Region:Asia

Author(s):Rebecca

Product Code:KRAA6497

Pages:90

Published On:January 2026

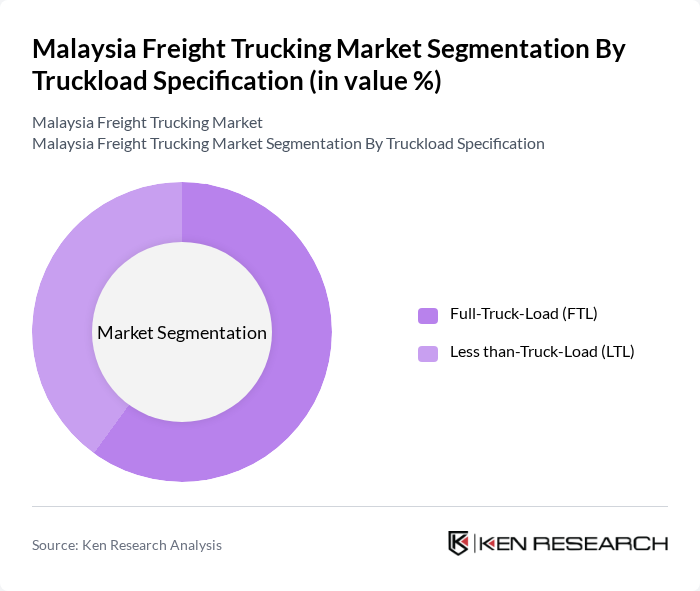

By Truckload Specification:The trucking market is segmented into Full-Truck-Load (FTL) and Less than-Truck-Load (LTL). FTL is preferred for large shipments, providing cost efficiency for bulk transport, while LTL caters to smaller loads, allowing businesses to share transportation costs. The growing trend of e-commerce has led to an increase in LTL shipments, as businesses seek flexible shipping options.

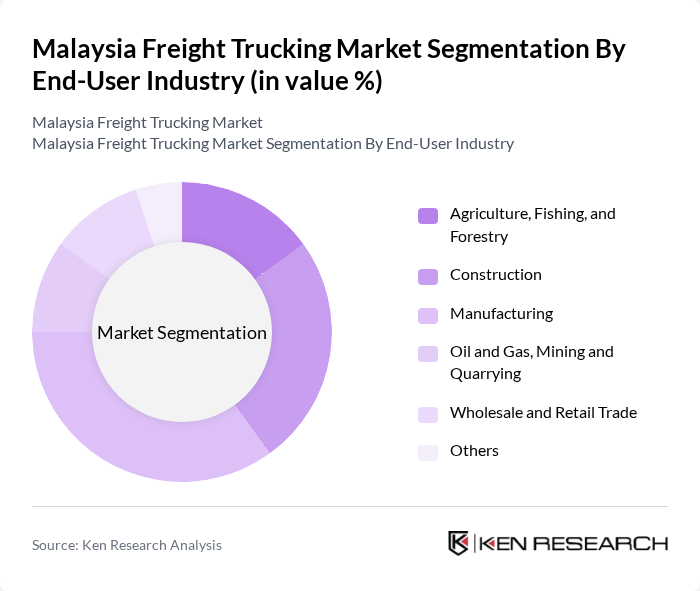

By End-User Industry:The freight trucking market serves various industries, including Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas, Mining and Quarrying; Wholesale and Retail Trade; and Others. The manufacturing sector is the largest consumer of freight trucking services, driven by the need for timely delivery of raw materials and finished goods. The construction industry also significantly contributes to demand due to ongoing infrastructure projects.

The Malaysia Freight Trucking Market is characterized by a dynamic mix of regional and international players. Leading participants such as CJ Logistics Corporation, DHL Group, NYK (Nippon Yusen Kaisha) Line, Taipanco Sdn Bhd, Tiong Nam Logistics Holdings Berhad, GEODIS, Kuehne + Nagel, YTL Corporation Berhad, Scomi Group Berhad, SCS Logistics, SRS Logistics, SML Logistics, Sinar Jernih Logistics, Sinar Mas Logistics, APL Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia freight trucking market appears promising, driven by technological advancements and increasing demand for efficient logistics solutions. As companies adopt digital tools and automation, operational efficiencies are expected to improve significantly. Furthermore, the shift towards sustainable practices, including electric vehicles and eco-friendly logistics, will likely reshape the industry landscape. These trends, combined with ongoing government support, will create a dynamic environment for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Truckload Specification | Full-Truck-Load (FTL) Less than-Truck-Load (LTL) |

| By End-User Industry | Agriculture, Fishing, and Forestry Construction Manufacturing Oil and Gas, Mining and Quarrying Wholesale and Retail Trade Others |

| By Region | Central Region Northern Region Southern Region Eastern Region |

| By Destination | Domestic International |

| By Containerization | Containerized Non-Containerized |

| By Distance | Long Haul Short Haul |

| By Temperature Control | Non-Temperature Controlled Temperature Controlled |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Long-Haul Freight Operations | 120 | Fleet Managers, Operations Directors |

| Local Delivery Services | 100 | Logistics Coordinators, Dispatch Managers |

| Cold Chain Logistics | 80 | Supply Chain Managers, Quality Assurance Officers |

| Construction Material Transport | 90 | Project Managers, Procurement Officers |

| Intermodal Freight Solutions | 110 | Business Development Managers, Freight Forwarders |

The Malaysia Freight Trucking Market is valued at approximately USD 8.6 billion, reflecting a significant growth driven by the increasing demand for logistics services, particularly from the e-commerce and manufacturing sectors.