Region:Asia

Author(s):Dev

Product Code:KRAC5101

Pages:96

Published On:January 2026

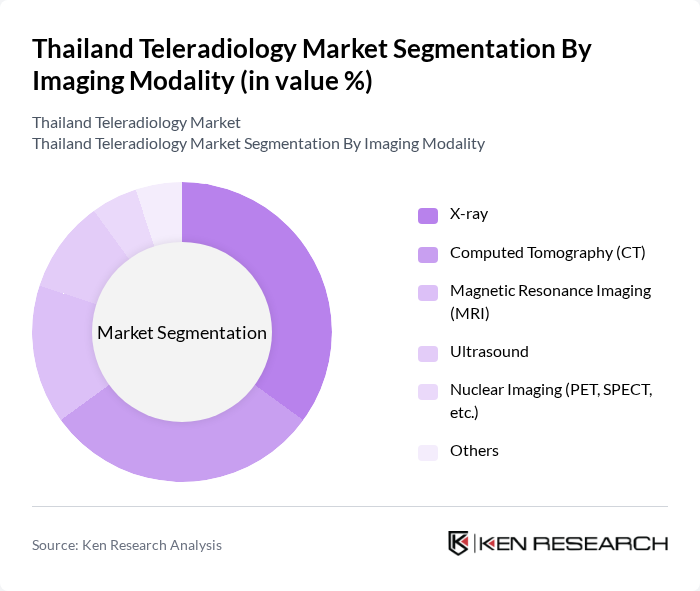

By Imaging Modality:The teleradiology market is segmented based on various imaging modalities, including X-ray, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, Nuclear Imaging (PET, SPECT, etc.), and Others. In Thailand, X-ray remains the largest revenue-generating product segment in teleradiology, followed by CT, reflecting their widespread availability and suitability for high-volume, routine diagnostic work. These modalities are widely used in teleradiology due to their cost-effectiveness, rapid image acquisition, and applicability across emergency, trauma, chest, and musculoskeletal imaging. The increasing adoption of advanced multi-slice CT and higher-field MRI, along with digital radiography and ultrasound integrated with PACS, is further supporting remote image transfer and reporting, strengthening demand across both urban referral centers and regional hospitals.

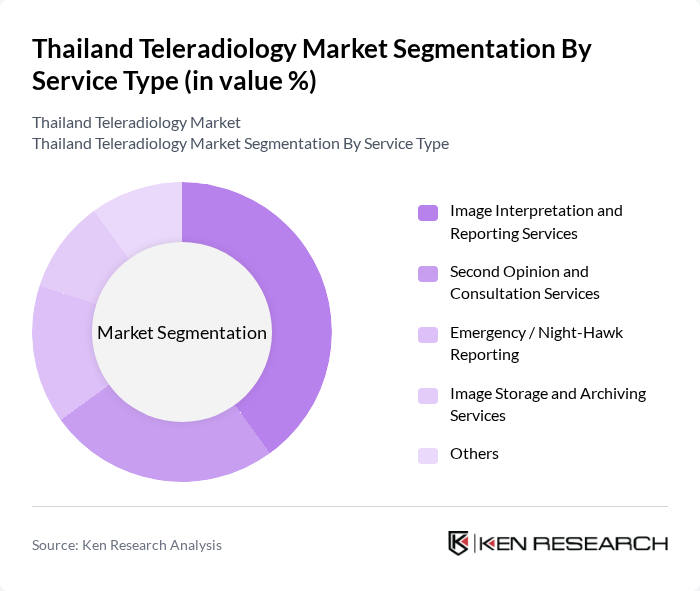

By Service Type:The market is also segmented by service type, which includes Image Interpretation and Reporting Services, Second Opinion and Consultation Services, Emergency / Night-Hawk Reporting, Image Storage and Archiving Services, and Others. Image Interpretation and Reporting Services dominate the market, in line with global trends where outsourced reading and remote reporting form the core of teleradiology revenue. Demand for around-the-clock emergency and Night-Hawk reporting is increasing as hospitals seek to address radiologist shortages and ensure continuous coverage, particularly for CT and trauma cases, while second opinion and subspecialty consultations are expanding for oncology, neuroradiology, and cardiovascular imaging. Image storage and archiving services are also gaining traction, driven by cloud-based PACS, regulatory expectations for secure retention of medical images, and hospital strategies to centralize imaging data across networks.

The Thailand Teleradiology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bumrungrad International Hospital, Bangkok Hospital (BDMS Network), Samitivej Hospital, Vejthani Hospital, Phyathai Hospital Group, Paolo Hospital Group, Ramkhamhaeng Hospital, Thonburi Healthcare Group (THG), BNH Hospital, Piyavate Hospital, MedPark Hospital, Bangkok Chain Hospital PCL (KASEM Group), Siriraj Hospital (Mahidol University), Chulalongkorn Hospital (King Chulalongkorn Memorial Hospital), and leading dedicated teleradiology providers and imaging networks in Thailand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the teleradiology market in Thailand appears promising, driven by increasing acceptance of telemedicine and the integration of artificial intelligence in diagnostic processes. As healthcare providers adapt to value-based care models, the focus will shift towards enhancing patient outcomes through technology. The anticipated growth in mobile health applications will further facilitate remote diagnostics, making healthcare more accessible. Continued government support and investment in telehealth infrastructure will likely bolster the market, ensuring its resilience and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Imaging Modality | X-ray Computed Tomography (CT) Magnetic Resonance Imaging (MRI) Ultrasound Nuclear Imaging (PET, SPECT, etc.) Others |

| By Service Type | Image Interpretation and Reporting Services Second Opinion and Consultation Services Emergency / Night-Hawk Reporting Image Storage and Archiving Services Others |

| By Service Delivery Model | Onshore Teleradiology Services Offshore / Cross-Border Teleradiology Services Hybrid Service Models Others |

| By Type of Report | Preliminary / Stat Reports Final Reports Subspecialty Reports (e.g., Neuroradiology, Musculoskeletal, Oncology) Others |

| By Technology Platform | Cloud-Based Teleradiology Platforms Web-Based / PACS-RIS Integrated Platforms On-Premise Solutions AI-Enabled / Decision-Support Platforms Others |

| By End-User | Public Hospitals Private Hospitals Diagnostic Imaging Centers Mobile Imaging Providers Others |

| By Geography (Within Thailand) | Bangkok Metropolitan Region Central Thailand (Excl. Bangkok) Northern Thailand Northeastern (Isan) Thailand Southern Thailand Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Administrators | 120 | Chief Medical Officers, IT Directors |

| Radiologists | 90 | Diagnostic Radiologists, Interventional Radiologists |

| Healthcare IT Professionals | 80 | Health Informatics Specialists, IT Managers |

| Patients Utilizing Teleradiology | 70 | Patients with chronic conditions, Recent telehealth users |

| Telehealth Policy Makers | 60 | Government Health Officials, Regulatory Bodies |

The Thailand Teleradiology Market is valued at approximately USD 200 million, reflecting a significant growth driven by the increasing demand for remote healthcare services and advancements in digital imaging technologies.