Region:Asia

Author(s):Dev

Product Code:KRAA6413

Pages:83

Published On:September 2025

By Type:The market is segmented into various types of online advertising, including Display Advertising, Search Engine Marketing, Social Media Advertising, Video Advertising, Mobile Advertising, Affiliate Marketing, and Others. Among these, Social Media Advertising has emerged as a dominant force due to the widespread use of platforms like Facebook and Instagram, where businesses can engage directly with consumers. The increasing time spent on social media by users has made it a preferred channel for advertisers looking to maximize their reach and engagement.

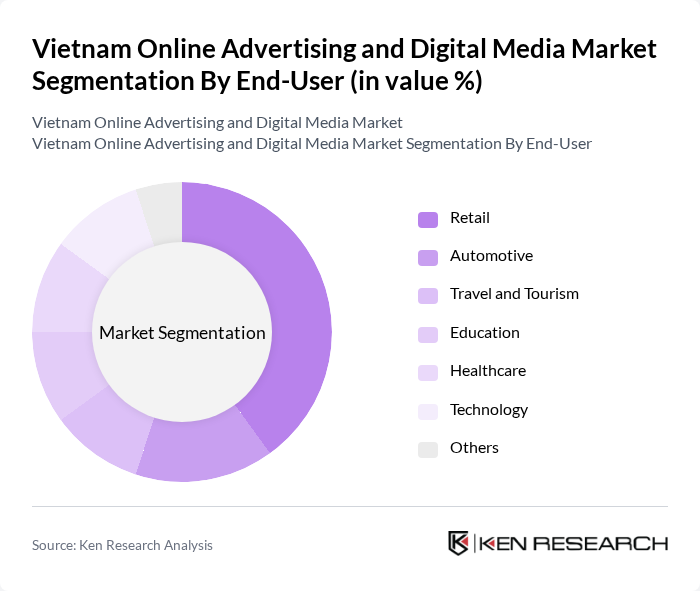

By End-User:The end-user segmentation includes Retail, Automotive, Travel and Tourism, Education, Healthcare, Technology, and Others. The Retail sector is the leading end-user of online advertising, driven by the growth of e-commerce platforms and the need for businesses to reach consumers effectively. Retailers are increasingly leveraging digital channels to promote their products, engage with customers, and drive sales, making it a critical segment in the online advertising landscape.

The Vietnam Online Advertising and Digital Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as VNG Corporation, FPT Corporation, MobiFone, Viettel Media, Admicro, Yeah1 Network, Zalo, Tiki Corporation, Shopee Vietnam, Lazada Vietnam, MoMo, Sendo, VCCorp, C?c C?c, VTV Digital contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam online advertising and digital media market is poised for significant transformation, driven by technological advancements and evolving consumer behaviors. The integration of artificial intelligence in advertising strategies is expected to enhance targeting and personalization, improving campaign effectiveness. Additionally, the rise of video content consumption will likely lead to increased investments in video advertising formats, creating new avenues for engagement. As businesses adapt to these trends, the market will continue to evolve, presenting both challenges and opportunities for stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Video Advertising Mobile Advertising Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Education Healthcare Technology Others |

| By Industry Vertical | E-commerce Financial Services Consumer Goods Telecommunications Entertainment Real Estate Others |

| By Advertising Format | Native Advertising Sponsored Content Email Marketing Retargeting Ads Influencer Collaborations Others |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Networks Social Media Platforms Others |

| By Geographic Focus | Urban Areas Rural Areas Regional Markets National Campaigns Others |

| By Customer Segment | B2B B2C C2C Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Media Advertising | 150 | Marketing Managers, Social Media Strategists |

| Search Engine Marketing | 100 | Digital Marketing Specialists, SEO Experts |

| Display Advertising | 80 | Advertising Executives, Brand Managers |

| Content Marketing Strategies | 70 | Content Creators, Brand Strategists |

| Influencer Marketing | 60 | Influencer Managers, PR Executives |

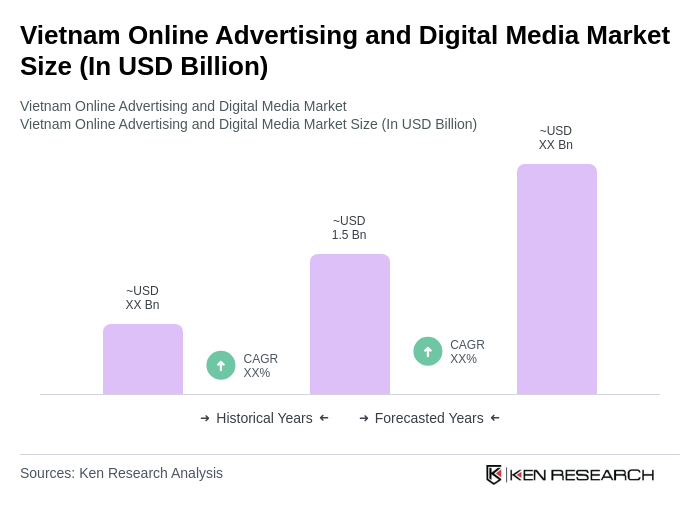

The Vietnam Online Advertising and Digital Media Market is valued at approximately USD 1.5 billion, driven by increased internet penetration, mobile device usage, and a shift from traditional to digital advertising platforms.