Region:Middle East

Author(s):Rebecca

Product Code:KRAA6596

Pages:80

Published On:January 2026

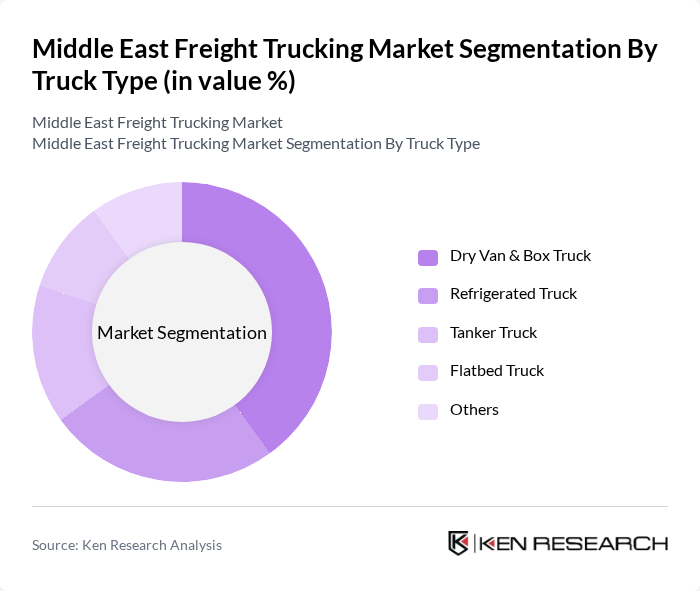

By Truck Type:The freight trucking market is segmented into various truck types, including Dry Van & Box Truck, Refrigerated Truck, Tanker Truck, Flatbed Truck, and Others. Each type serves specific transportation needs, with Dry Van & Box Trucks being the most commonly used due to their versatility in transporting a wide range of goods. Refrigerated Trucks are essential for temperature-sensitive cargo, while Tanker Trucks are crucial for liquid transportation.

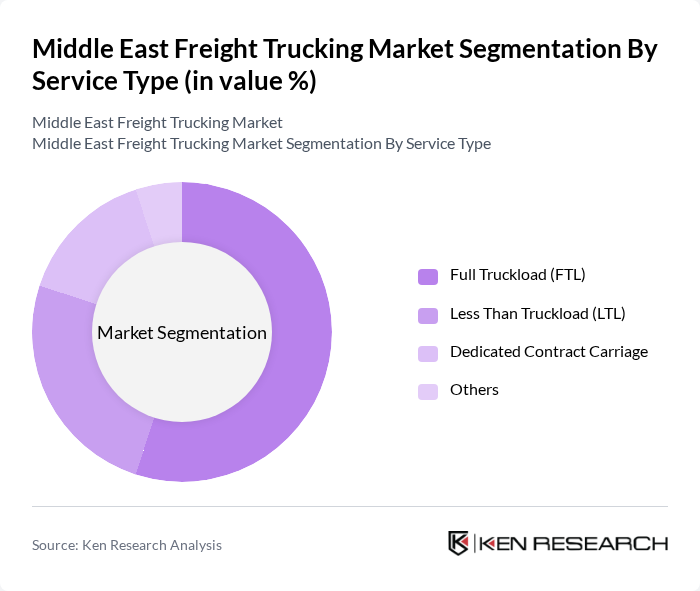

By Service Type:The market is also segmented by service type, which includes Full Truckload (FTL), Less Than Truckload (LTL), Dedicated Contract Carriage, and Others. Full Truckload services dominate the market due to their efficiency in transporting large volumes of goods directly from the shipper to the receiver, making them a preferred choice for many businesses.

The Middle East Freight Trucking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, Agility Logistics, Gulf Agency Company (GAC), Al-Futtaim Logistics, DB Schenker, Kuehne + Nagel, DHL Supply Chain, CEVA Logistics, XPO Logistics, Emirates Logistics, Al-Muhaidib Group, Al-Jazira Transport, Al-Hokair Group, National Shipping Company of Saudi Arabia (NSCSA), Bahri contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East freight trucking market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of digital platforms for logistics management is expected to streamline operations, enhancing efficiency and reducing costs. Additionally, the focus on sustainability will likely lead to increased adoption of eco-friendly trucking solutions. As the region continues to invest in infrastructure and embraces innovation, the freight trucking sector will adapt to meet the growing demands of a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Truck Type | Dry Van & Box Truck Refrigerated Truck Tanker Truck Flatbed Truck Others |

| By Service Type | Full Truckload (FTL) Less Than Truckload (LTL) Dedicated Contract Carriage Others |

| By Cargo Type | Dry Bulk Goods Liquids Temperature Controlled Goods Others |

| By End-User Industry | Oil & Gas Industrial & Manufacturing Consumer Goods Pharmaceutical & Healthcare Food & Beverages Chemicals Others |

| By Region | Saudi Arabia Turkey UAE Egypt Qatar Rest of Middle East |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Long-Haul Freight Operations | 120 | Fleet Managers, Operations Directors |

| Regional Distribution Networks | 100 | Logistics Coordinators, Supply Chain Managers |

| Cold Chain Logistics | 80 | Warehouse Managers, Quality Control Officers |

| Intermodal Freight Solutions | 70 | Transport Planners, Freight Forwarders |

| Last-Mile Delivery Services | 90 | Delivery Managers, Customer Experience Leads |

The Middle East Freight Trucking Market is valued at approximately USD 154.7 billion, driven by increasing demand for logistics services, e-commerce growth, and infrastructure development projects across the region.