Region:Asia

Author(s):Rebecca

Product Code:KRAA6496

Pages:95

Published On:January 2026

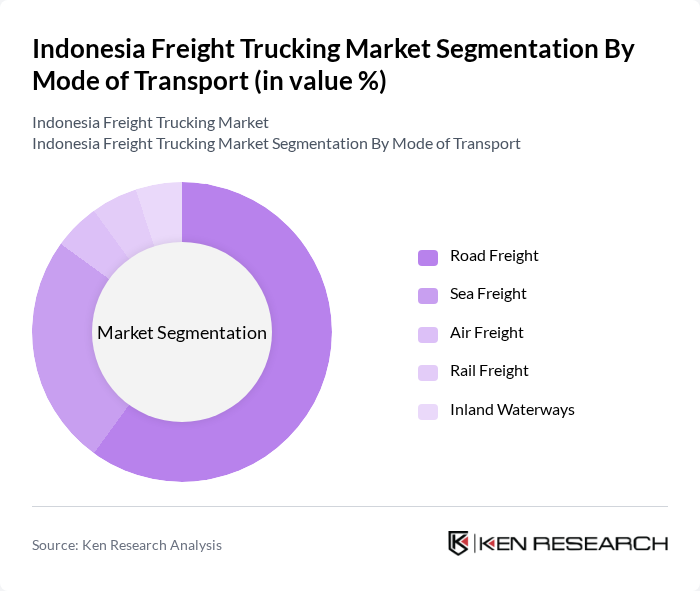

By Mode of Transport:The freight trucking market in Indonesia is segmented by various modes of transport, including road freight, sea freight, air freight, rail freight, and inland waterways. Among these, road freight is the most dominant mode due to the extensive road network and the flexibility it offers for transporting goods across the archipelago. Sea freight is also significant, especially for inter-island transportation, while air freight caters to time-sensitive deliveries. Rail freight and inland waterways are less utilized but are gradually gaining traction.

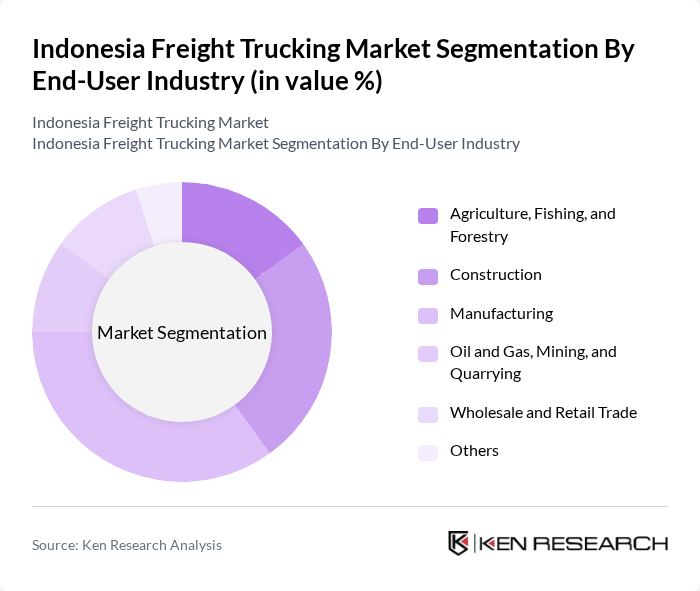

By End-User Industry:The freight trucking market serves various end-user industries, including agriculture, fishing, and forestry; construction; manufacturing; oil and gas, mining, and quarrying; wholesale and retail trade; and others. The manufacturing sector is the largest consumer of freight trucking services, driven by the need for raw materials and finished goods transportation amid high export orientation in automotive, electronics, and textiles. The construction industry also significantly contributes to the demand, particularly for heavy equipment and materials.

The Indonesia Freight Trucking Market is characterized by a dynamic mix of regional and international players. Leading participants such as NYK Line (Nippon Yusen Kaisha), Pancaran Group, PT ABM Investama TBK (PT Cipta Krida Bahari), PT Repex Wahana (RPX), PT Siba Surya, Wahana Prestasi Logistik, Garuda Logistics, Cargonesia, Kargo Technologies, Anteraja, Indah Logistik, Sinar Jaya, Bhinneka, Tanjung Perak Port, Mitra Adiperkasa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian freight trucking market appears promising, driven by technological advancements and increasing demand for efficient logistics solutions. The integration of digital platforms and AI in operations is expected to streamline processes, enhancing service delivery. Additionally, the government's commitment to infrastructure development will likely improve connectivity, further supporting market growth. As sustainability becomes a priority, companies are anticipated to adopt greener practices, positioning themselves favorably in an evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Road Freight Sea Freight Air Freight Rail Freight Inland Waterways |

| By End-User Industry | Agriculture, Fishing, and Forestry Construction Manufacturing Oil and Gas, Mining, and Quarrying Wholesale and Retail Trade Others |

| By Region | Java Sumatra Kalimantan Sulawesi Others |

| By Service Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Transportation Warehousing Distribution Value-Added Services |

| By Distance | Long Haul Short Haul |

| By Containerization | Containerized Non-Containerized |

| By Temperature Control | Temperature Controlled Non-Temperature Controlled |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Long-Haul Freight Operations | 120 | Fleet Managers, Logistics Directors |

| Urban Delivery Services | 100 | Operations Supervisors, Delivery Coordinators |

| Cold Chain Logistics | 80 | Supply Chain Managers, Quality Control Officers |

| Construction Material Transport | 70 | Project Managers, Procurement Specialists |

| Inter-Island Freight Services | 90 | Regional Managers, Shipping Coordinators |

The Indonesia Freight Trucking Market is valued at approximately USD 54 billion, driven by factors such as urbanization, industrial growth, and the expansion of e-commerce. This valuation reflects a five-year historical analysis of the market's performance.