Region:Asia

Author(s):Rebecca

Product Code:KRAA7077

Pages:87

Published On:January 2026

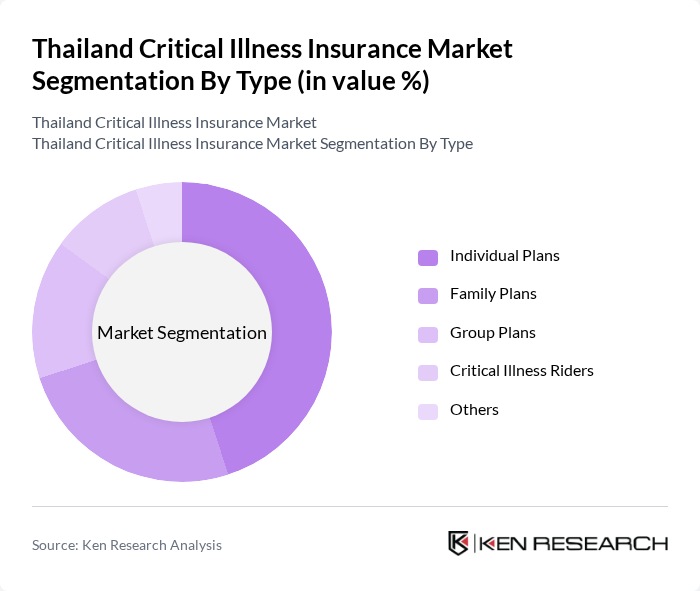

By Type:

The segmentation by type includes Individual Plans, Family Plans, Group Plans, Critical Illness Riders, and Others. Among these, Individual Plans dominate the market due to the increasing number of individuals seeking personalized coverage tailored to their specific health needs. The trend towards individualization in insurance products has led to a rise in demand for plans that cater to personal health risks, making this segment the most popular choice among consumers.

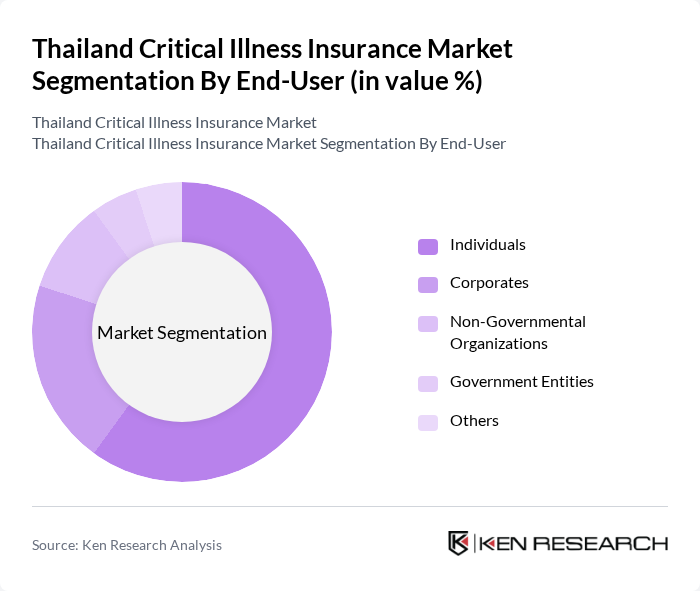

By End-User:

This segmentation includes Individuals, Corporates, Non-Governmental Organizations, Government Entities, and Others. The Individuals segment leads the market, driven by a growing awareness of health risks and the need for personal financial security. As more people recognize the importance of safeguarding their health and finances, individual policies have become increasingly popular, reflecting a shift towards personal responsibility in health management.

The Thailand Critical Illness Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bangkok Insurance Public Company Limited, Muang Thai Life Assurance Public Company Limited, Thai Life Insurance Public Company Limited, Allianz Ayudhya Assurance Public Company Limited, Prudential Life Assurance (Thailand) Public Company Limited, AIA Thailand, Generali Life Assurance (Thailand) Public Company Limited, SCB Life Assurance Public Company Limited, Bangkok Insurance Public Company Limited, Krungthai-AXA Life Insurance Public Company Limited, TQM Insurance Broker Public Company Limited, Thai Group Holdings, Chubb Samaggi Insurance Public Company Limited, Liberty Insurance Public Company Limited, FWD Life Insurance Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand critical illness insurance market appears promising, driven by technological advancements and evolving consumer preferences. As digital platforms gain traction, insurers are expected to enhance their online offerings, making it easier for consumers to access and purchase policies. Additionally, the integration of personalized health solutions into insurance products will likely attract a broader customer base, fostering growth in this sector. The emphasis on preventive healthcare will further shape the market landscape, encouraging proactive health management.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Plans Family Plans Group Plans Critical Illness Riders Others |

| By End-User | Individuals Corporates Non-Governmental Organizations Government Entities Others |

| By Age Group | Under 30 50 Above 50 Others |

| By Coverage Amount | Low Coverage Medium Coverage High Coverage Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Others |

| By Policy Duration | Short-term Policies Long-term Policies Others |

| By Payment Frequency | Monthly Payments Annual Payments One-time Payments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Policyholders | 150 | Current policyholders of critical illness insurance |

| Insurance Agents | 100 | Agents selling critical illness insurance products |

| Healthcare Professionals | 80 | Doctors and healthcare providers involved in patient care |

| Insurance Company Executives | 60 | Senior management from insurance firms |

| Financial Advisors | 70 | Advisors providing insurance and financial planning services |

The Thailand Critical Illness Insurance Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by rising healthcare costs, increased awareness of critical illnesses, and a growing middle-class population seeking financial security against health-related risks.