Region:Asia

Author(s):Geetanshi

Product Code:KRAA3369

Pages:86

Published On:January 2026

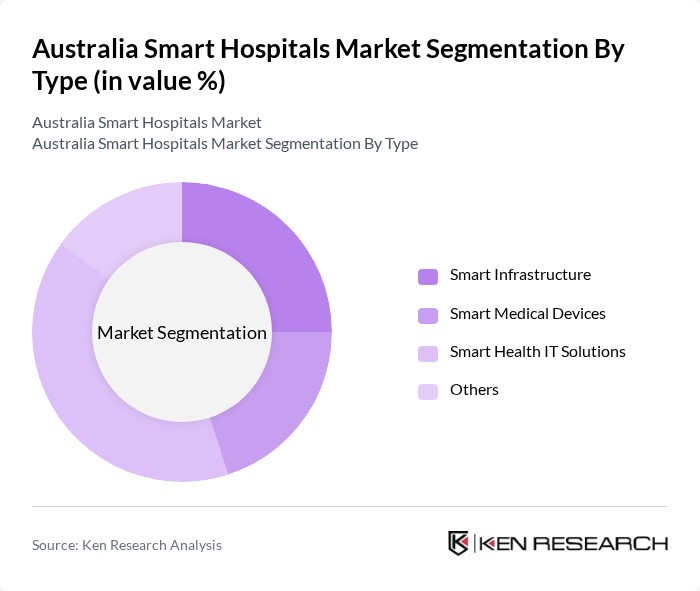

By Type:The market is segmented into Smart Infrastructure, Smart Medical Devices, Smart Health IT Solutions, Smart Patient Management Systems, and Others. Among these, Smart Health IT Solutions is the leading sub-segment, driven by the increasing need for efficient data management and patient care systems. The growing trend of digital health and telemedicine has further propelled the adoption of these solutions, as healthcare providers seek to enhance operational efficiency and patient engagement.

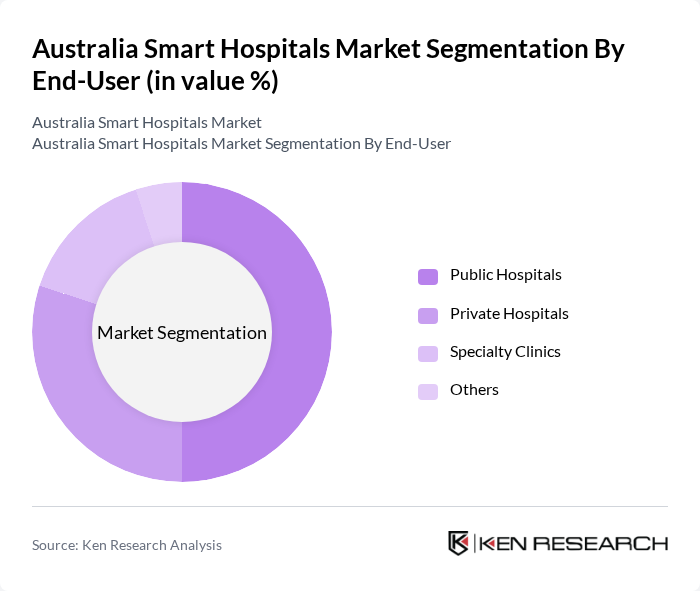

By End-User:The end-user segmentation includes Public Hospitals, Private Hospitals, Specialty Clinics, Rehabilitation Centers, and Others. Public Hospitals dominate the market due to their larger patient base and government funding, which facilitates the adoption of smart technologies. The increasing focus on improving healthcare services and patient outcomes in public healthcare facilities drives the demand for smart hospital solutions.

The Australia Smart Hospitals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Telstra Health, Siemens Healthineers, Philips Healthcare, GE Healthcare, IBM Watson Health, Cerner Corporation, Allscripts Healthcare Solutions, Medtronic, Oracle Health Sciences, Agfa HealthCare, InterSystems, NextGen Healthcare, Epic Systems Corporation, Varian Medical Systems, McKesson Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart hospitals market in Australia appears promising, driven by ongoing technological advancements and a strong push for digital health integration. As the healthcare landscape evolves, hospitals are expected to increasingly adopt innovative solutions that enhance patient care and operational efficiency. The focus on value-based care and patient engagement will further accelerate the transition towards smart hospitals, creating a more connected and efficient healthcare ecosystem that prioritizes patient outcomes and satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Infrastructure Smart Medical Devices Smart Health IT Solutions Smart Patient Management Systems Others |

| By End-User | Public Hospitals Private Hospitals Specialty Clinics Rehabilitation Centers Others |

| By Service Type | Telemedicine Services Remote Patient Monitoring Health Information Exchange Others |

| By Technology | Cloud Computing Artificial Intelligence Big Data Analytics Internet of Things (IoT) Others |

| By Application | Patient Care Management Operational Efficiency Clinical Decision Support Others |

| By Investment Source | Government Funding Private Investments Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Administrators | 100 | CEOs, CFOs, IT Directors |

| Private Healthcare Providers | 80 | Operations Managers, Technology Officers |

| Healthcare Technology Vendors | 60 | Sales Directors, Product Managers |

| Healthcare Policy Makers | 50 | Government Officials, Health Policy Analysts |

| Clinical Staff in Smart Hospitals | 70 | Nurses, Physicians, IT Support Staff |

The Australia Smart Hospitals Market is valued at approximately USD 4.3 billion, reflecting significant growth driven by the adoption of advanced healthcare technologies, efficient patient management systems, and government initiatives to enhance healthcare infrastructure.