Region:Middle East

Author(s):Dev

Product Code:KRAC5097

Pages:83

Published On:January 2026

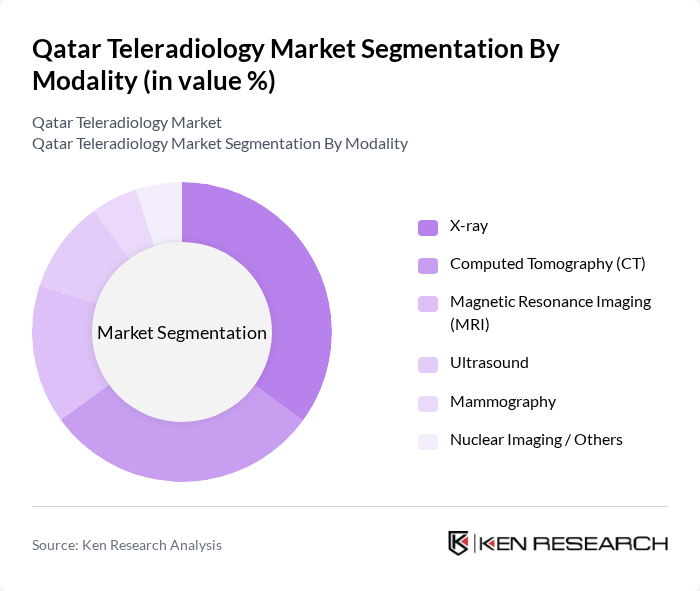

By Modality:The teleradiology market can be segmented based on various modalities, including X-ray, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, Mammography, and Nuclear Imaging/Others. Each modality serves specific diagnostic needs, with X-ray and CT being the most commonly used due to their widespread application in emergency, trauma, chest, and routine diagnostics, in line with global teleradiology trends where X-ray accounts for the largest share of remote reads. The demand for MRI and Ultrasound is also growing, driven by advancements in technology, increasing use in oncology, neurology, and obstetrics, and rising awareness of early disease detection and preventive screening in Qatar’s hospital and specialty clinic network.

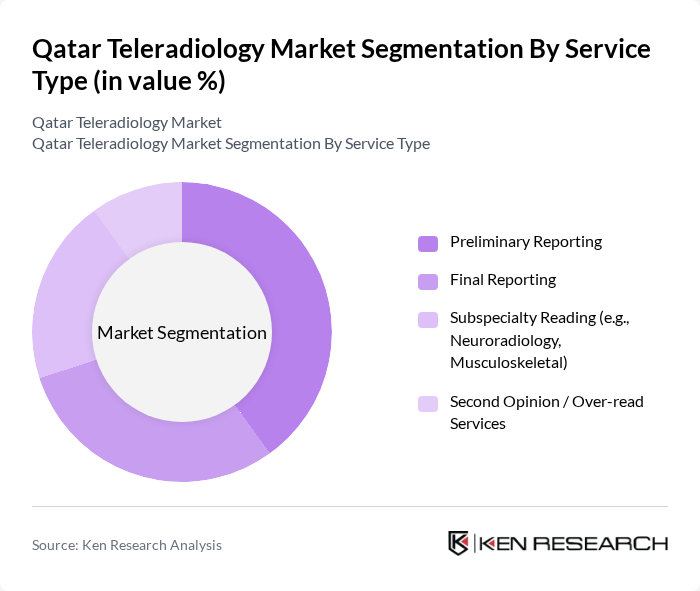

By Service Type:The market can also be segmented by service type, which includes Preliminary Reporting, Final Reporting, Subspecialty Reading (e.g., Neuroradiology, Musculoskeletal), and Second Opinion/Over-read Services. Preliminary and Final Reporting services dominate the market due to their essential role in providing timely diagnostic information to emergency departments, inpatient services, and outpatient clinics, mirroring global patterns where preliminary reports account for the largest share of teleradiology volumes. The demand for Subspecialty Reading is increasing as healthcare facilities in Qatar seek expert opinions for complex neuro, musculoskeletal, oncologic, and pediatric imaging cases, often leveraging regional or international teleradiology expertise to address local subspecialist shortages.

The Qatar Teleradiology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hamad Medical Corporation (HMC), Sidra Medicine, Al Ahli Hospital, Al Emadi Hospital, Aster DM Healthcare – Qatar, Naseem Medical Centre, Turkish Hospital, The View Hospital, Doha Clinic Hospital, Al Wakra Hospital, Al Khor Hospital, Cuban Hospital (Dukhan), Sidra–HMC Teleradiology Network (Internal Network), Regional / Offshore Teleradiology Providers Serving Qatar, Technology Vendors Supporting Teleradiology (PACS/RIS/Cloud) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the teleradiology market in Qatar appears promising, driven by technological advancements and increasing healthcare demands. By future, the integration of artificial intelligence in radiology is expected to enhance diagnostic accuracy, while the expansion of telehealth services will improve patient access to specialists. Additionally, the growing trend towards value-based care will encourage healthcare providers to adopt teleradiology solutions, ultimately leading to improved patient outcomes and operational efficiencies across the healthcare system.

| Segment | Sub-Segments |

|---|---|

| By Modality | X-ray Computed Tomography (CT) Magnetic Resonance Imaging (MRI) Ultrasound Mammography Nuclear Imaging / Others |

| By Service Type | Preliminary Reporting Final Reporting Subspecialty Reading (e.g., Neuroradiology, Musculoskeletal) Second Opinion / Over-read Services |

| By End-User | Public Hospitals (e.g., HMC Facilities) Private Hospitals Diagnostic Imaging Centers Primary Care & Outpatient Clinics |

| By Technology Platform | PACS (Picture Archiving and Communication System) RIS (Radiology Information System) Integrated PACS–RIS Solutions Cloud-based Teleradiology Platforms |

| By Delivery Model | In-house Teleradiology Onshore (Domestic) Third-party Services Offshore Teleradiology Services |

| By Time Coverage | Routine Day-time Reporting Night-time / Nighthawk Services Weekend & Holiday Coverage |

| By Clinical Application | Oncology Neurology Cardiology Musculoskeletal & Trauma Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Teleradiology Services | 120 | Radiologists, Hospital Administrators |

| Private Clinic Teleradiology Solutions | 90 | Clinic Owners, General Practitioners |

| Telemedicine Technology Providers | 60 | Product Managers, Technology Developers |

| Healthcare Policy Makers | 50 | Health Ministry Officials, Regulatory Experts |

| Patient Experience with Teleradiology | 80 | Patients, Caregivers |

The Qatar Teleradiology Market is valued at approximately USD 140 million, reflecting a significant growth driven by the increasing demand for remote diagnostic services and advancements in imaging technologies.