Region:Asia

Author(s):Rebecca

Product Code:KRAA7170

Pages:86

Published On:January 2026

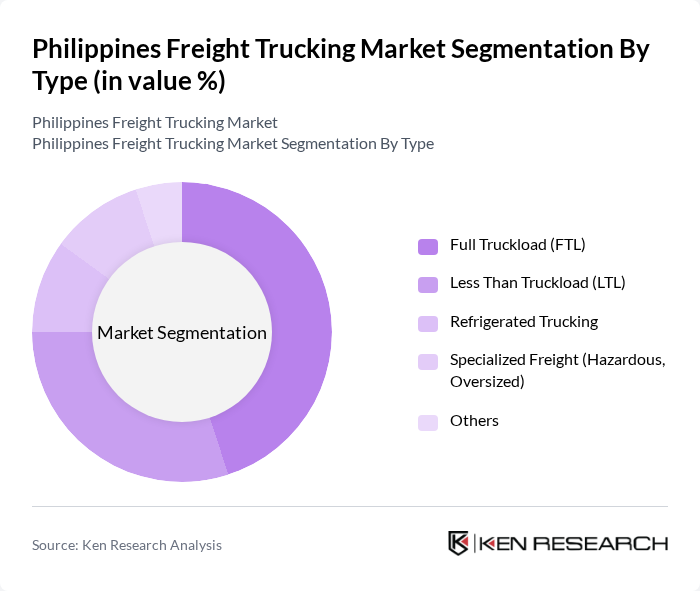

By Type:The freight trucking market can be segmented into various types, including Full Truckload (FTL), Less Than Truckload (LTL), Refrigerated Trucking, Specialized Freight (Hazardous, Oversized), and Others. Each of these segments caters to different logistics needs, with FTL and LTL being the most prominent due to their efficiency in transporting goods over varying distances.

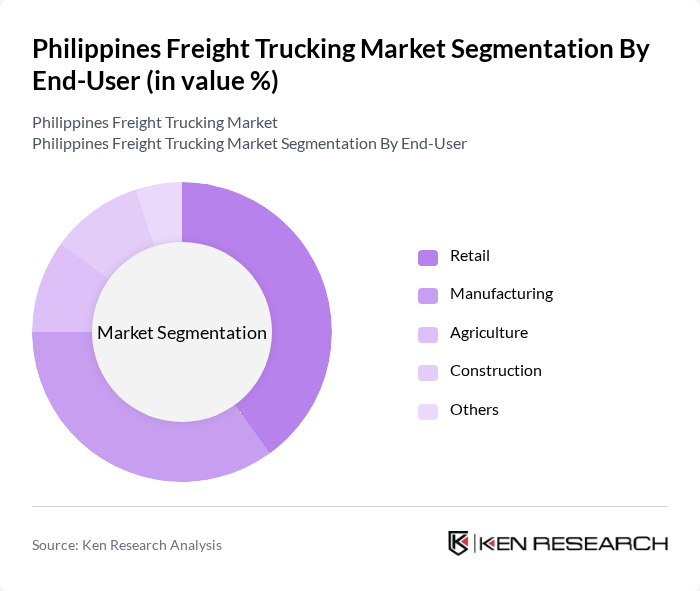

By End-User:The end-user segmentation includes Retail, Manufacturing, Agriculture, Construction, and Others. Each sector has unique logistics requirements, with Retail and Manufacturing being the largest consumers of freight trucking services due to their high volume of goods movement.

The Philippines Freight Trucking Market is characterized by a dynamic mix of regional and international players. Leading participants such as JRS Express, LBC Express, 2GO Group, Aboitiz Transport System, Fast Logistics, Air21, XPO Logistics, DHL Supply Chain, FedEx Philippines, Gogo Xpress, Transnational Diversified Group, AAI Logistics, Santeh Feeds Corporation, A. D. M. Logistics, A. M. Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines freight trucking market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As logistics companies increasingly adopt digital solutions, such as fleet management software and AI-driven analytics, operational efficiencies are expected to improve. Additionally, the growing emphasis on sustainable practices will likely lead to the adoption of eco-friendly vehicles and practices, aligning with global trends towards sustainability in transportation and logistics.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Truckload (FTL) Less Than Truckload (LTL) Refrigerated Trucking Specialized Freight (Hazardous, Oversized) Others |

| By End-User | Retail Manufacturing Agriculture Construction Others |

| By Cargo Type | Consumer Goods Industrial Equipment Food and Beverages Pharmaceuticals Others |

| By Distance | Short Haul Long Haul Intercity Intra-city Others |

| By Fleet Size | Small Fleet (1-10 Trucks) Medium Fleet (11-50 Trucks) Large Fleet (51+ Trucks) Others |

| By Service Type | Dedicated Contract Carriage Private Fleet Third-Party Logistics (3PL) Others |

| By Payment Model | Pay-per-Use Subscription-Based Contractual Agreements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Trucking Operations | 120 | Fleet Managers, Operations Directors |

| Logistics Service Providers | 100 | Business Development Managers, Sales Executives |

| Manufacturing Sector Freight Needs | 80 | Supply Chain Managers, Procurement Specialists |

| Retail Distribution Logistics | 70 | Logistics Coordinators, Warehouse Supervisors |

| Government Transport Policy Impact | 50 | Transport Policy Analysts, Regulatory Affairs Managers |

The Philippines Freight Trucking Market is valued at approximately USD 18 billion, driven by increasing logistics demand, e-commerce growth, and manufacturing sector expansion. This valuation reflects a significant rise in freight volumes, indicating robust economic growth and infrastructure development in the country.