offer extensive coverage and benefits. Additionally, the increasing focus on employee wellness and health management programs has further solidified the position of this segment as a market leader .

The UAE Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daman National Health Insurance Company (Daman), Abu Dhabi National Insurance Company (ADNIC), Oman Insurance Company (Sukoon), AXA Gulf (now GIG Gulf), MetLife Gulf, Allianz Partners, Dubai Insurance Company, Orient Insurance PJSC, Emirates Insurance Company, National General Insurance Company (NGI), Al Ain Ahlia Insurance Company, Union Insurance Company, Fujairah National Insurance Company (FNIC), Al Wathba National Insurance Company (AWNIC), Qatar Insurance Company (QIC) contribute to innovation, geographic expansion, and service delivery in this space .

The UAE health insurance market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As the population grows and healthcare needs diversify, insurers will increasingly focus on personalized and value-based care models. The integration of artificial intelligence and telemedicine will enhance service delivery, while regulatory frameworks will continue to evolve, ensuring consumer protection. Overall, the market is expected to adapt to these changes, fostering innovation and improving access to healthcare services.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Group Health Insurance Family Floater Plans Critical Illness Insurance Travel Health Insurance Short-term Health Insurance Others |

| By End-User | Individuals Corporates (SMEs & Large Enterprises) Government Entities Non-Profit Organizations Others |

| By Demographics | Age Group (Children, Adults, Seniors) Gender Income Level Nationality (UAE Nationals, Expatriates) Others |

| By Coverage Level | Platinum Gold Silver Bronze Others |

| By Distribution Channel | Agents and Brokers Direct Sales (Insurer Websites, Sales Force) Online Platforms (Aggregators, Comparison Websites) Banks Others |

| By Policy Duration | Short-term Policies Long-term Policies Lifetime Coverage Others |

| By Health Condition | Pre-existing Conditions Chronic Illnesses General Health Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Health Insurance Policies | 60 | Policyholders, Insurance Brokers |

| Corporate Health Insurance Plans | 50 | HR Managers, Corporate Insurance Advisors |

| Government Health Insurance Schemes | 40 | Public Health Officials, Policy Makers |

| Health Insurance Product Development | 45 | Product Managers, Actuaries |

| Consumer Awareness and Satisfaction | 55 | General Public, Healthcare Consumers |

The UAE Health Insurance Market is valued at approximately USD 8.7 billion, driven by factors such as the increasing expatriate population, rising healthcare costs, and government mandates for health insurance coverage for residents and expatriates.