Kuwait Freight Trucking Market Overview

- The Kuwait Freight Trucking Market is valued at USD 1.4 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for logistics services due to the expansion of the retail and construction sectors, alongside a rise in e-commerce activities and significant investments in infrastructure projects. The market has seen a steady increase in freight volumes, supported by infrastructure development, government initiatives aimed at enhancing transportation efficiency, and the growth of the e-commerce industry requiring efficient freight transport solutions.

- Kuwait City is the dominant hub in the freight trucking market, owing to its strategic location and well-developed infrastructure. Other significant areas include Al Ahmadi and Hawalli, which benefit from proximity to industrial zones and major highways. The concentration of businesses and logistics companies in these regions facilitates efficient transportation and distribution, making them key players in the market.

- The Ministerial Resolution No. 512 of 2021 issued by the Ministry of Public Works requires heavy-duty vehicles engaged in freight trucking to comply with emission standards equivalent to Euro IV levels, applicable to vehicles exceeding 3.5 tons gross vehicle weight. Operators must obtain annual certification for emission compliance through authorized testing centers, with thresholds limiting particulate matter to 0.02 g/kWh and NOx to 3.5 g/kWh, alongside mandatory fleet modernization for vehicles over 10 years old. These measures enhance safety and efficiency of freight trucking operations by reducing environmental impact and promoting sustainable practices within the logistics sector.

Kuwait Freight Trucking Market Segmentation

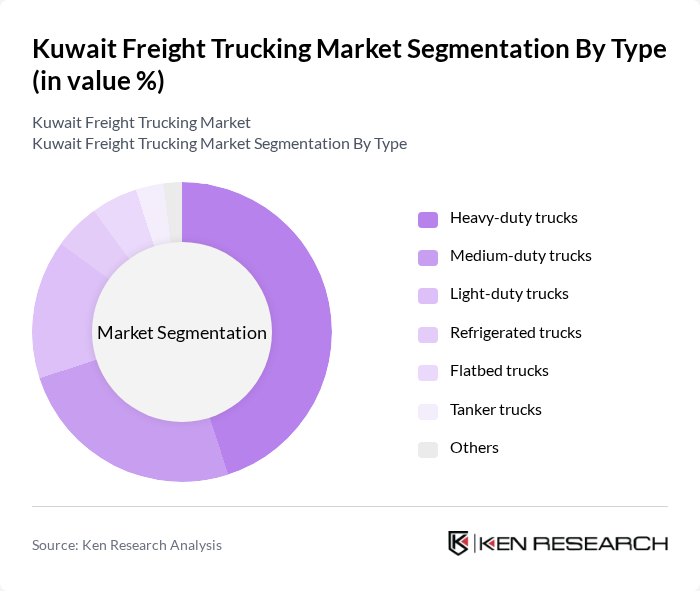

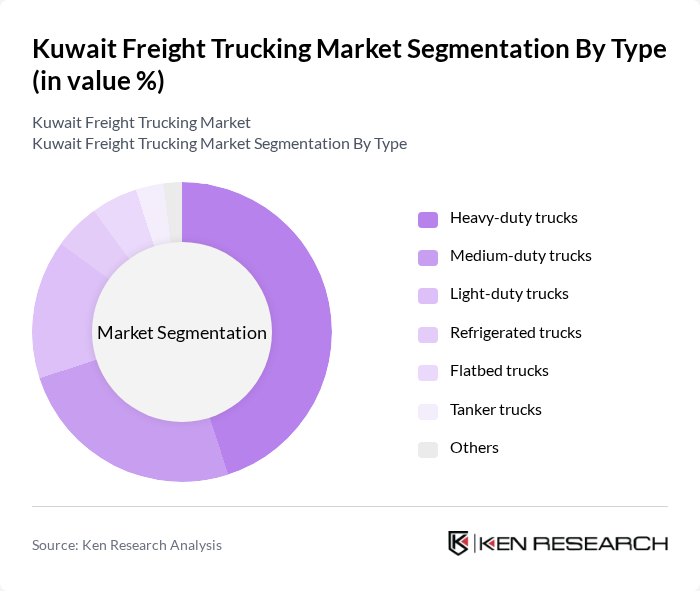

By Type:The freight trucking market is segmented into various types of trucks, including heavy-duty, medium-duty, light-duty, refrigerated, flatbed, tanker trucks, and others. Heavy-duty trucks dominate the market due to their capacity to transport large volumes of goods, making them essential for long-haul operations in construction, logistics, and infrastructure development. Medium-duty and light-duty trucks are also significant, catering to urban deliveries and smaller freight needs. Refrigerated trucks are increasingly in demand due to the growth of the food and beverage sector, while flatbed and tanker trucks serve specialized cargo requirements.

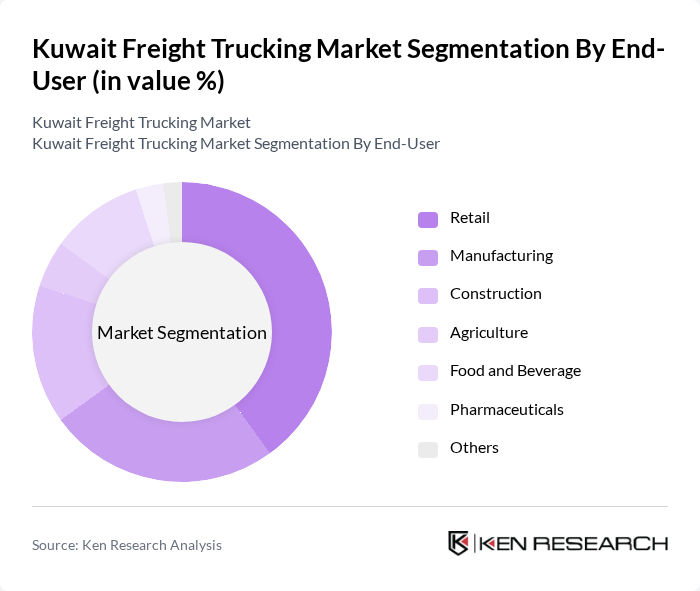

By End-User:The end-user segmentation includes retail, manufacturing, construction, agriculture, food and beverage, pharmaceuticals, and others. The retail sector is the largest consumer of freight trucking services, driven by the rise of e-commerce and the need for efficient distribution networks. Manufacturing and construction also significantly contribute to the demand, as they require reliable logistics for raw materials and finished goods, with construction leading due to ongoing infrastructure investments. The food and beverage sector is growing, particularly for refrigerated transport, while pharmaceuticals demand specialized handling and timely deliveries.

Kuwait Freight Trucking Market Competitive Landscape

The Kuwait Freight Trucking Market is characterized by a dynamic mix of regional and international players. Leading participants such as KGL Logistics, Agility Logistics, Gulf Warehousing Company, Al-Mutlaa Logistics, Al-Futtaim Logistics, Al-Hazm Logistics, Al-Qabas Logistics, Al-Mansour Logistics, Al-Sayer Logistics, Al-Majed Logistics, Al-Bahar Logistics, Al-Khaldi Logistics, Al-Salam Logistics, Al-Mohammed Logistics, Al-Jazeera Logistics contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Freight Trucking Market Industry Analysis

Growth Drivers

- Increasing Demand for Logistics Services:The logistics sector in Kuwait is projected to grow significantly, driven by a 6% increase in consumer spending, reaching approximately $32 billion in future. This surge in demand for logistics services is fueled by the rising need for efficient supply chain solutions, particularly in the retail and manufacturing sectors. The World Bank reports that Kuwait's logistics performance index has improved, indicating a more favorable environment for freight trucking operations, thus enhancing service demand.

- Expansion of E-commerce:E-commerce in Kuwait is expected to reach $4 billion in future, reflecting a 15% annual growth rate. This rapid expansion is driving the need for efficient freight trucking services to facilitate timely deliveries. The increase in online shopping has led to a higher volume of goods requiring transportation, prompting logistics companies to enhance their freight capabilities. As a result, the trucking sector is positioned to benefit from this e-commerce boom, necessitating improved logistics infrastructure.

- Infrastructure Development Projects:Kuwait's government has allocated $12 billion for infrastructure projects in future, focusing on enhancing transportation networks. This investment includes the development of new highways and logistics hubs, which are crucial for improving freight trucking efficiency. Enhanced infrastructure will reduce transit times and operational costs, making the trucking sector more competitive. The ongoing projects are expected to significantly boost the overall logistics capacity, facilitating smoother freight operations across the region.

Market Challenges

- High Operational Costs:The freight trucking industry in Kuwait faces high operational costs, with fuel prices averaging $0.80 per liter in future. Additionally, maintenance and labor costs have risen by 12% over the past year, impacting profit margins. These escalating expenses pose a significant challenge for trucking companies, forcing them to optimize their operations and seek cost-effective solutions to remain competitive in the market.

- Regulatory Compliance Issues:The trucking industry is burdened by complex regulatory compliance requirements, including stringent safety and environmental regulations. In future, the government is expected to implement new regulations that could increase compliance costs by up to 25%. These regulations can create barriers for smaller operators, limiting their ability to compete effectively. Navigating these compliance challenges requires significant resources, which can strain operational capabilities.

Kuwait Freight Trucking Market Future Outlook

The future of the Kuwait freight trucking market appears promising, driven by technological advancements and increasing demand for efficient logistics solutions. The integration of digital platforms and automation is expected to streamline operations, enhancing service delivery. Additionally, the government's commitment to infrastructure development will further support the growth of the trucking sector. As e-commerce continues to expand, logistics providers will need to adapt to changing consumer expectations, ensuring timely and reliable deliveries to maintain competitiveness in the market.

Market Opportunities

- Adoption of Technology in Logistics:The increasing adoption of technology, such as GPS tracking and route optimization software, presents a significant opportunity for the trucking industry. By leveraging these technologies, companies can enhance operational efficiency and reduce costs, ultimately improving service quality. The investment in tech-driven solutions is projected to increase by 30% in future, reflecting the industry's shift towards more innovative logistics practices.

- Growth in Cross-Border Trade:Kuwait's strategic location as a gateway to the Gulf Cooperation Council (GCC) markets offers substantial opportunities for cross-border trade. In future, cross-border trade is expected to increase by 15%, driven by improved trade agreements and regional economic integration. This growth will necessitate enhanced freight trucking services to facilitate the movement of goods across borders, creating new revenue streams for logistics providers.