Region:Middle East

Author(s):Geetanshi

Product Code:KRAA3368

Pages:80

Published On:January 2026

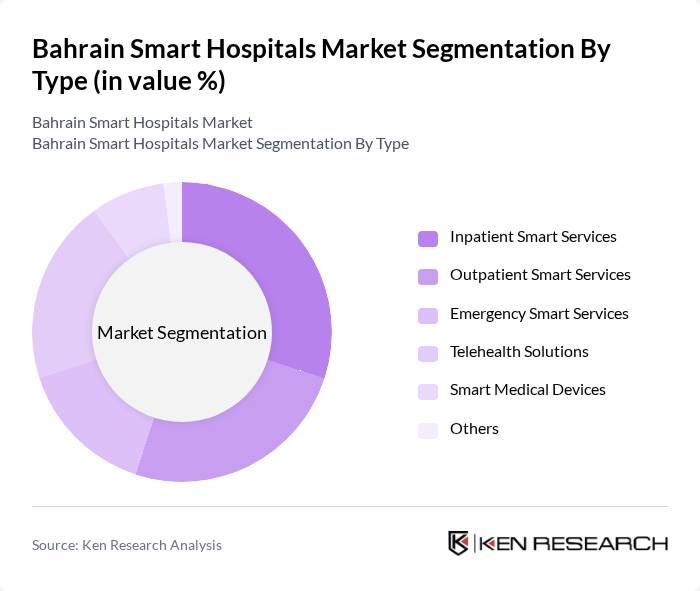

By Type:The market is segmented into various types of smart services, including inpatient smart services, outpatient smart services, emergency smart services, telehealth solutions, smart medical devices, and others. Each of these segments plays a crucial role in enhancing patient care and operational efficiency within hospitals.

The inpatient smart services segment is currently dominating the market due to the increasing need for efficient patient management systems and enhanced care delivery in hospitals. This segment includes advanced monitoring systems, automated medication dispensing, and integrated health records, which are essential for improving patient outcomes and operational efficiency. The growing trend of personalized medicine and the need for real-time data access further bolster the demand for inpatient smart services, making it a critical area of focus for healthcare providers.

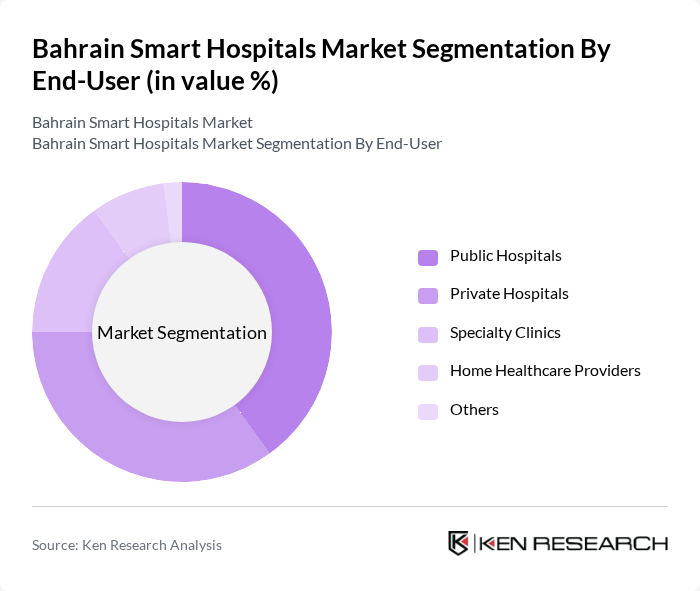

By End-User:The market is segmented by end-users, including public hospitals, private hospitals, specialty clinics, home healthcare providers, and others. Each end-user category has unique requirements and contributes differently to the overall market dynamics.

Public hospitals are leading the market due to their larger patient base and government support for adopting smart technologies. These institutions are increasingly investing in digital health solutions to enhance service delivery and patient care. The integration of smart technologies in public hospitals is also driven by regulatory mandates and funding from the government, which aims to improve healthcare accessibility and quality across the nation. This trend is expected to continue as public hospitals strive to meet the growing healthcare demands of the population.

The Bahrain Smart Hospitals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Specialist Hospital, Royal Bahrain Hospital, American Mission Hospital, Ibn Al-Nafis Hospital, Bahrain Defence Force Hospital, Al Hilal Hospital, Aster DM Healthcare, Gulf Medical University Hospital, KIMS Bahrain Medical Centre, Dr. A. S. Al-Mansoori Medical Centre, Bahrain Medical Center, Al Jazeera Medical Centre, Seef Health Centre, Al Noor Hospital, Bahrain International Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain smart hospitals market appears promising, driven by technological advancements and a supportive regulatory environment. As the government continues to invest in healthcare digitization, the integration of AI and IoT will likely enhance patient care and operational efficiency. Additionally, the growing acceptance of telemedicine and remote monitoring solutions will reshape healthcare delivery, making it more accessible and patient-centric, ultimately leading to improved health outcomes across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Inpatient Smart Services Outpatient Smart Services Emergency Smart Services Telehealth Solutions Smart Medical Devices Others |

| By End-User | Public Hospitals Private Hospitals Specialty Clinics Home Healthcare Providers Others |

| By Service Type | Diagnostic Services Therapeutic Services Rehabilitation Services Preventive Services Others |

| By Technology | Electronic Health Records (EHR) Remote Patient Monitoring Artificial Intelligence Applications Internet of Medical Things (IoMT) Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Geographic Coverage | Urban Areas Rural Areas Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Hospital Technology Adoption | 45 | Hospital Administrators, IT Directors |

| Patient Experience with Digital Health Solutions | 50 | Patients, Caregivers |

| Healthcare IT Vendor Insights | 35 | Sales Executives, Product Managers |

| Telemedicine Utilization Trends | 40 | Healthcare Providers, Telehealth Coordinators |

| Regulatory Impact on Smart Healthcare | 30 | Policy Makers, Healthcare Consultants |

The Bahrain Smart Hospitals Market is valued at approximately USD 85 million, reflecting a significant growth driven by the adoption of advanced healthcare technologies, rising patient expectations, and government initiatives aimed at enhancing healthcare infrastructure.