Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3402

Pages:97

Published On:January 2026

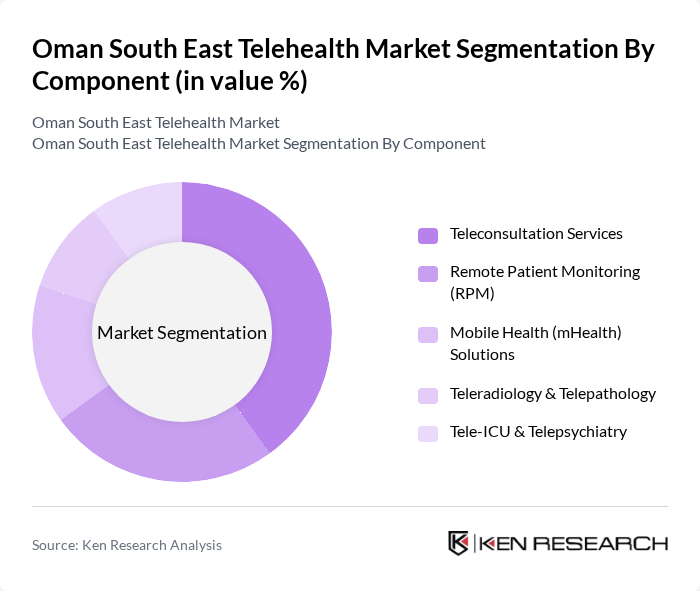

By Component:The telehealth market can be segmented into various components, including teleconsultation services, remote patient monitoring (RPM), mobile health (mHealth) solutions, teleradiology & telepathology, and tele-ICU & telepsychiatry. Among these, teleconsultation services are leading due to their convenience and the growing preference for virtual consultations among patients. RPM is also gaining traction as chronic disease management becomes increasingly important.

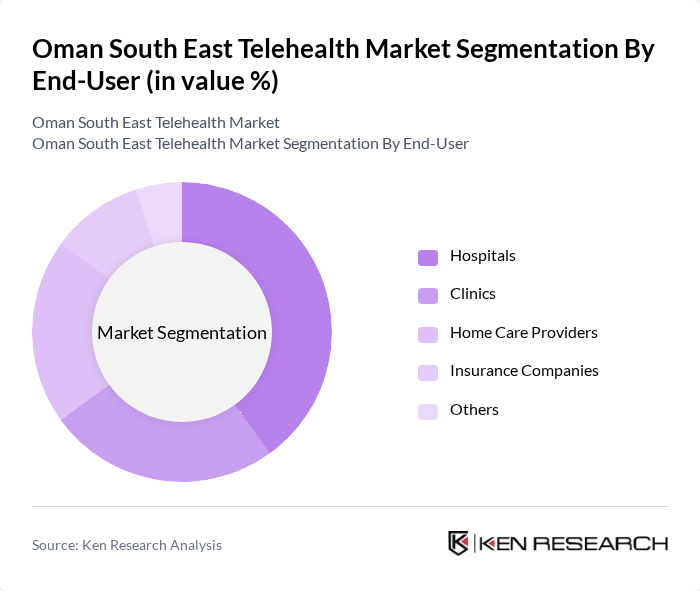

By End-User:The end-user segmentation includes hospitals & healthcare facilities, clinics & diagnostic centers, home healthcare, corporate & employee wellness programs, and pharmacies & retail clinics. Hospitals and healthcare facilities dominate the market as they increasingly adopt telehealth solutions to improve patient care and operational efficiency. Home healthcare is also emerging as a significant segment due to the rising demand for at-home medical services.

The Oman South East Telehealth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Medical Specialty Centre, Muscat Private Hospital, Aster DM Healthcare, Al Nahda Hospital, Dr. Ahmed Al Shamsi Clinic, Oman Telehealth Services, Health 360, Medcare Hospital, Seha Virtual Hospital, Al Hayat Hospital, Muscat Health Services, Oman Health Authority, Al Noor Hospital, Salalah Medical Services, and Sohar Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the telehealth market in Oman appears promising, driven by technological advancements and increasing consumer acceptance. As the government continues to invest in digital health infrastructure, the integration of AI and machine learning is expected to enhance service delivery and patient outcomes in future. Furthermore, the growing trend of virtual health consultations is likely to reshape healthcare delivery, making it more accessible and efficient. This evolution will be pivotal in addressing the healthcare needs of the population, particularly in rural areas.

| Segment | Sub-Segments |

|---|---|

| By Component | Teleconsultation Services Remote Patient Monitoring (RPM) Mobile Health (mHealth) Solutions Teleradiology & Telepathology Tele-ICU & Telepsychiatry |

| By End-User | Hospitals & Healthcare Facilities Clinics & Diagnostic Centers Home Healthcare Corporate & Employee Wellness Programs Pharmacies & Retail Clinics |

| By Delivery Mode | Web-based Mobile-based Cloud-Based Solutions On-Premise Solutions |

| By Connectivity Type | G G Broadband / Wi-Fi Satellite Connectivity |

| By Application | Teleconsultation Remote Patient Monitoring Tele-ICU & Teleradiology Mental Health Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Doctors, Clinic Managers, Telehealth Coordinators |

| Patients Using Telehealth Services | 120 | Telehealth Users, Patients with Chronic Conditions |

| Healthcare Policy Makers | 50 | Health Ministry Officials, Regulatory Bodies |

| Telehealth Technology Providers | 80 | IT Managers, Product Development Leads |

| Insurance Companies | 60 | Health Insurance Underwriters, Claims Managers |

The Oman South East Telehealth Market is valued at approximately USD 120 million, reflecting significant growth driven by the adoption of digital health solutions and the need for accessible medical services, particularly in remote areas.