Region:Asia

Author(s):Dev

Product Code:KRAC5099

Pages:93

Published On:January 2026

By Service Type:The service type segmentation includes various categories such as Emergency Teleradiology Services, Routine / Scheduled Reporting Services, Subspecialty Teleradiology (Neuro, MSK, Cardiac, Oncology, etc.), Second Opinion & Over-read Services, Night-hawk / After-hours Reporting, and Others. Routine / Scheduled Reporting Services is the leading sub-segment due to the consistent demand for regular imaging services in hospitals and clinics and the need to clear daily reporting backlogs for high-volume modalities like X-ray and CT. The increasing reliance on timely and accurate reporting for patient management, hospital quality metrics, and integrated electronic medical record workflows has solidified its position in the market.

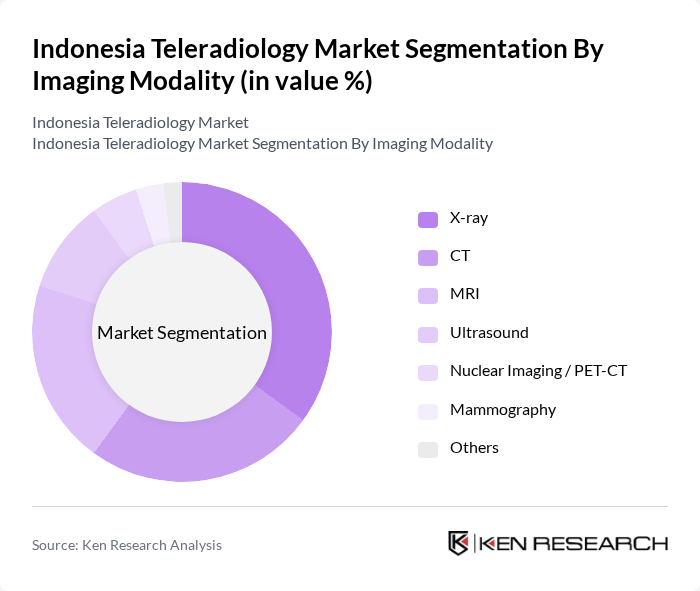

By Imaging Modality:The imaging modality segmentation encompasses X-ray, CT, MRI, Ultrasound, Nuclear Imaging / PET-CT, Mammography, and Others. The X-ray modality is the most dominant due to its widespread use as a first-line diagnostic tool in public and private healthcare facilities, including primary care centers and district hospitals. Its relatively low cost, high throughput, and the ability to digitize and transmit images quickly make it a preferred choice among healthcare providers, thereby driving its share in teleradiology workloads, particularly for chest, musculoskeletal, and emergency imaging.

The Indonesia Teleradiology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halodoc, Alodokter, KlikDokter, ProSehat, Medigo Indonesia, Teleradiology Solutions, Telemedicine Clinic (PT Global Telemedika), Global Diagnostics, 3D Global Telemedicine Indonesia, Qure.ai, Telerad Tech, Siemens Healthineers, GE HealthCare, Philips Healthcare, and Fujifilm Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the teleradiology market in Indonesia appears promising, driven by technological advancements and increasing healthcare investments. As the government continues to enhance healthcare infrastructure and internet connectivity, the adoption of teleradiology services is expected to rise significantly. Additionally, the integration of artificial intelligence in diagnostic processes will likely improve efficiency and accuracy, making teleradiology an essential component of Indonesia's healthcare landscape. This evolution will ultimately lead to better patient outcomes and expanded access to medical services.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Emergency Teleradiology Services Routine / Scheduled Reporting Services Subspecialty Teleradiology (Neuro, MSK, Cardiac, Oncology, etc.) Second Opinion & Over?read Services Night?hawk / After?hours Reporting Others |

| By Imaging Modality | X?ray CT MRI Ultrasound Nuclear Imaging / PET?CT Mammography Others |

| By End-User | Public Hospitals Private Hospitals Diagnostic Imaging Centers Telemedicine Platforms & Virtual Clinics Primary Care / Community Health Facilities (Puskesmas, Clinics) Others |

| By Delivery Model | Cloud-based Teleradiology Platforms Web-based / PACS-integrated Solutions Hybrid (On-premise + Cloud) Models AI-assisted Reporting Platforms Others |

| By Geography (Within Indonesia) | Java & Bali Sumatra Kalimantan Sulawesi Papua & Maluku Others |

| By Client Type | Single-site Facilities Multi-site Hospital Networks Diagnostic Chains Public Sector / Government Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Teleradiology Services | 100 | Radiologists, Hospital Administrators |

| Private Clinic Teleradiology Adoption | 80 | Clinic Owners, General Practitioners |

| Patient Experience with Teleradiology | 120 | Patients who have used teleradiology services |

| Regulatory Impact on Teleradiology | 60 | Healthcare Policy Makers, Legal Advisors |

| Technological Adoption in Teleradiology | 70 | IT Managers, Health Tech Innovators |

The Indonesia Teleradiology Market is valued at approximately USD 110 million, reflecting significant growth driven by the increasing demand for remote healthcare services and advancements in imaging technology.