Region:Asia

Author(s):Rebecca

Product Code:KRAA6506

Pages:91

Published On:January 2026

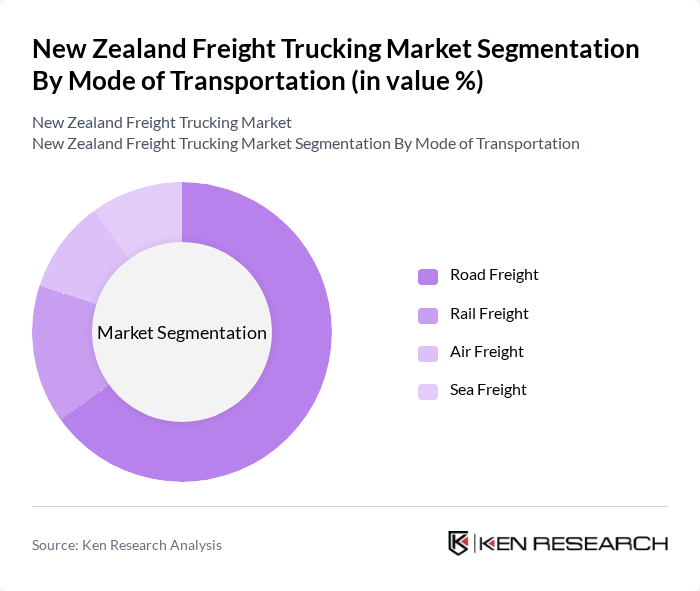

By Mode of Transportation:The freight trucking market in New Zealand is segmented into various modes of transportation, including road freight, rail freight, air freight, and sea freight. Road transport carries 93% of the total freight volume in New Zealand, making it the most dominant mode due to its flexibility and ability to reach remote areas. Rail freight, while efficient for bulk transport, is limited by infrastructure. Air freight is preferred for time-sensitive deliveries, while sea freight is utilized for international shipping.

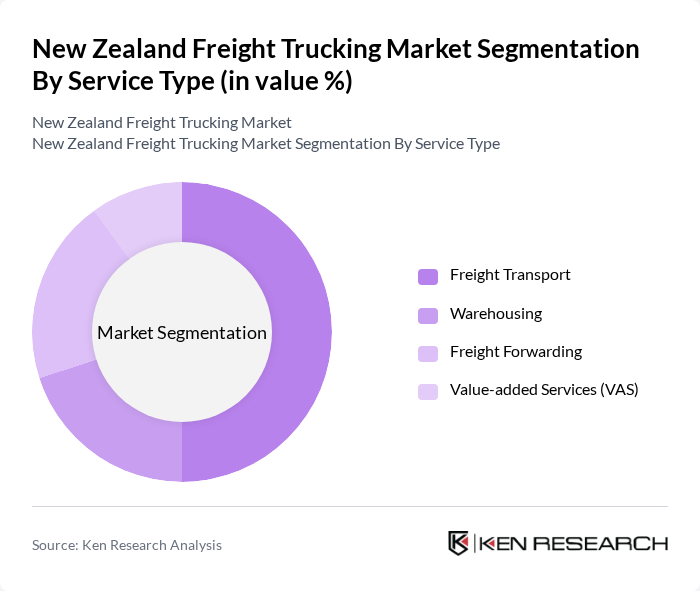

By Service Type:The service types in the freight trucking market include freight transport, warehousing, freight forwarding, and value-added services (VAS). Transportation services dominate the market, driven by the country's reliance on the efficient movement of goods across domestic and international supply chains. Warehousing services are essential for inventory management, while freight forwarding facilitates international shipping. VAS, including packaging and logistics consulting, is gaining traction as businesses seek comprehensive solutions.

The New Zealand Freight Trucking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mainfreight, Toll Group, Fliway Group, Freightways, Linfox, NZ Post, C3S Logistics, PBT Transport, TNL Group, and Cooks Transport contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand freight trucking market is poised for transformation, driven by technological advancements and evolving consumer preferences. As e-commerce continues to expand, logistics providers will increasingly adopt smart logistics solutions to enhance efficiency. Additionally, sustainability initiatives will gain traction, prompting companies to explore electric trucks and alternative fuels. The integration of data analytics will further optimize operations, enabling trucking firms to respond swiftly to market demands and regulatory changes, ensuring long-term viability and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transportation | Road Freight Rail Freight Air Freight Sea Freight |

| By Service Type | Freight Transport Warehousing Freight Forwarding Value-added Services (VAS) |

| By End-User | Manufacturing & Automotive Oil & Gas, Mining & Quarrying Agriculture, Fishing & Forestry Construction Distributive Trade (Wholesale & Retail) Other End Users |

| By Cargo Type | Materials Transport Log and Timber Transport Agricultural Goods Transport General Freight Transport Livestock Transport Waste Transport Steel and Aluminium Transport |

| By Distance | Short Haul Long Haul Regional National |

| By Fleet Size | Small Fleets Medium Fleets Large Fleets |

| By Technology Adoption | Traditional Methods Telematics Solutions Route Optimization Software Advanced Fleet Management Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Long-Haul Freight Operations | 120 | Fleet Managers, Logistics Directors |

| Regional Distribution Networks | 100 | Operations Managers, Supply Chain Analysts |

| Specialized Freight Services | 80 | Business Owners, Compliance Officers |

| Urban Freight Delivery | 70 | Logistics Coordinators, City Planners |

| Environmental Impact Assessments | 60 | Sustainability Managers, Policy Advisors |

The New Zealand Freight Trucking Market is valued at approximately USD 10.5 billion, reflecting a robust growth driven by increasing demand for logistics solutions, urbanization, and the expansion of e-commerce in the region.