Region:Middle East

Author(s):Dev

Product Code:KRAC5103

Pages:100

Published On:January 2026

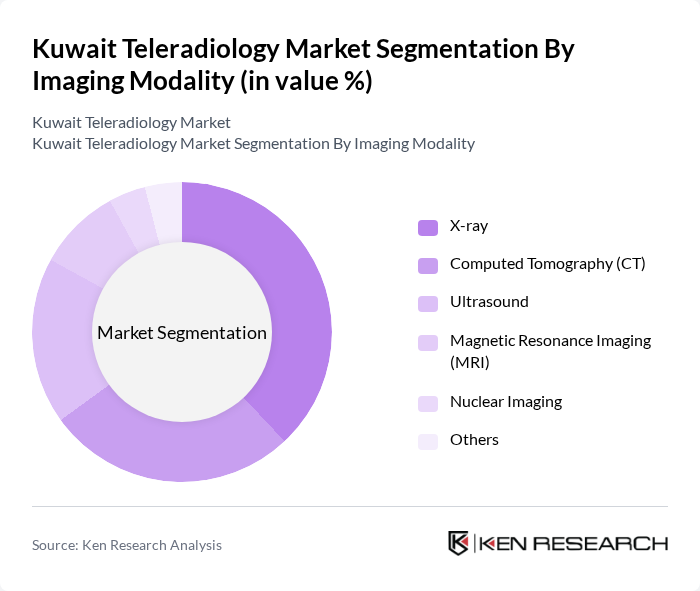

By Imaging Modality:

The imaging modality segment includes various technologies used in teleradiology, such as X-ray, Computed Tomography (CT), Ultrasound, Magnetic Resonance Imaging (MRI), Nuclear Imaging, and Others. Among these, X-ray, CT, and Ultrasound are the leading modalities in terms of teleradiology usage, reflecting their high examination volumes in routine, emergency, and inpatient care. X-ray remains a workhorse modality for trauma, chest, and musculoskeletal imaging, while CT is preferred for complex cross?sectional and emergency diagnostics, and Ultrasound contributes significantly due to its wide use in obstetrics, abdominal, and vascular imaging. The preference for these modalities is driven by their effectiveness in diagnosing a wide range of conditions, coupled with advancements such as dose?reduction techniques in CT, high?resolution digital X?ray, and improved ultrasound probes that enhance image quality and reduce examination time. The increasing demand for quick and accurate diagnostics in emergency and critical care settings, including night?time and weekend coverage, further solidifies the dominance of these modalities in teleradiology workflows.

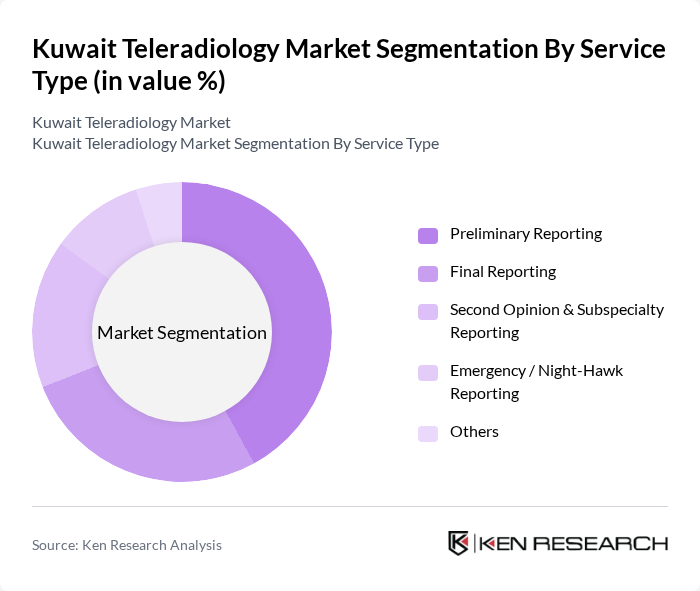

By Service Type:

This segment encompasses various service types offered in teleradiology, including Preliminary Reporting, Final Reporting, Second Opinion & Subspecialty Reporting, Emergency / Night-Hawk Reporting, and Others. The Preliminary Reporting service is currently the most dominant, as it provides initial assessments that are crucial for timely patient management, particularly for emergency, trauma, and intensive care cases where rapid decision-making is required. The increasing need for rapid diagnosis in emergency situations and the shortage or uneven distribution of radiologists during off?hours have led to a surge in demand for this service type, making it a critical component of the teleradiology market. At the same time, demand for Final Reporting and Second Opinion & Subspecialty Reporting is growing as hospitals in Kuwait and the wider GCC increasingly rely on external subspecialty expertise in neuroradiology, musculoskeletal, pediatric, and oncologic imaging to support complex cases and quality assurance.

The Kuwait Teleradiology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Radiology Center, Dar Al Shifa Hospital, Alorf Hospital, Second Opinions by USARAD (Partnered Services in Kuwait), Aycan Medical Systems (PACS Provider in Kuwait), Agfa-Gevaert NV, Koninklijke Philips N.V., Nano-X Imaging Ltd, Global Teleradiology Service Providers Active in GCC, Regional Teleradiology Networks in Middle East, Local Diagnostic Imaging Chains in Kuwait, Independent Radiologist Groups Providing Teleradiology, PACS/RIS Vendors with Kuwait Installations, Telehealth Platforms Offering Imaging-related Services, Emerging AI-enabled Teleradiology Start-ups Serving Kuwait contribute to innovation, geographic expansion, and service delivery in this space. Strategic collaborations have played a notable role in Kuwait, such as USARAD’s Second Opinions partnership with Dar Al Shifa Hospital for subspecialty teleradiology and quality assurance, and Aycan’s PACS deployment at Alorf Hospital, which have strengthened the digital imaging and teleradiology infrastructure in the country.

The future of the teleradiology market in Kuwait appears promising, driven by technological advancements and increasing healthcare demands. As the government continues to invest in healthcare infrastructure, the integration of artificial intelligence in diagnostic processes is expected to enhance efficiency and accuracy. Additionally, the expansion of telehealth services will likely facilitate greater access to specialized care, particularly in underserved areas, fostering a more inclusive healthcare environment for all citizens.

| Segment | Sub-Segments |

|---|---|

| By Imaging Modality | X-ray Computed Tomography (CT) Ultrasound Magnetic Resonance Imaging (MRI) Nuclear Imaging Others |

| By Service Type | Preliminary Reporting Final Reporting Second Opinion & Subspecialty Reporting Emergency / Night-Hawk Reporting Others |

| By End-User | Hospitals & Clinics Diagnostic Imaging Centers & Laboratories Long-term Care Centers, Nursing Homes & Assisted Living Facilities Others |

| By Deployment Model | On-premise Cloud-based Hybrid Others |

| By Application | Oncology Neurology Cardiology Musculoskeletal Others |

| By Geographic Coverage | Kuwait City & Metropolitan Areas Other Urban Areas Rural & Remote Areas Others |

| By Policy & Payer Environment | Public Sector / Government-funded Programs Private Insurance Out-of-pocket / Self-pay Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Radiology Departments | 60 | Radiologists, Department Heads |

| Teleradiology Service Providers | 50 | Business Development Managers, Technical Leads |

| Healthcare IT Solutions | 40 | IT Managers, System Administrators |

| Patient Experience with Teleradiology | 50 | Patients, Healthcare Advocates |

| Regulatory Bodies and Policy Makers | 40 | Healthcare Policy Analysts, Regulatory Officers |

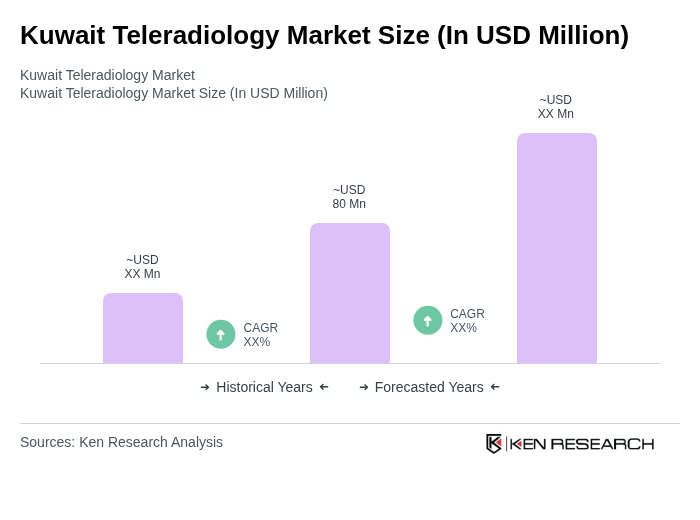

The Kuwait Teleradiology Market is valued at approximately USD 80 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for remote diagnostic services and advancements in imaging technologies.