Region:Asia

Author(s):Rebecca

Product Code:KRAD3153

Pages:97

Published On:January 2026

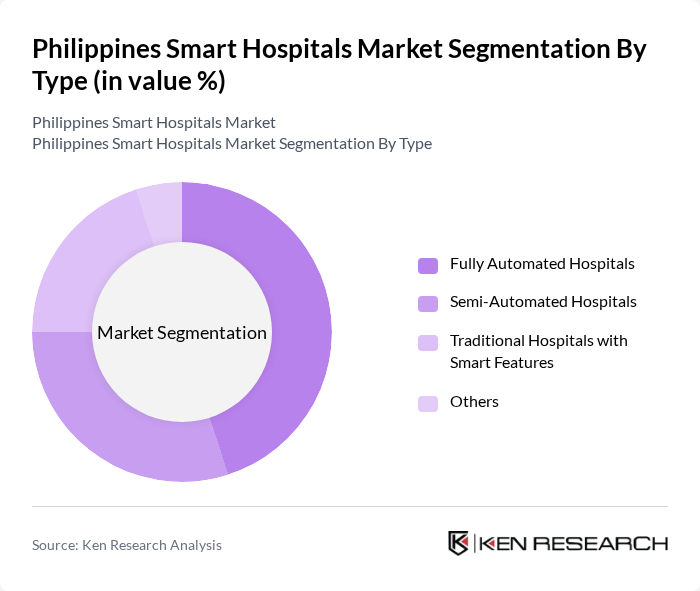

By Type:The market is segmented into various types, including Fully Automated Hospitals, Semi-Automated Hospitals, Traditional Hospitals with Smart Features, and Others. Fully Automated Hospitals are gaining traction due to their ability to streamline operations and enhance patient care through advanced technologies. Semi-Automated Hospitals are also popular as they offer a balance between traditional practices and modern technology. Traditional Hospitals with Smart Features are adapting to the changing landscape by integrating smart solutions to improve efficiency and patient satisfaction.

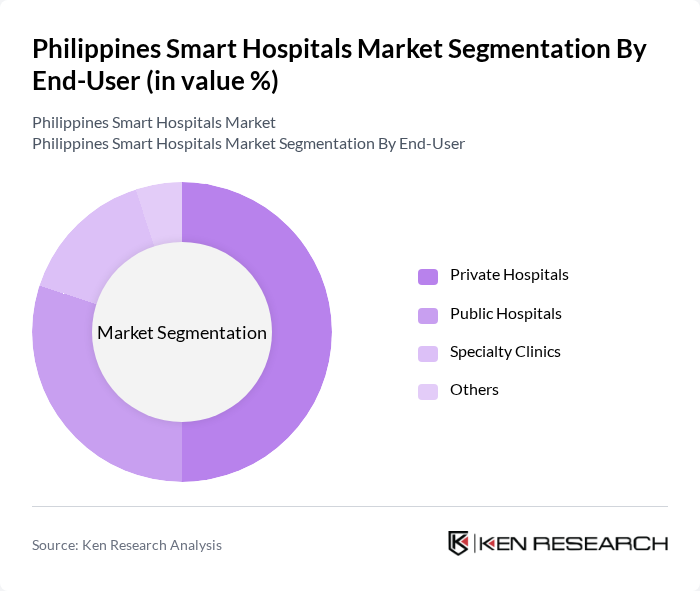

By End-User:The end-user segmentation includes Private Hospitals, Public Hospitals, Specialty Clinics, and Others. Private Hospitals dominate the market due to their ability to invest in advanced technologies and provide high-quality services. Public Hospitals are also significant players, especially with government support for modernization. Specialty Clinics are increasingly adopting smart technologies to cater to specific patient needs, while other healthcare facilities contribute to the overall market growth.

The Philippines Smart Hospitals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ayala Healthcare Holdings, Inc., Metro Pacific Investments Corporation, St. Luke's Medical Center, The Medical City, Makati Medical Center, Asian Hospital and Medical Center, Cardinal Santos Medical Center, Chong Hua Hospital, University of Santo Tomas Hospital, Philippine General Hospital, Research Institute for Tropical Medicine, Southern Philippines Medical Center, St. Paul’s Hospital, De La Salle University Medical Center, Manila Doctors Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines smart hospitals market appears promising, driven by ongoing government support and technological advancements. As healthcare providers increasingly adopt digital solutions, the focus will shift towards enhancing patient experiences and operational efficiencies. The integration of AI and IoT technologies will likely transform healthcare delivery, enabling personalized medicine and improved patient outcomes. Additionally, the expansion of telemedicine services will further facilitate access to healthcare, particularly in remote areas, ensuring a more inclusive healthcare system.

| Segment | Sub-Segments |

|---|---|

| By Type | Fully Automated Hospitals Semi-Automated Hospitals Traditional Hospitals with Smart Features Others |

| By End-User | Private Hospitals Public Hospitals Specialty Clinics Others |

| By Service Type | Inpatient Services Outpatient Services Emergency Services Others |

| By Technology Used | Electronic Health Records (EHR) Telemedicine Solutions Health Information Exchange (HIE) Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Geographic Location | Metro Manila Luzon Visayas Mindanao |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Hospital Administrators | 75 | Hospital Directors, IT Managers |

| Private Healthcare Providers | 60 | Chief Medical Officers, Operations Managers |

| Healthcare Technology Vendors | 45 | Product Managers, Sales Directors |

| Patient Experience Focus Groups | 40 | Patients, Caregivers |

| Healthcare Policy Makers | 30 | Government Officials, Health Policy Analysts |

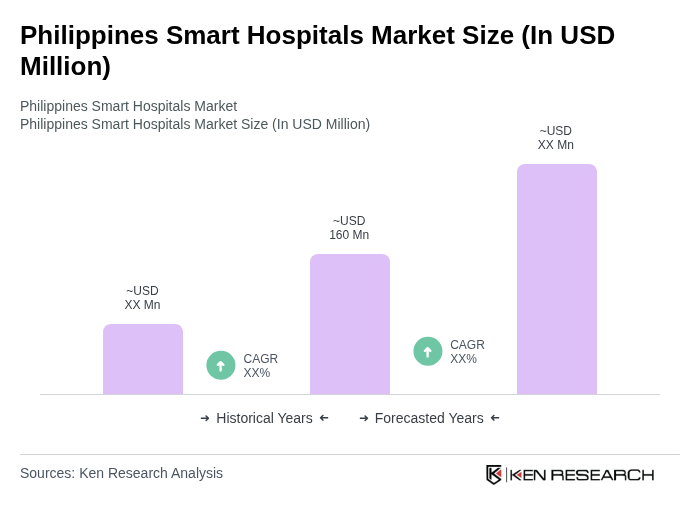

The Philippines Smart Hospitals Market is valued at approximately USD 160 million, reflecting a significant growth driven by the adoption of advanced healthcare technologies, rising patient expectations, and government initiatives to enhance healthcare infrastructure.