Region:Middle East

Author(s):Rebecca

Product Code:KRAD3155

Pages:90

Published On:January 2026

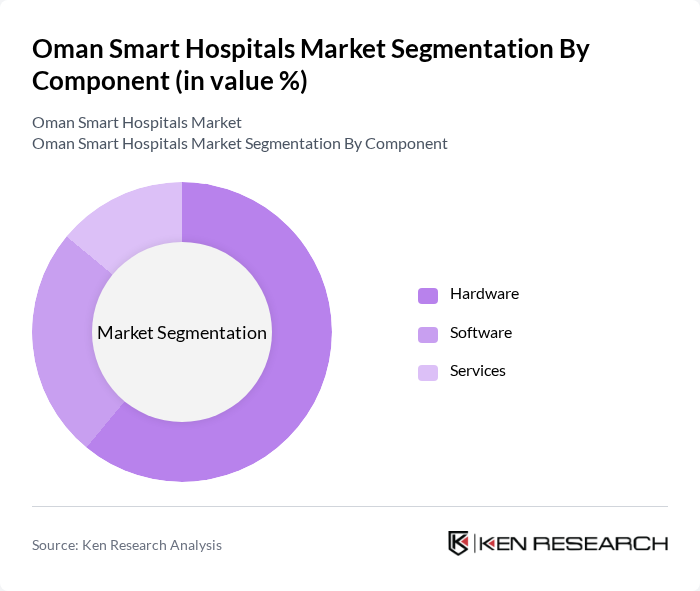

By Component:The components of the Oman Smart Hospitals Market include Hardware, Software, and Services. Each of these segments plays a crucial role in the overall functionality and efficiency of smart hospitals. Hardware encompasses medical devices and equipment, while Software includes applications for managing hospital operations. Services cover the support and maintenance of these technologies.

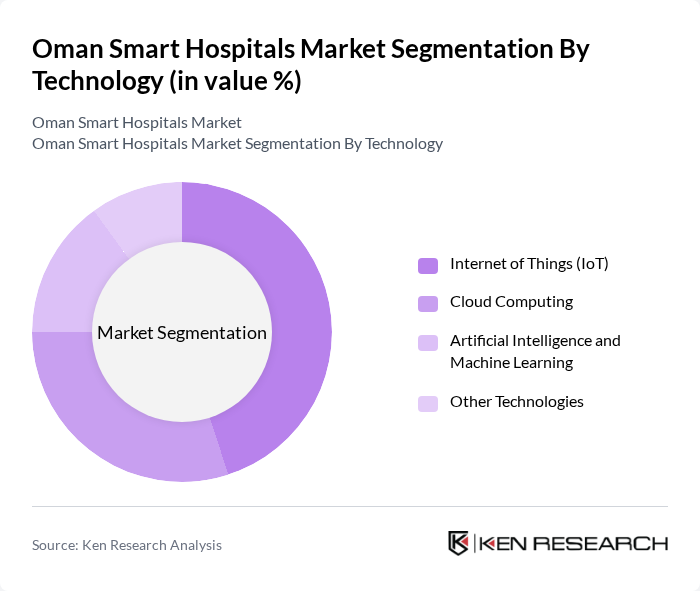

By Technology:The technology segment of the Oman Smart Hospitals Market includes Internet of Things (IoT), Cloud Computing, Artificial Intelligence and Machine Learning, and Other Technologies. These technologies are essential for enhancing hospital operations, improving patient care, and enabling data-driven decision-making.

The Oman Smart Hospitals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, GE Healthcare, Cerner Corporation, Medtronic, Aster Oman Telehealth, Badr Al Samaa Telemedicine, Burjeel Oman eConsult, KIMS Oman Virtual Care, Starcare Oman Telemedicine, MOH Shifa Tele-clinics, Teladoc Health, Epic Systems Corporation, IBM Watson Health, Oracle Health Sciences contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman smart hospitals market appears promising, driven by ongoing technological advancements and government support. As healthcare providers increasingly adopt AI and telemedicine solutions, patient care is expected to improve significantly. Additionally, the focus on value-based care models will encourage hospitals to enhance service quality while managing costs effectively. The integration of smart health monitoring systems will further revolutionize patient engagement and outcomes, positioning Oman as a leader in healthcare innovation in the region.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware Software Services |

| By Technology | Internet of Things (IoT) Cloud Computing Artificial Intelligence and Machine Learning Other Technologies |

| By Route of Connectivity | Wireless Wired |

| By Application | Medical Connected Imaging Remote Patient Monitoring Electronic Health Records and Clinical Workflow Emergency Care Services Other Applications |

| By End-User | Hospitals Clinics Home Care Providers Government Health Agencies Private Healthcare Providers |

| By Geographic Distribution | Muscat Salalah Sohar Others |

| By Deployment Mode | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Hospital Technology Adoption | 45 | Hospital Administrators, IT Directors |

| Telemedicine Implementation | 50 | Healthcare Providers, Telehealth Coordinators |

| IoT Solutions in Healthcare | 40 | Biomedical Engineers, Technology Managers |

| Patient Engagement Tools | 35 | Patient Experience Officers, Marketing Managers |

| Healthcare Data Analytics | 48 | Data Analysts, Chief Information Officers |

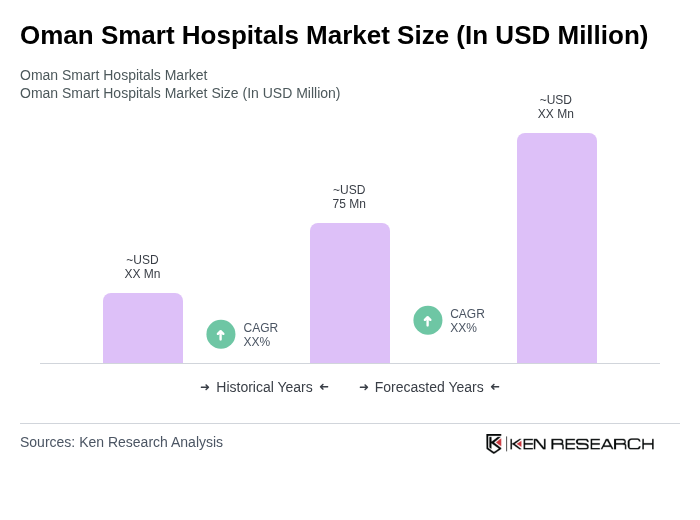

The Oman Smart Hospitals Market is valued at approximately USD 80 million, reflecting a significant growth driven by the adoption of digital health technologies, government initiatives, and increasing patient demand for efficient healthcare services.