Thailand Freight Trucking Market Overview

- The Thailand Freight Trucking Market is valued at approximately USD 21.63 billion, based on current market analysis. This growth is primarily driven by the increasing demand for logistics services, fueled by the expansion of e-commerce and manufacturing sectors. The rise in infrastructure development and government initiatives to enhance transportation networks have also significantly contributed to the market's growth. Wholesale and retail trade contributed the largest shipment value at 37.11% in 2024, with long-haul freight securing 73.49% of total value, as national distribution channels stretch from Bangkok to Chiang Mai, Phuket, and border crossings.

- Key regions in this market include Bangkok, Chonburi, and the Eastern Economic Corridor (EEC), which dominate due to their strategic locations and robust industrial activities. Bangkok serves as the economic hub, while Chonburi is vital for its port facilities and Laem Chabang container operations, and the EEC supports integrated manufacturing and agricultural logistics, making these regions critical for freight trucking operations.

- The Thai government has implemented comprehensive transportation regulations to improve freight trucking safety and efficiency standards, mandating advanced vehicle tracking and telematics systems in commercial trucks. These initiatives aim to enhance route efficiency, reduce accidents, and ensure compliance with transportation laws. Digital transformation through technologies like GPS tracking, warehouse automation, and real-time analytics has been accelerating across the sector, thereby improving overall service quality in the freight trucking industry.

Thailand Freight Trucking Market Segmentation

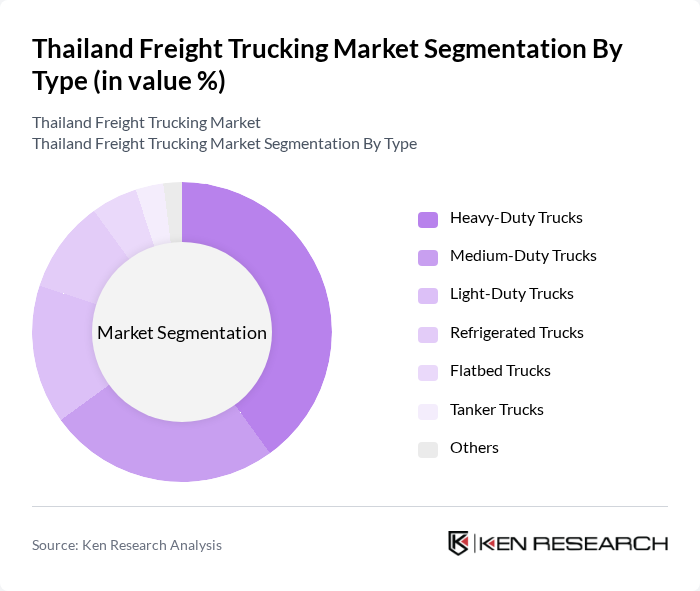

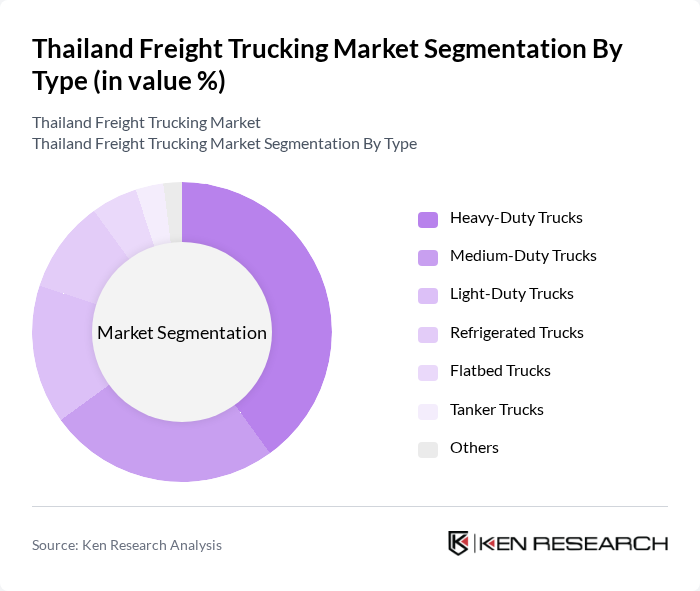

By Type:The freight trucking market can be segmented into various types, including Heavy-Duty Trucks, Medium-Duty Trucks, Light-Duty Trucks, Refrigerated Trucks, Flatbed Trucks, Tanker Trucks, and Others. Each type serves specific transportation needs, with Heavy-Duty Trucks being the most utilized for long-haul freight due to their capacity and durability. Full-truck-load lanes generated 82.38% of value in 2024 as auto parts, electronics, and bulk commodities move in full container or pallet units, while less-than-truck-load services are registering robust growth as parcelized commerce increases.

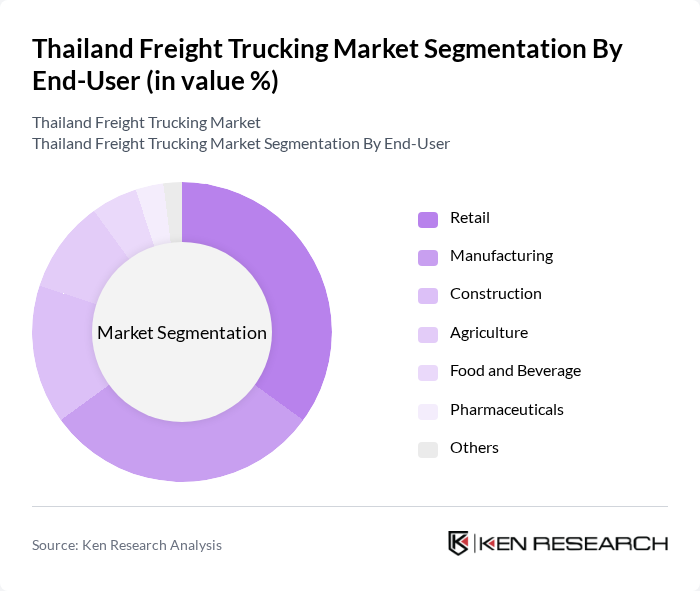

By End-User:The market is also segmented by end-users, including Retail, Manufacturing, Construction, Agriculture, Food and Beverage, Pharmaceuticals, and Others. Wholesale and retail trade is the largest consumer of freight trucking services, driven by the growth of e-commerce and the need for timely deliveries. Rising online penetration, omnichannel store formats, and rapid-replenishment models expand urban and peri-urban delivery runs, with the segment on track for a 6.87% CAGR between 2025-2030.

Thailand Freight Trucking Market Competitive Landscape

The Thailand Freight Trucking Market is characterized by a dynamic mix of regional and international players. Leading participants such as SCG Logistics, Thai Freight Forwarding, Kerry Logistics, JWD Group, TPI Polene Logistics, NCL Logistics, Yusen Logistics, DB Schenker, DHL Supply Chain, Kuehne + Nagel, Agility Logistics, Panalpina, CEVA Logistics, Rhenus Logistics, XPO Logistics contribute to innovation, geographic expansion, and service delivery in this space.

Thailand Freight Trucking Market Industry Analysis

Growth Drivers

- Increasing E-commerce Demand:The Thai e-commerce market is projected to reach approximately THB 3 trillion (USD 90 billion) in future, driven by a surge in online shopping. This growth is expected to increase freight trucking demand significantly, as logistics play a crucial role in fulfilling e-commerce orders. The rise in consumer spending, which is anticipated to grow by 5.5% in future, further supports this trend, creating a robust environment for freight trucking services.

- Infrastructure Development Initiatives:The Thai government has allocated THB 1.5 trillion (USD 45 billion) for infrastructure projects, including road expansions and upgrades, aimed at enhancing logistics efficiency. These initiatives are expected to improve connectivity and reduce transit times, thereby boosting the freight trucking sector. With over 1,000 kilometers of new highways planned in future, the infrastructure improvements will facilitate smoother operations for trucking companies across the country.

- Government Support for Logistics Sector:The Thai government is actively promoting the logistics sector through various policies, including tax incentives and subsidies for green logistics initiatives. In future, the government plans to invest THB 20 billion (USD 600 million) in logistics technology and training programs. This support is expected to enhance operational efficiency and attract foreign investment, further driving growth in the freight trucking market.

Market Challenges

- High Fuel Prices:Fuel prices in Thailand have surged, with diesel prices averaging THB 30 per liter (USD 0.90) in early future. This increase significantly impacts operational costs for trucking companies, squeezing profit margins. The volatility in global oil prices, influenced by geopolitical tensions and supply chain disruptions, poses a persistent challenge for the freight trucking industry, necessitating strategic adjustments by operators to maintain profitability.

- Traffic Congestion in Urban Areas:Major cities in Thailand, such as Bangkok, experience severe traffic congestion, with average speeds dropping to 20 km/h during peak hours. This congestion leads to increased delivery times and operational inefficiencies for freight trucking companies. In future, the estimated economic cost of traffic congestion is projected to reach THB 200 billion (USD 6 billion), highlighting the urgent need for effective traffic management solutions in urban logistics.

Thailand Freight Trucking Market Future Outlook

The Thailand freight trucking market is poised for significant transformation, driven by advancements in technology and a shift towards sustainable practices. As companies increasingly adopt digital solutions for fleet management, operational efficiency is expected to improve. Additionally, the growing emphasis on green logistics will likely lead to the adoption of electric and hybrid vehicles, aligning with global sustainability trends. These developments will create a more resilient and competitive freight trucking landscape in Thailand, catering to evolving consumer demands and regulatory requirements.

Market Opportunities

- Adoption of Green Logistics:The push for environmentally friendly logistics solutions presents a significant opportunity for the freight trucking market. With the government promoting electric vehicles through tax incentives, companies can reduce operational costs while enhancing their sustainability profile. This shift is expected to attract eco-conscious consumers and businesses, driving demand for green logistics services in Thailand.

- Expansion of Cold Chain Logistics:The growing demand for perishable goods, particularly in the food and pharmaceutical sectors, is driving the need for cold chain logistics. The market for cold chain logistics in Thailand is projected to grow to THB 100 billion (USD 3 billion) in future. This expansion offers trucking companies a lucrative opportunity to diversify their services and cater to the increasing need for temperature-controlled transportation.