Region:Asia

Author(s):Dev

Product Code:KRAC5102

Pages:100

Published On:January 2026

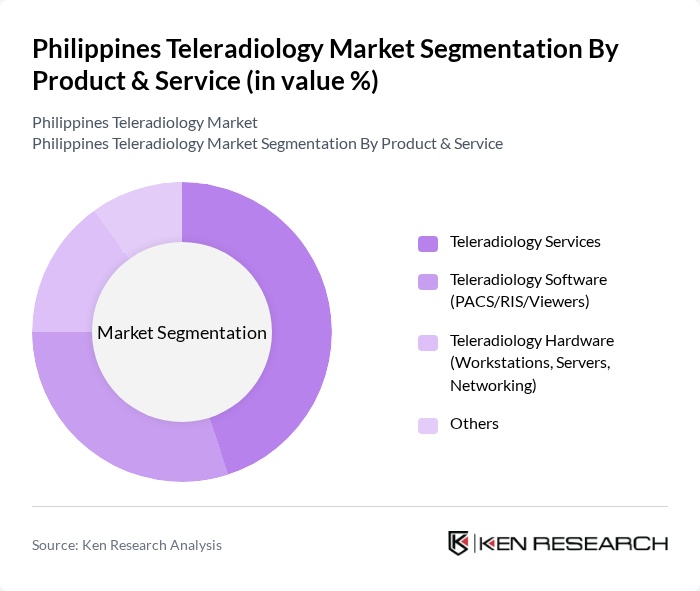

By Product & Service:The product and service segmentation of the Philippines Teleradiology Market includes Teleradiology Services, Teleradiology Software (PACS/RIS/Viewers), Teleradiology Hardware (Workstations, Servers, Networking), and Others. Teleradiology Services is the leading sub-segment due to the increasing adoption of remote diagnostic reporting by hospitals and diagnostic centers and the need to address radiologist shortages, especially outside major urban areas. The demand for efficient and timely reporting of radiological images, supported by cloud-based PACS/RIS and artificial intelligence–enabled workflow tools, has surged, making this segment crucial for healthcare delivery.

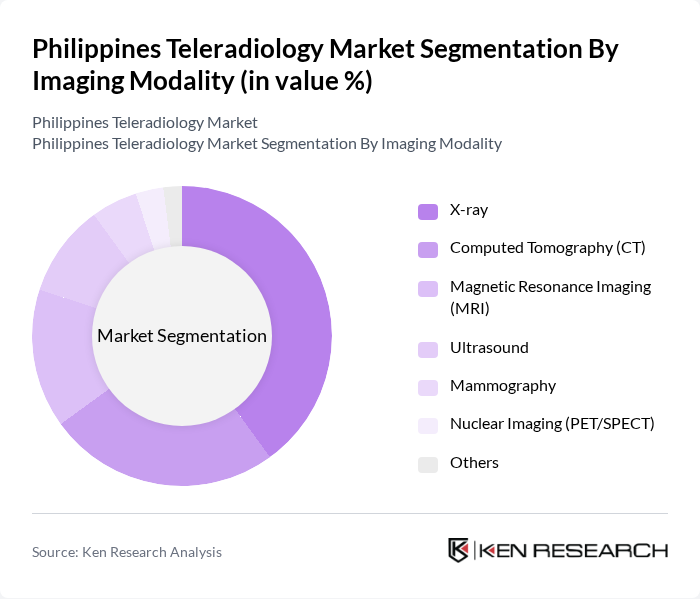

By Imaging Modality:The imaging modality segmentation includes X-ray, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, Mammography, Nuclear Imaging (PET/SPECT), and Others. The X-ray segment dominates the market due to its widespread use as a first-line imaging modality across emergency, inpatient, and outpatient settings and its cost-effectiveness. Globally, X-ray represents the largest share of teleradiology volumes, and this pattern is mirrored in the Philippines as imaging centers and hospitals increasingly route plain radiography, followed by CT and MRI, through teleradiology networks to improve turnaround times and specialist access.

The Philippines Teleradiology Market is characterized by a dynamic mix of regional and international players. Leading participants such as IntelliRad Imaging Corporation, TeleRad Asia Inc., StatRad Philippines, Global Telemedicine Services Philippines, Lifetrack Medical Systems, Aurora TeleRad Services, Rad365 Teleradiology, MediView Teleradiology, Pacific Telehealth & Imaging, Southeast Asia Teleradiology Network, CloudPACS Philippines, Radiology Partners Philippines, eHealth Imaging Services, Asia-Pacific Remote Radiology Group, PrimeScan Teleradiology contribute to innovation, geographic expansion, and service delivery in this space.

The future of the teleradiology market in the Philippines appears promising, driven by ongoing technological advancements and increasing healthcare investments. As the government continues to enhance telehealth infrastructure, the integration of AI and cloud-based solutions will likely streamline diagnostic processes. Furthermore, the rising trend of remote patient monitoring will facilitate greater collaboration between healthcare providers and radiologists, ultimately improving patient outcomes and expanding service reach across the archipelago.

| Segment | Sub-Segments |

|---|---|

| By Product & Service | Teleradiology Services Teleradiology Software (PACS/RIS/Viewers) Teleradiology Hardware (Workstations, Servers, Networking) Others |

| By Imaging Modality | X-ray Computed Tomography (CT) Magnetic Resonance Imaging (MRI) Ultrasound Mammography Nuclear Imaging (PET/SPECT) Others |

| By Report Type | Preliminary / Stat Reporting Final Reporting Sub?specialty Reporting (e.g., Neuro, MSK, Oncology) Second Opinion & Over?read Services |

| By Service Delivery Model | On?Demand / Per?Case Services Contract / Subscription-Based Services Hybrid Models Outsourced Night?Hawk / After?Hours Services |

| By End-User | Public Hospitals Private Hospitals Diagnostic & Imaging Centers Specialty Clinics Others |

| By Technology Deployment | Cloud-Based Solutions On-Premise Solutions Web & Mobile-Based Platforms AI-Enabled / Decision-Support Solutions |

| By Geographic Coverage | Metro & Urban Areas Semi-Urban Areas Rural & Remote Areas Cross-Regional / Cross-Border Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Teleradiology Services | 120 | Radiologists, Hospital Administrators |

| Private Clinic Imaging Solutions | 90 | Clinic Owners, Imaging Technologists |

| Telemedicine Platforms | 75 | IT Managers, Telehealth Coordinators |

| Diagnostic Imaging Equipment Suppliers | 60 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 50 | Health Department Officials, Policy Analysts |

The Philippines Teleradiology Market is valued at approximately USD 170 million, reflecting a significant growth driven by the increasing demand for remote diagnostic services and advancements in imaging technology.