Region:Middle East

Author(s):Rebecca

Product Code:KRAA6502

Pages:94

Published On:January 2026

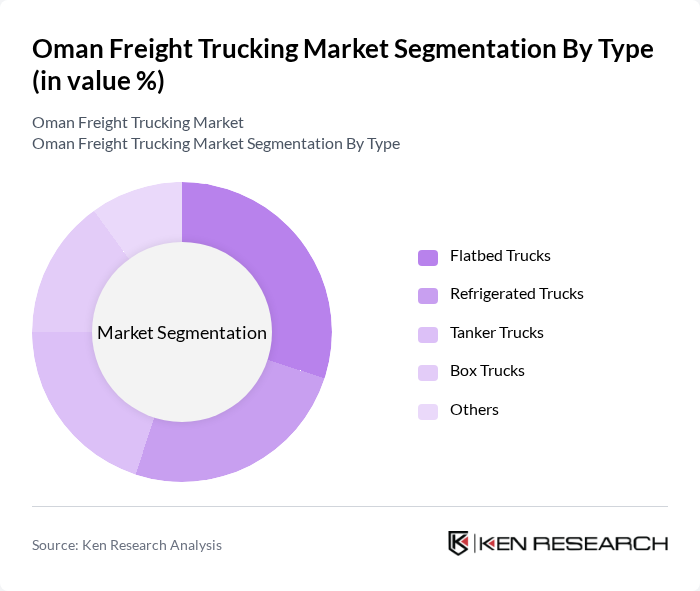

By Type:The freight trucking market can be segmented into various types, including Flatbed Trucks, Refrigerated Trucks, Tanker Trucks, Box Trucks, and Others. Each type serves specific transportation needs, with flatbed trucks being popular for heavy loads, while refrigerated trucks are essential for transporting perishable goods. The demand for these trucks is influenced by the nature of cargo and the requirements of different industries.

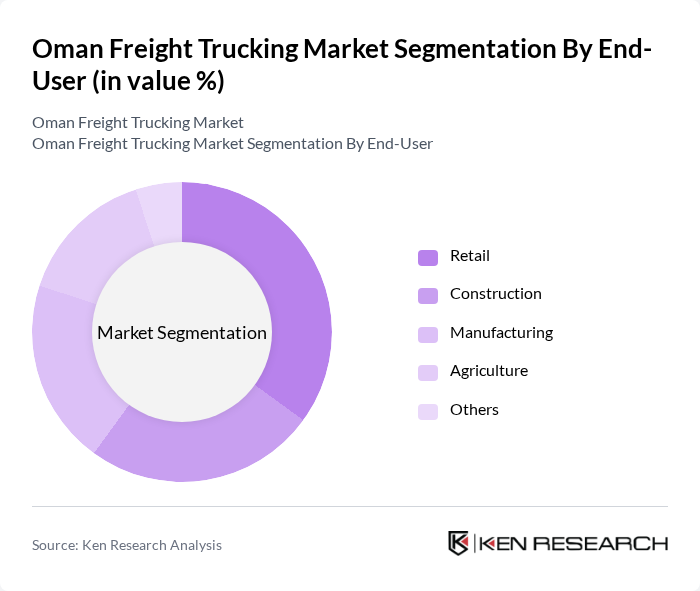

By End-User:The end-user segmentation includes Retail, Construction, Manufacturing, Agriculture, and Others. Each sector has unique logistics requirements, with retail driving demand for efficient delivery systems and construction relying on heavy equipment transport. The growth in these sectors directly impacts the freight trucking market, as they require reliable transportation solutions to meet their operational needs.

The Oman Freight Trucking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Global Logistics, Al Jazeera Transport, Oman National Transport Company, Muscat Freight Services, Gulf Transport and Logistics, Al Mufeed Transport, Oman Trucking Company, Al Harthy Transport, Al Ahlia Logistics, Al Muna Transport, Oman Logistics Company, Al Fawaz Transport, Al Shanfari Transport, Al Makhazen Logistics, Al Mufeed Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The Oman freight trucking market is poised for transformative growth, driven by advancements in technology and infrastructure. As digital platforms for freight management become more prevalent, companies will enhance operational efficiency and customer satisfaction. Additionally, the shift towards sustainable transportation solutions will encourage investments in eco-friendly vehicles and practices. With the ongoing expansion of logistics networks, the market is expected to adapt to evolving consumer demands, positioning itself for long-term success in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Flatbed Trucks Refrigerated Trucks Tanker Trucks Box Trucks Others |

| By End-User | Retail Construction Manufacturing Agriculture Others |

| By Cargo Type | Dry Cargo Liquid Cargo Hazardous Materials Perishable Goods Others |

| By Fleet Size | Small Fleet Operators Medium Fleet Operators Large Fleet Operators Others |

| By Service Type | Full Truck Load (FTL) Less than Truck Load (LTL) Dedicated Contract Carriage Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Technology Adoption | Traditional Trucking Smart Trucking Solutions Fleet Management Software Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Freight Transportation | 100 | Logistics Managers, Operations Directors |

| Construction Material Logistics | 80 | Project Managers, Supply Chain Coordinators |

| Retail Distribution Networks | 90 | Warehouse Managers, Distribution Supervisors |

| Food & Beverage Transport | 70 | Quality Control Managers, Logistics Analysts |

| Pharmaceutical Supply Chain | 60 | Regulatory Affairs Managers, Supply Chain Directors |

The Oman Freight Trucking Market is valued at approximately USD 1.1 billion, driven by increased demand for logistics services, trade expansion, and infrastructure development, particularly in the oil and gas sector and e-commerce growth.