Region:Middle East

Author(s):Dev

Product Code:KRAC5098

Pages:84

Published On:January 2026

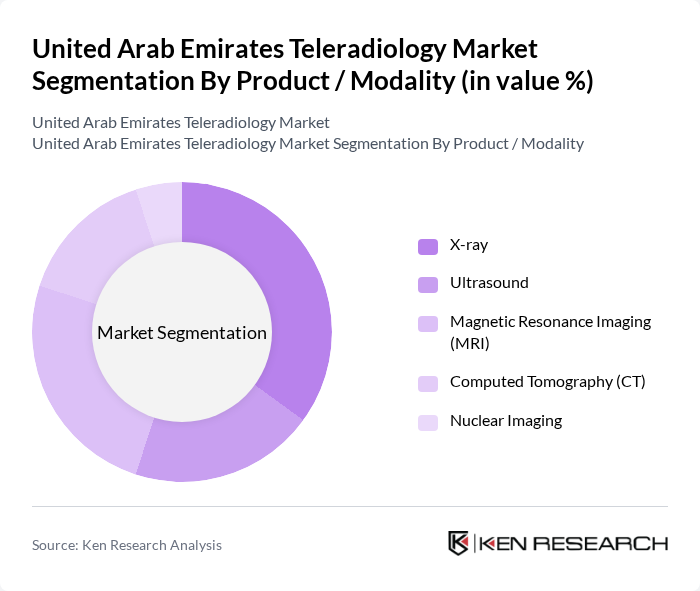

By Product / Modality:The teleradiology market is segmented into various modalities, including X-ray, Ultrasound, Magnetic Resonance Imaging (MRI), Computed Tomography (CT), and Nuclear Imaging, in line with leading market studies on the United Arab Emirates teleradiology sector. Among these, Ultrasound currently accounts for the largest revenue share in the country, while Computed Tomography is emerging as one of the most lucrative and fast-growing segments due to its critical role in emergency and oncology imaging. X-ray and MRI, however, remain widely used in teleradiology workflows because of their broad clinical applications, from musculoskeletal and chest imaging to neurology and oncology, and their compatibility with remote reporting systems. The increasing adoption of advanced imaging technologies, integration with RIS/PACS and cloud platforms, and the need for quick, round-the-clock diagnostic solutions across hospital networks and satellite clinics are driving the growth of these modalities.

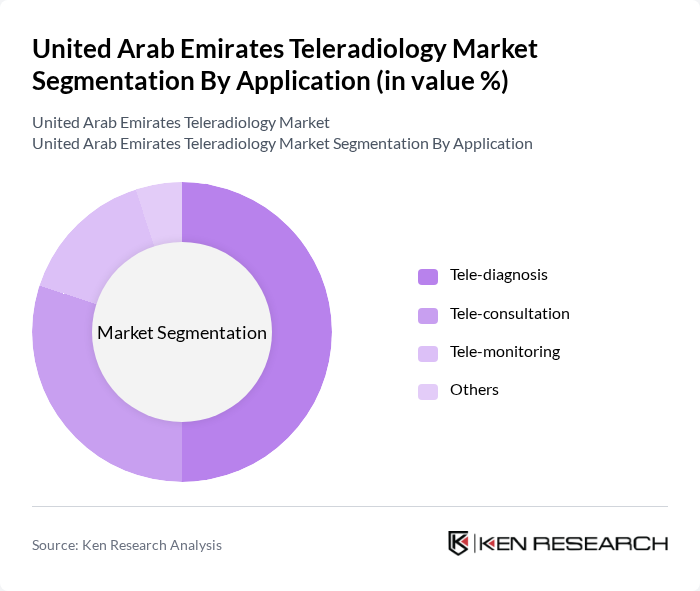

By Application:The applications of teleradiology include Tele-diagnosis, Tele-consultation, Tele-monitoring, and others, which is consistent with recognized segmentation used in United Arab Emirates teleradiology market analyses. Tele-diagnosis is the leading application, driven by the need for timely, accurate interpretation of imaging studies, especially during off-hours and for facilities in remote or underserved locations that rely on centralized radiology expertise. The increasing reliance on telehealth services, expansion of integrated health information exchanges, and growing acceptance of remote specialist consultations among providers and patients are further propelling this segment's growth and supporting the use of Tele-consultation and Tele-monitoring to coordinate multidisciplinary care.

The United Arab Emirates Teleradiology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Health Services Company (SEHA), Dubai Health Authority (DHA), Mediclinic Middle East, NMC Healthcare, Al Zahra Hospital Dubai, Emirates Healthcare Group, American Hospital Dubai, HealthPlus Network of Specialty Centers, Aster DM Healthcare, Saudi German Hospital Dubai, Burjeel Hospital, Rashid Hospital, Mediclinic City Hospital, Al Noor Hospital, Dubai London Clinic and Specialty Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the teleradiology market in the UAE appears promising, driven by technological advancements and increasing healthcare demands. As the government continues to invest in healthcare infrastructure, the integration of artificial intelligence and cloud-based solutions is expected to enhance diagnostic capabilities. Additionally, the growing emphasis on patient-centric care models will likely lead to more personalized and efficient healthcare delivery, positioning teleradiology as a vital component of the UAE's healthcare landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Product / Modality | X-ray Ultrasound Magnetic Resonance Imaging (MRI) Computed Tomography (CT) Nuclear Imaging |

| By Application | Tele-diagnosis Tele-consultation Tele-monitoring Others |

| By Service Delivery Model | Cloud-based Teleradiology Web-based Teleradiology On-premises Teleradiology Hybrid Models |

| By End-User | Hospitals Diagnostic Imaging Centers Ambulatory Surgical Centers Others |

| By Type of Reading | Primary Reading Second Opinion / Over-read Subspecialty Reading (e.g., neuroradiology, musculoskeletal) Emergency / Night Hawk Services |

| By Healthcare Setting | Public Sector Facilities Private Sector Facilities Specialty Clinics Others |

| By Emirate | Abu Dhabi Dubai Sharjah Other Emirates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Radiology Departments | 60 | Radiologists, Department Heads |

| Teleradiology Service Providers | 50 | Business Development Managers, Technical Leads |

| Healthcare IT Solutions | 40 | IT Managers, System Administrators |

| Insurance Companies Offering Telehealth | 40 | Policy Analysts, Claims Managers |

| Regulatory Bodies in Healthcare | 40 | Policy Makers, Compliance Officers |

The United Arab Emirates Teleradiology Market is valued at approximately USD 85 million, reflecting a significant growth trend driven by increasing demand for remote healthcare services and advancements in imaging technologies.