Region:North America

Author(s):Dev

Product Code:KRAD7833

Pages:95

Published On:December 2025

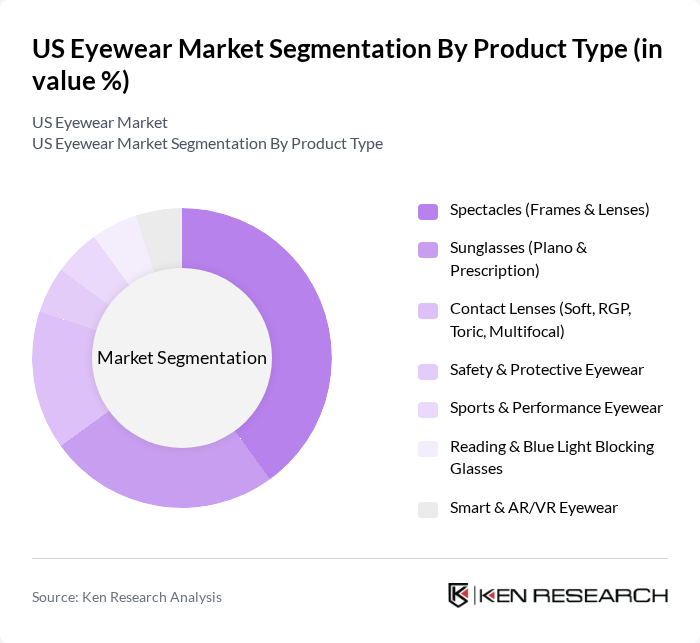

By Product Type:The product type segmentation includes various categories such as spectacles, sunglasses, contact lenses, safety eyewear, sports eyewear, reading glasses, and smart eyewear. This reflects the major consumption categories tracked by leading industry bodies and market research firms. Among these, spectacles, which encompass both frames and lenses, dominate the market due to their essential role in vision correction and the increasing trend of personalized and premium eyewear designs. Sunglasses also hold a significant share, driven by fashion trends, growing awareness of UV protection, and strong sales of plano sunglasses highlighted as the leading non-prescription category in recent US optical industry data.

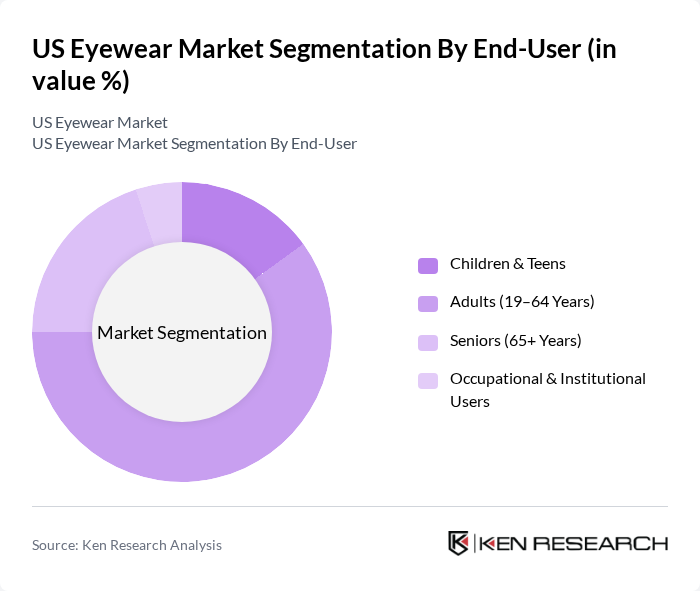

By End-User:The end-user segmentation includes children and teens, adults, seniors, and occupational users, which aligns with prevalence patterns of refractive errors and presbyopia in the US population. Adults aged 19-64 years represent the largest segment, driven by high screen exposure, work-related visual demands, and the growing trend of eyewear as a fashion statement and lifestyle accessory. Seniors also contribute significantly to the market due to the higher incidence of age-related vision issues such as presbyopia and cataract-related refractive changes, leading to increased demand for prescription eyewear, multifocal lenses, and specialty contact lenses.

The US Eyewear Market is characterized by a dynamic mix of regional and international players. Leading participants such as EssilorLuxottica S.A. (including Ray-Ban & Oakley), Johnson & Johnson Vision Care, Inc., Alcon Inc., Bausch + Lomb Corporation, CooperVision, Inc., Safilo Group S.p.A., Warby Parker Inc., National Vision Holdings, Inc. (America’s Best, Eyeglass World), Vision Source / EssilorLuxottica Independent Practice Network, Costco Wholesale Corporation (Optical), Walmart Inc. (Walmart & Sam’s Club Optical), Luxottica Retail North America (LensCrafters, Pearle Vision), Zenni Optical, Inc., Maui Jim, Inc., Silhouette International Schmied AG contribute to innovation, geographic expansion, and service delivery in this space.

The US eyewear market is poised for continued growth, driven by technological advancements and evolving consumer preferences. As smart eyewear technology becomes more mainstream, brands will likely invest in innovative features that enhance user experience. Additionally, the increasing awareness of eye health and the demand for stylish, functional eyewear will further stimulate market expansion. Companies that adapt to these trends and prioritize sustainability will be well-positioned to capture emerging opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Spectacles (Frames & Lenses) Sunglasses (Plano & Prescription) Contact Lenses (Soft, RGP, Toric, Multifocal) Safety & Protective Eyewear Sports & Performance Eyewear Reading & Blue Light Blocking Glasses Smart & AR/VR Eyewear |

| By End-User | Children & Teens Adults (19–64 Years) Seniors (65+ Years) Occupational & Institutional Users |

| By Distribution Channel | Optical Stores & Eye Care Clinics Independent Brand Showrooms Mass Retail & Warehouse Clubs Online Direct-to-Consumer Platforms Pharmacies & Drugstores Others |

| By Frame & Lens Material | Plastic & Acetate Metal & Alloy Mixed & Composite Materials High-Index, Polycarbonate & Trivex Lenses Eco-friendly & Recycled Materials |

| By Price Range | Economy & Value Mid-Range Premium Luxury |

| By Consumer Profile | Men Women Unisex Fashion-Driven vs Function-Driven Users |

| By Brand Positioning | Global Luxury & Designer Brands National & Specialty Retail Brands Private Label & Store Brands Direct-to-Consumer Digital-Native Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Prescription Eyewear Market | 120 | Optometrists, Eyewear Retail Managers |

| Sunglasses Consumer Preferences | 100 | Fashion Retail Buyers, Brand Managers |

| Contact Lens Usage Trends | 80 | Opticians, Contact Lens Product Managers |

| Online Eyewear Sales Insights | 100 | E-commerce Managers, Digital Marketing Specialists |

| Emerging Eyewear Brands Analysis | 70 | Startup Founders, Product Development Teams |

The US Eyewear Market is valued at approximately USD 39 billion, reflecting a significant growth trend driven by increased consumer awareness of eye health and the rising demand for eyewear as a fashion accessory.