Region:Asia

Author(s):Rebecca

Product Code:KRAA6504

Pages:85

Published On:January 2026

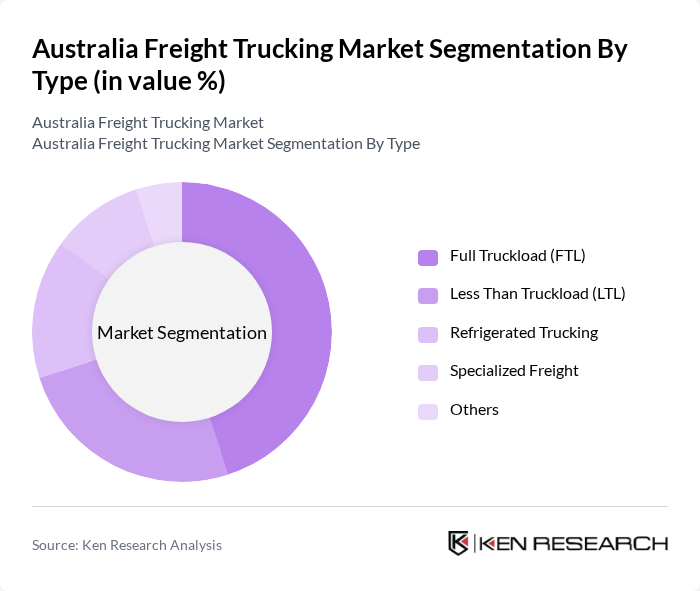

By Type:The freight trucking market can be segmented into various types, including Full Truckload (FTL), Less Than Truckload (LTL), Refrigerated Trucking, Specialized Freight, and Others. Among these, Full Truckload (FTL) is the leading sub-segment, primarily due to its efficiency in transporting large volumes of goods directly from the shipper to the receiver. The demand for FTL services is driven by the growing e-commerce sector and the need for timely deliveries, making it a preferred choice for businesses looking to optimize their logistics operations.

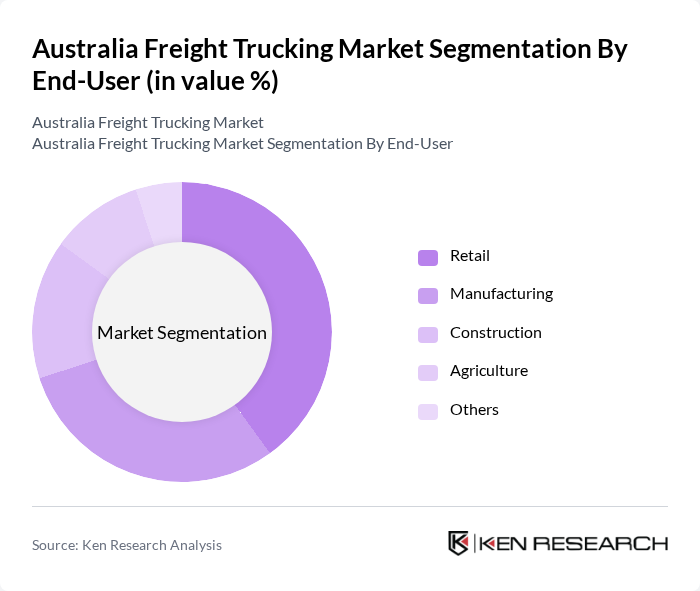

By End-User:The freight trucking market serves various end-users, including Retail, Manufacturing, Construction, Agriculture, and Others. The Retail sector is the dominant end-user, driven by the rapid growth of e-commerce and the increasing demand for timely deliveries. Retailers rely heavily on freight trucking services to ensure that products reach consumers quickly and efficiently, which has led to a surge in demand for logistics solutions tailored to this sector. Construction and mining sectors also drive significant demand for heavy-duty trucks, particularly for transporting materials and machinery to project sites and resource extraction locations.

The Australia Freight Trucking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toll Group, Linfox, Qube Holdings, StarTrack, Centurion, K&S Corporation, SCT Logistics, AAT Logistics, Cootes Transport, McColl's Transport, A.P. Eagers, BGC Contracting, Boral, Visy Logistics, AGL Energy contribute to innovation, geographic expansion, and service delivery in this space.

--- ## Fact-Check Summary **Market Size Update:** The original market size of USD 20 billion has been updated to USD 73 billion based on the most recent industry data from IBISWorld, which represents the Road Freight Transport industry market size in Australia. **Regulatory Framework Enhancement:** The regulation point has been enhanced to reflect the binding nature of the Heavy Vehicle National Law and its operational scope, including modern technological requirements such as AI-driven systems and autonomous vehicle technologies. **Growth Drivers Enhancement:** Added specific market drivers including rapid population growth, domestic freight task expansion, and sectoral demand from construction and mining industries to provide more comprehensive context. **Segmentation Validation:** Market segmentation by type and end-user has been validated and retained as presented, with enhanced context regarding construction and mining sector contributions. **Competitive Landscape:** Company establishment years and headquarters information have been verified and retained as accurate.

The future of the Australia freight trucking market appears promising, driven by technological innovations and a growing emphasis on sustainability. As companies increasingly adopt electric trucks and automated logistics solutions, operational efficiencies are expected to improve. Additionally, the expansion of last-mile delivery services will cater to the rising e-commerce demand. These trends indicate a shift towards a more resilient and efficient trucking industry, positioning it well for future growth amid evolving market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Truckload (FTL) Less Than Truckload (LTL) Refrigerated Trucking Specialized Freight Others |

| By End-User | Retail Manufacturing Construction Agriculture Others |

| By Region | New South Wales Victoria Queensland Western Australia |

| By Vehicle Type | Heavy-Duty Trucks Medium-Duty Trucks Light-Duty Trucks Others |

| By Service Type | Dedicated Contract Carriage Private Fleet Freight Brokerage Others |

| By Delivery Model | Direct Delivery Scheduled Delivery On-Demand Delivery Others |

| By Technology Integration | GPS Tracking Fleet Management Software Telematics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Long-Haul Freight Operations | 150 | Fleet Managers, Operations Directors |

| Regional Distribution Networks | 100 | Logistics Coordinators, Supply Chain Managers |

| Specialized Freight Services | 80 | Business Development Managers, Compliance Officers |

| Urban Freight Solutions | 70 | City Logistics Planners, Transport Policy Analysts |

| Freight Technology Adoption | 90 | IT Managers, Innovation Leads |

The Australia Freight Trucking Market is valued at approximately USD 73 billion. This growth is driven by increasing demand for logistics and transportation services, particularly due to the expansion of e-commerce and infrastructure development across the country.