Region:Asia

Author(s):Dev

Product Code:KRAA5322

Pages:84

Published On:January 2026

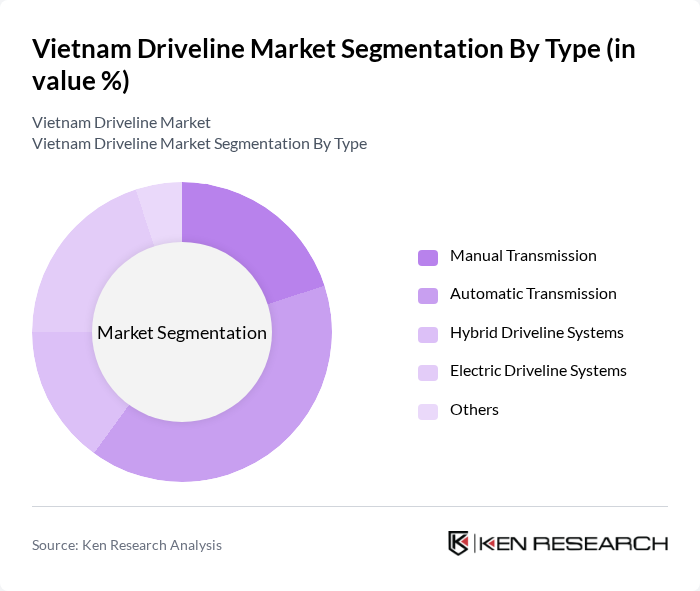

By Type:The driveline market can be segmented into various types, including Manual Transmission, Automatic Transmission, Hybrid Driveline Systems, Electric Driveline Systems, and Others. Among these, Automatic Transmission is gaining significant traction due to its ease of use and increasing consumer preference for convenience in driving. The demand for Electric Driveline Systems is also on the rise, driven by the government's push for electric vehicles and sustainability.

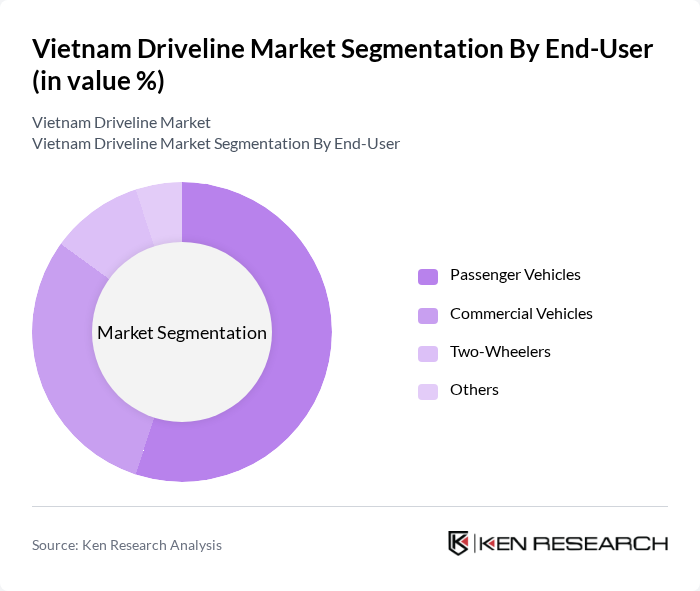

By End-User:The market is also segmented by end-user applications, including Passenger Vehicles, Commercial Vehicles, Two-Wheelers, and Others. The Passenger Vehicles segment is the largest, driven by the increasing purchasing power of consumers and the growing trend of personal vehicle ownership. Commercial Vehicles are also significant, supported by the expansion of logistics and transportation services in urban areas.

The Vietnam Driveline Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thaco Group, SAMCO, VinFast, Toyota Motor Vietnam, Honda Vietnam, Ford Vietnam, Mitsubishi Motors Vietnam, Isuzu Vietnam, Hino Motors Vietnam, Nissan Vietnam, Hyundai Thanh Cong, Mercedes-Benz Vietnam, Piaggio Vietnam, Suzuki Vietnam, Kia Motors Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam driveline market is poised for transformative growth, driven by technological advancements and a shift towards sustainable solutions. As the government continues to promote electric vehicles and infrastructure development, manufacturers are likely to invest in innovative driveline technologies. Additionally, the increasing focus on automation and lightweight materials will enhance production efficiency and product performance. These trends indicate a dynamic market landscape, where adaptability and strategic partnerships will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Transmission Automatic Transmission Hybrid Driveline Systems Electric Driveline Systems Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Others |

| By Vehicle Segment | Economy Segment Luxury Segment SUV Segment Others |

| By Component Type | Gearboxes Driveshafts Differentials Others |

| By Fuel Type | Petrol Diesel Electric Others |

| By Distribution Channel | Direct Sales Online Sales Dealerships Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Driveline Components | 45 | Product Managers, R&D Engineers |

| Commercial Vehicle Driveline Systems | 38 | Operations Managers, Fleet Supervisors |

| Electric Vehicle Driveline Innovations | 42 | Technical Directors, Sustainability Officers |

| Aftermarket Driveline Services | 35 | Service Managers, Parts Distributors |

| Driveline Manufacturing Processes | 40 | Manufacturing Engineers, Quality Control Managers |

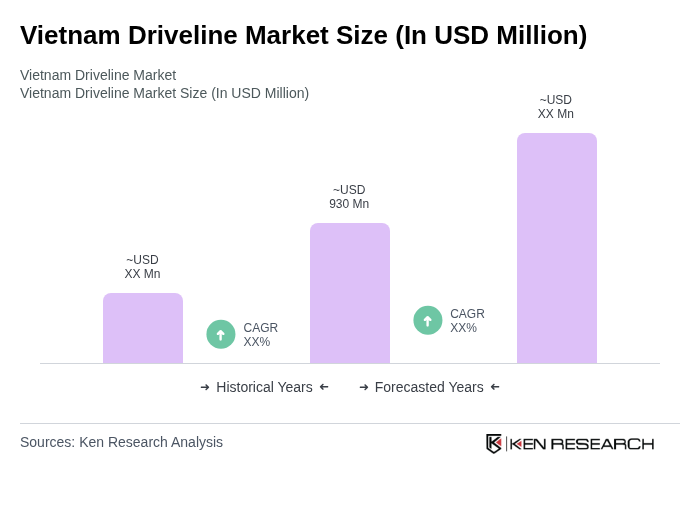

The Vietnam Driveline Market is valued at approximately USD 930 million, reflecting a significant growth driven by increasing vehicle demand, advancements in automotive technology, and a shift towards efficient driveline systems.