Region:Middle East

Author(s):Rebecca

Product Code:KRAA6494

Pages:95

Published On:January 2026

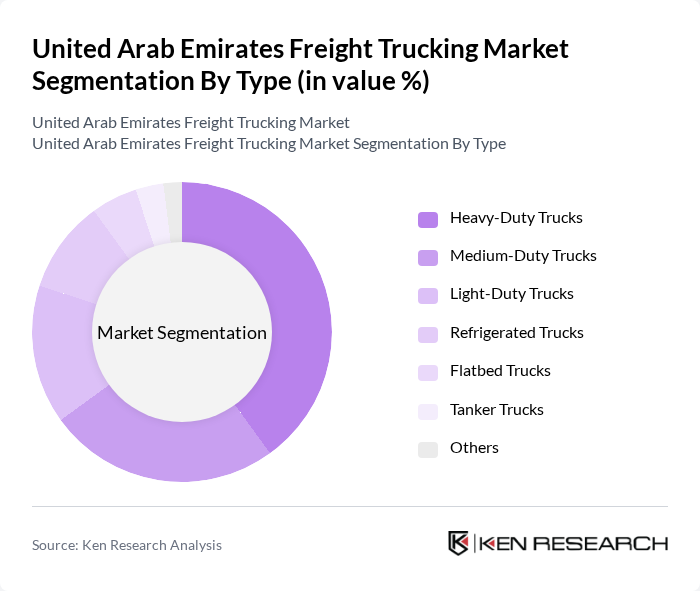

By Type:The freight trucking market can be segmented into various types of trucks, including Heavy-Duty Trucks, Medium-Duty Trucks, Light-Duty Trucks, Refrigerated Trucks, Flatbed Trucks, Tanker Trucks, and Others. Each type serves specific transportation needs, catering to different industries and cargo requirements.

The Heavy-Duty Trucks segment dominates the market due to their capability to transport large volumes of goods over long distances, making them essential for industries such as construction and oil & gas. The increasing demand for heavy machinery and equipment transportation has further solidified their market position. Medium-Duty Trucks also play a significant role, particularly in urban logistics, where they are favored for their balance of capacity and maneuverability. The trend towards e-commerce has led to a growing demand for Light-Duty Trucks, which are ideal for last-mile deliveries.

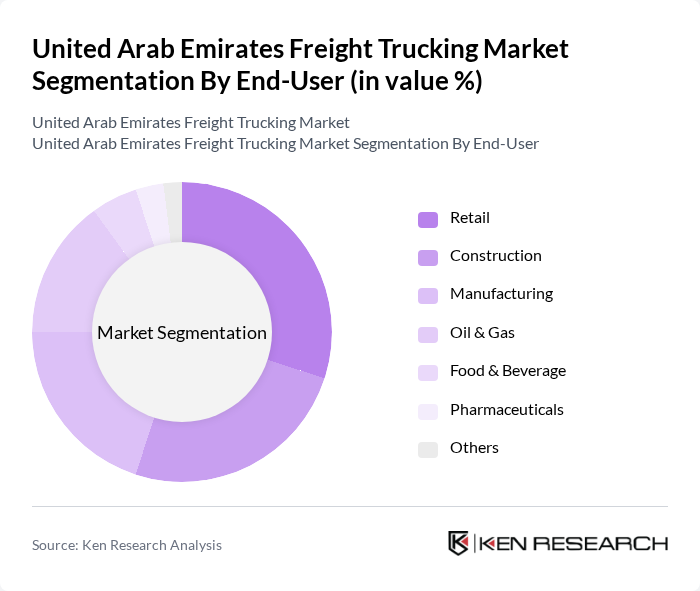

By End-User:The market can be segmented based on end-users, including Retail, Construction, Manufacturing, Oil & Gas, Food & Beverage, Pharmaceuticals, and Others. Each end-user segment has unique requirements and contributes differently to the overall market dynamics.

The Retail segment is the largest end-user, driven by the booming e-commerce sector and the need for efficient logistics solutions. The Construction sector follows closely, requiring heavy-duty trucks for transporting materials and equipment. Manufacturing also significantly contributes to the market, as it relies on freight trucking for raw material supply and product distribution. The Oil & Gas sector has specific transportation needs, particularly for heavy and specialized equipment, while the Food & Beverage and Pharmaceuticals sectors require refrigerated and temperature-controlled transport solutions.

The United Arab Emirates Freight Trucking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Transport, Al-Futtaim Logistics, Agility Logistics, GAC Group, Aramex, DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, Al Naboodah Group, Al Jaber Group, National Transport and Contracting Company, Al Maktoum International Airport Logistics, Abu Dhabi Ports, Gulf Agency Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE freight trucking market appears promising, driven by technological advancements and a focus on sustainability. The integration of electric trucks and AI in fleet management is expected to enhance operational efficiency and reduce environmental impact. Additionally, the ongoing digitalization of supply chain processes will streamline logistics operations, making them more responsive to market demands. As the industry adapts to these trends, it is likely to see increased investment and innovation, positioning it for sustained growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy-Duty Trucks Medium-Duty Trucks Light-Duty Trucks Refrigerated Trucks Flatbed Trucks Tanker Trucks Others |

| By End-User | Retail Construction Manufacturing Oil & Gas Food & Beverage Pharmaceuticals Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Application | Freight Transportation Logistics Services Supply Chain Management Warehousing Others |

| By Fleet Size | Small Fleet (1-10 trucks) Medium Fleet (11-50 trucks) Large Fleet (51+ trucks) Others |

| By Service Type | Full Truck Load (FTL) Less than Truck Load (LTL) Dedicated Contract Carriage Others |

| By Technology Adoption | Traditional Trucking Digital Freight Platforms Autonomous Vehicles Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Long-Haul Freight Operations | 120 | Fleet Managers, Operations Directors |

| Last-Mile Delivery Services | 100 | Logistics Coordinators, Delivery Supervisors |

| Cold Chain Logistics | 80 | Supply Chain Managers, Quality Control Officers |

| Construction Material Transport | 70 | Project Managers, Procurement Specialists |

| Freight Brokerage Services | 90 | Freight Brokers, Business Development Managers |

The United Arab Emirates Freight Trucking Market is valued at approximately USD 5.5 billion, driven by the growth of the logistics sector, e-commerce demand, infrastructure investments, and the adoption of electric and autonomous trucks.