Region:Asia

Author(s):Rebecca

Product Code:KRAA6505

Pages:90

Published On:January 2026

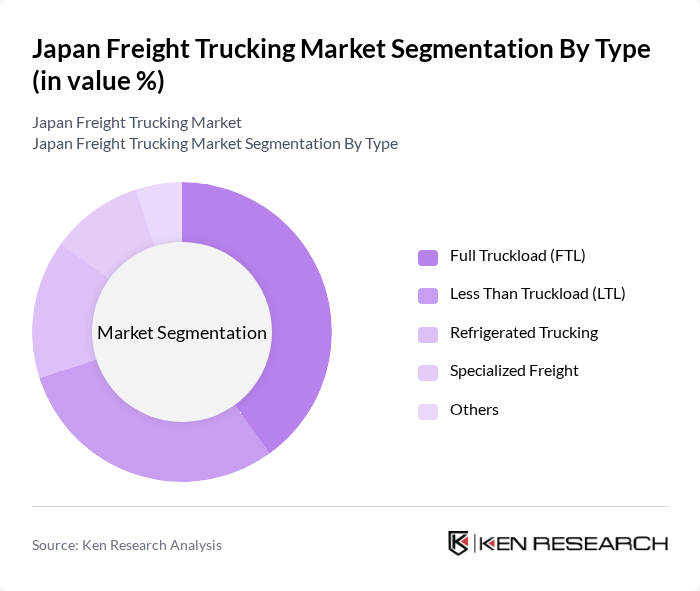

By Type:The freight trucking market can be segmented into various types, including Full Truckload (FTL), Less Than Truckload (LTL), Refrigerated Trucking, Specialized Freight, and Others. Each of these segments caters to different logistics needs, with FTL and LTL being the most prominent due to their efficiency in transporting goods over long distances. The demand for refrigerated trucking has also increased significantly, driven by the growth in the food and pharmaceutical sectors.

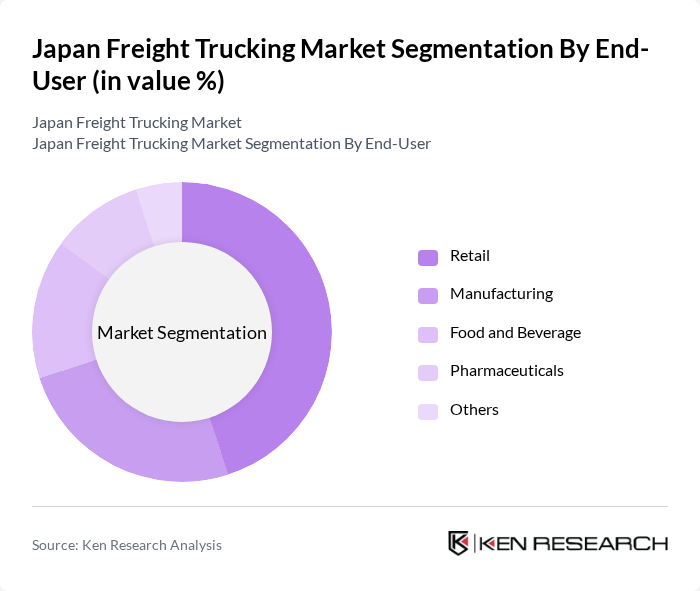

By End-User:The end-user segmentation includes Retail, Manufacturing, Food and Beverage, Pharmaceuticals, and Others. The retail sector is the largest consumer of freight trucking services, driven by the rise of e-commerce and consumer demand for quick delivery. The manufacturing sector also plays a significant role, as it requires efficient logistics to transport raw materials and finished goods.

The Japan Freight Trucking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express, Yamato Transport, Sagawa Express, Seino Transportation, Fukuyama Transporting, Kintetsu World Express, Marubeni Logistics, Hitachi Transport System, Japan Post, Kokusai Express, Aioi Unyu, Kanto Transportation, Kinki Transport, Kanto Unyu, Kinki Express contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan freight trucking market appears promising, driven by technological innovations and a growing emphasis on sustainability. As companies increasingly adopt electric and hybrid trucks, the market is expected to witness a shift towards greener logistics solutions. Additionally, the integration of AI and automation will enhance operational efficiency, allowing firms to better manage resources and respond to evolving consumer demands. This transformation will likely position the industry for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full Truckload (FTL) Less Than Truckload (LTL) Refrigerated Trucking Specialized Freight Others |

| By End-User | Retail Manufacturing Food and Beverage Pharmaceuticals Others |

| By Cargo Type | Dry Goods Hazardous Materials Perishable Goods Heavy Machinery Others |

| By Fleet Size | Small Fleets Medium Fleets Large Fleets Others |

| By Service Type | Dedicated Contract Carriage Private Fleet Freight Brokerage Others |

| By Delivery Model | Scheduled Deliveries On-Demand Deliveries Same-Day Deliveries Others |

| By Technology Adoption | GPS Tracking Fleet Management Software Telematics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Long-Haul Freight Operations | 120 | Fleet Managers, Operations Directors |

| Regional Distribution Networks | 100 | Logistics Coordinators, Supply Chain Managers |

| Cold Chain Logistics | 80 | Warehouse Managers, Quality Control Officers |

| Urban Freight Delivery | 70 | City Logistics Planners, Delivery Supervisors |

| Freight Technology Adoption | 90 | IT Managers, Innovation Leads |

The Japan Freight Trucking Market is valued at approximately USD 140 billion, reflecting significant growth driven by increased logistics demand, particularly from the e-commerce sector and advancements in technology and infrastructure.