Region:Middle East

Author(s):Rebecca

Product Code:KRAD3154

Pages:81

Published On:January 2026

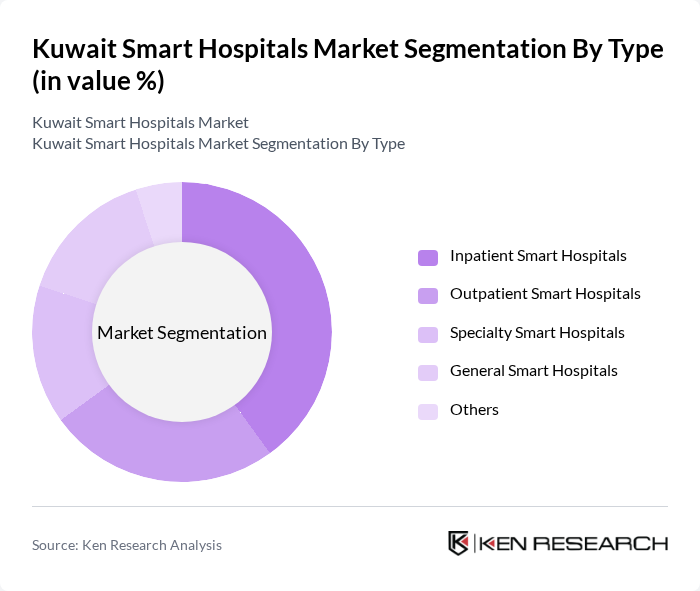

By Type:The market is segmented into various types of smart hospitals, including inpatient, outpatient, specialty, general, and others. Inpatient smart hospitals are designed to provide comprehensive care for patients requiring overnight stays, while outpatient smart hospitals focus on providing services that do not require overnight hospitalization. Specialty smart hospitals cater to specific medical fields, such as cardiology or orthopedics, and general smart hospitals offer a wide range of services. The "Others" category includes facilities that may not fit neatly into the aforementioned classifications.

The inpatient smart hospitals segment is currently leading the market due to the increasing number of patients requiring complex medical care and extended hospital stays. This segment benefits from advancements in medical technology, which enhance patient monitoring and treatment capabilities. Additionally, the growing prevalence of chronic diseases necessitates more inpatient services, driving demand for these facilities. The trend towards integrated care models further supports the growth of inpatient smart hospitals, as they provide comprehensive services under one roof.

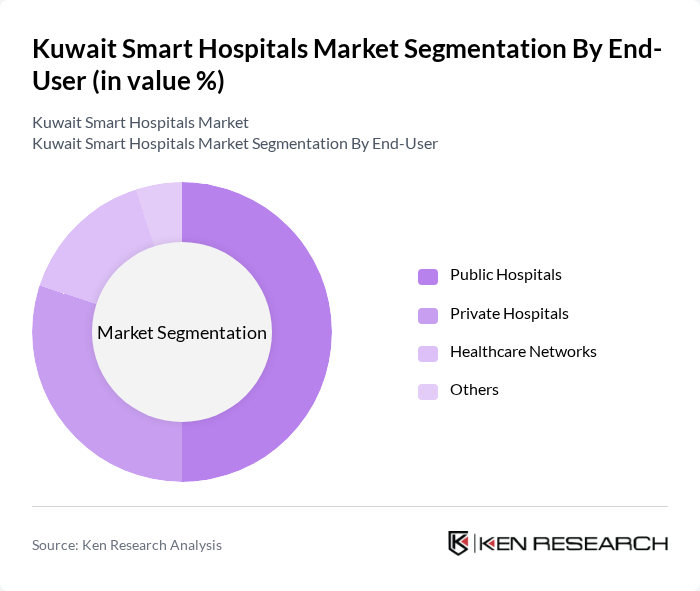

By End-User:The market is segmented based on end-users, including public hospitals, private hospitals, healthcare networks, and others. Public hospitals are typically government-funded and provide services to a larger population, while private hospitals offer specialized services and cater to patients seeking premium care. Healthcare networks consist of interconnected facilities that collaborate to provide comprehensive care, and the "Others" category includes various healthcare providers not classified under the main categories.

Public hospitals dominate the market due to their extensive reach and the essential services they provide to the population. The government's commitment to improving healthcare access and quality has led to significant investments in public hospital infrastructure and technology. Additionally, the increasing patient load in public hospitals, driven by a growing population and rising healthcare needs, further solidifies their leading position in the market. The integration of smart technologies in public hospitals enhances operational efficiency and patient care, making them a focal point for healthcare advancements.

The Kuwait Smart Hospitals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Sabah Medical Center, Kuwait Hospital, Dar Al Shifa Hospital, Adan Hospital, Ibn Sina Hospital, Al Amiri Hospital, Mubarak Al-Kabeer Hospital, Al Razi Hospital, Kuwait Medical Center, Al Seef Hospital, Al Jazeera Hospital, Al Farwaniyah Hospital, Al Khair Hospital, Al Qabas Hospital, Al Mowasat Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Smart Hospitals Market is poised for significant advancements, driven by ongoing government support and technological innovations. As healthcare providers increasingly adopt cloud-based solutions and mobile health applications, patient-centered care will become a focal point. The integration of big data analytics will further enhance decision-making processes, leading to improved patient outcomes. In future, the emphasis on personalized healthcare solutions is expected to reshape service delivery, making healthcare more efficient and accessible for the Kuwaiti population.

| Segment | Sub-Segments |

|---|---|

| By Type | Inpatient Smart Hospitals Outpatient Smart Hospitals Specialty Smart Hospitals General Smart Hospitals Others |

| By End-User | Public Hospitals Private Hospitals Healthcare Networks Others |

| By Service Type | Emergency Services Surgical Services Diagnostic Services Rehabilitation Services Others |

| By Technology Integration | Electronic Health Records (EHR) Telemedicine Solutions Wearable Health Devices AI and Machine Learning Applications Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Geographic Coverage | Urban Areas Rural Areas Suburban Areas Others |

| By Funding Source | Government Funding Private Investments Public-Private Partnerships (PPP) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Hospital Technology Adoption | 120 | Healthcare IT Managers, Hospital Administrators |

| Patient Experience with Smart Services | 100 | Patients, Caregivers |

| Telemedicine Implementation Insights | 80 | Telehealth Coordinators, Physicians |

| IoT Device Utilization in Hospitals | 70 | Biomedical Engineers, IT Support Staff |

| AI in Healthcare Decision-Making | 90 | Clinical Decision Support Specialists, Data Analysts |

The Kuwait Smart Hospitals Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by advanced healthcare technologies, rising patient expectations, and government initiatives to enhance healthcare infrastructure.