Region:Middle East

Author(s):Rebecca

Product Code:KRAA6503

Pages:97

Published On:January 2026

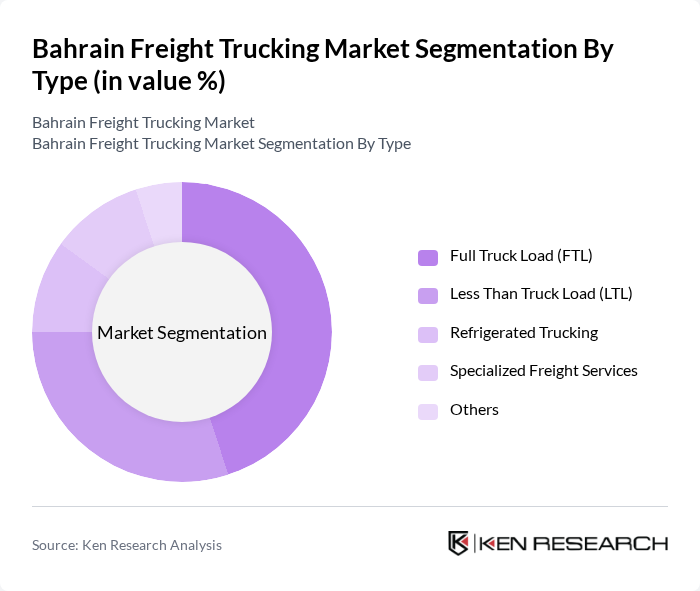

By Type:The freight trucking market can be segmented into various types, including Full Truck Load (FTL), Less Than Truck Load (LTL), Refrigerated Trucking, Specialized Freight Services, and Others. Each of these segments caters to different logistics needs, with FTL and LTL being the most prominent due to their efficiency in transporting goods over varying distances.

The Full Truck Load (FTL) segment dominates the market due to its cost-effectiveness for transporting large volumes of goods. Businesses prefer FTL for bulk shipments, as it allows for dedicated use of the truck, reducing transit times and costs per unit. The Less Than Truck Load (LTL) segment is also significant, catering to smaller shipments that do not require a full truck, thus appealing to a broader range of businesses, including SMEs. The demand for refrigerated trucking is growing, driven by the need for transporting perishable goods, while specialized freight services are gaining traction due to the rise in e-commerce and specific industry requirements.

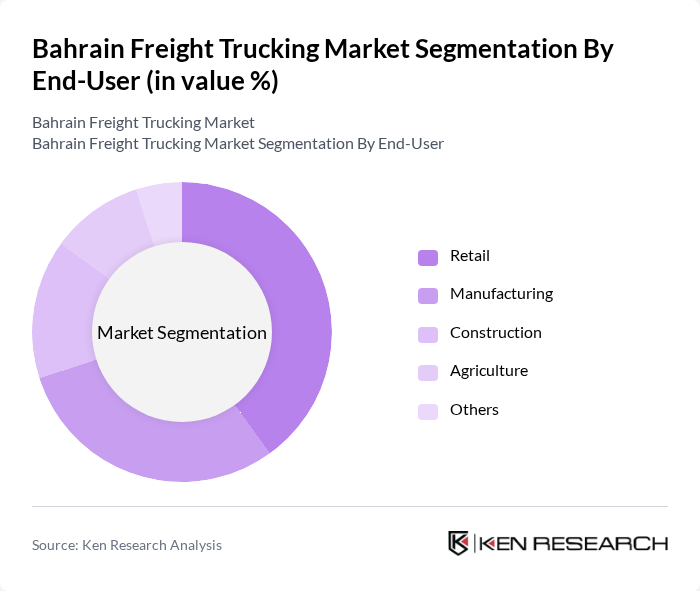

By End-User:The market can also be segmented by end-user industries, including Retail, Manufacturing, Construction, Agriculture, and Others. Each sector has unique logistics requirements, influencing the demand for different trucking services.

The Retail sector is the largest end-user, driven by the need for efficient distribution networks to meet consumer demand. The Manufacturing sector follows closely, requiring reliable logistics for raw materials and finished goods. The Construction industry also plays a significant role, as it relies on trucking services for transporting heavy machinery and materials. Agriculture is a growing segment, particularly for transporting perishable goods, while other sectors contribute to the overall demand.

The Bahrain Freight Trucking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Agency Company (GAC), Agility Logistics, DHL Supply Chain Bahrain, Kuehne + Nagel, DB Schenker, Aramex, Bahri, Almoayed Group, Al-Futtaim Logistics, Al-Haddad Group, Ahlia Logistics, Al-Moayyed International Group, Al-Bahar Group, Al-Salam International, Bahrain Logistics Company contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain Freight Trucking Market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. The integration of digital freight solutions is expected to streamline operations, enhancing efficiency and reducing costs. Additionally, the focus on sustainability will likely lead to increased investments in eco-friendly trucking solutions. As e-commerce continues to expand, the demand for last-mile delivery services will further shape the logistics landscape, presenting new opportunities for innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Refrigerated Trucking Specialized Freight Services Others |

| By End-User | Retail Manufacturing Construction Agriculture Others |

| By Cargo Type | Dry Goods Hazardous Materials Perishable Goods Heavy Machinery Others |

| By Distance | Short Haul Long Haul Regional International Others |

| By Fleet Type | Owned Fleet Leased Fleet Third-Party Logistics Others |

| By Service Type | Dedicated Contract Carriage Spot Market Services Intermodal Services Others |

| By Region | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Freight Trucking | 120 | Logistics Managers, Fleet Operators |

| Specialized Freight Services | 85 | Operations Managers, Compliance Officers |

| Construction Material Transport | 70 | Project Managers, Procurement Specialists |

| Food and Beverage Logistics | 60 | Supply Chain Directors, Quality Assurance Managers |

| Automotive Parts Distribution | 50 | Warehouse Managers, Logistics Coordinators |

The Bahrain Freight Trucking Market is valued at approximately USD 80 million, driven by the increasing demand for logistics services, particularly from the retail and manufacturing sectors, along with government infrastructure development initiatives.